Times are changing, altering many familiar, established and cherished concepts—in our daily lives and also in our industry. With the revolutionary and breathtaking evolutions we have seen in the field of mobility in recent years, with the challenges of climate protection and its questions for future transport concepts, with new usage models and changed consumer behaviour, we are asking ourselves whether and how the (motor) insurance industry can find the right answers and survive in the future.

Guy Carpenter’s annual review of the motor insurance industry in Europe, the Middle East and Africa provides a review of the prior year’s events and trends, and their impact on the industry. It also looks ahead, providing our point of view on where the industry, and in a broader sense, mobility, are heading.

In our view of the market for motor insurance, we observe three major movements, each of which alone has the potential to change permanently the face of the industry.

1. Consumer behaviour

In the past, people wanted a car and needed insurance. Today, on the other hand, people want to get from A to B and need a solution—a mobility concept. Getting from A to B takes many forms, such as a short holiday or weekend trip, the daily (or less frequent, due to the pandemic) drive to work, the weekly trip to the supermarket or the annual visit to the furniture store.

This change in demand leads to two changes in the product conception of insurance.

- Mobility solutions increasingly are being offered together with insurance cover, be it a leased car with warranty and comprehensive insurance, a rented van with fuel card and insurance cover, or a holiday motorhome including tenant's liability insurance.

- Insurance companies offer short-term, coordinated solutions. A 14-day hire cover for the holiday, a tenant's liability in addition, or a reassuring breakdown cover for the next six months. With a clever sales platform and state-of-the art IT, an insurer has essential components to set itself apart positively from the competition.

2. New Competitors

According to a recent study, an average of USD 37 billion in investment capital has been invested in mobility start-ups worldwide over the past five years. However, investments in InsurTechs are not made only to bring “me-too” insurers to the markets, but to endeavour to dissect the value chain. One InsurTech may have special expertise in claims processing, another in data processing and analysis, the next in lean sales via WhatsApp or Facebook. These competencies combine with each other—like building blocks—to create a virtual, full insurance company. One entity can perform a certain skill particularly well, as it is its core competency, while others are delegated to those that can do them better.

The result is faster, more flexible and more agile. Free agents and managing general agents (MGAs) deserve special mention here. Long unknown in Central Europe, they are gaining more and more traction. They know the customers, master the distribution channel, define the policy–but what they seek is a pure risk taker to support growth or expansion into a new market.

3. External Influences

The topic of climate change dominates the headlines. Coalfired power plants are dirty, CO2 is the devil, new internal combustion vehicles soon no longer will be wanted, SUVs are too big and solar panels too small. Green investments are welcomed, whether as window dressing or through genuine conviction. This trend may actually have a profound influence on the consumer behaviour of the next generation. Where there is only one car per family instead of two, only one policy is needed. Car sharing for a larger group is insured differently than it would be for the family car for three.

The COVID-19 pandemic has also shown how quickly requirements and usage habits can change. If no one drives, no accidents can happen. For example, in Germany, where motor insurance results in 2020 were favourable, some insurers wanted to grant additional premium refunds to their existing customers.

In the long run, however, the opposite trend may emerge. With the successful field test of the sudden and radical home office, one may observe a flight from the cities in the long term, which may be combined with an increase in individual transport.

This article is shared with the kind permission of ICMIF Supporting Member Guy Carpenter. To download the full Guy Carpenter’s briefing, EMEA Motor Insurance Summary—2021: Insurance for a Changing World, click here

Published September 2022

Effects of Covid-19

Industry and economic overview

2020 saw the first global pandemic in over a century. COVID-19, and government responses to it, affected all economic sectors in every country, with global GDP falling by 3.3%, compared with a 4.4% rise in 2019. The pandemic’s impact on the world economy in 2020 was strong, but the end result was somewhat less drastic when compared to the initial pre-crisis projections.

The consequences of the economic downturn have been particularly significant on advanced economies (-4.7%, compared with +1.6% in 2019), with the European Union (EU) GDP dropping by 7%. In contrast, the GDP of emerging markets, thanks to the swift recovery of China, declined by less than half of the above rate (-2.2%, compared with +3.6% in 2019).

During the first wave of the pandemic (mid-March to mid-May 2020), many insurance business lines experienced a double-digit reduction in new premiums written, with varying levels of recovery in national markets in subsequent months.

In a sample of the main European markets (Belgium, France, Germany, Italy, Netherlands, UK and Spain), overall written insurance premium in 2020 totalled EUR 1,031 billion, marking a 5.9% drop from 2019.#

COVID-19 and motor premiums

According to Insurance Europe, insurers in many markets offered, on a case-by-case basis and for different lengths of time, moratoria on premium payments, free extensions to contracts, fee waivers, or even partial refunds of premium payments to respond to the restrictions on vehicle use.

- In France, motor premiums grew more slowly than in previous years (+1.0%) due to rate freezes.

- In some countries, a reduction in the number of newly registered vehicles added to the impact on premium volumes. This was the case in Spain (-2%) and Italy (-4%).

- In Latvia, motor premiums fell 10.1% after the law was amended to allow the suspension of policies for commercial transport.

- In Sweden, where there were no government-imposed lockdowns in 2020, people continued to travel more or less as usual, and motor premiums increased 4%.

- In some countries the number of insured vehicles continued to grow, prompting increases in premiums, such as in the Czech Republic, which saw a rise of 8.1%.

COVID-19 and claims impact

Government-imposed mobility restrictions meant fewer vehicles on the roads in many countries for several months of 2020. Falls in motor claims frequency mirrored the severity of the restrictions in those countries that imposed them. However, many of the same countries reported increases in average claims—and notably average bodily injury claims—as those who did drive on the quieter roads often did so at higher speeds.

The trends of growing repair costs and increasing medical costs, observed for many years, continued in 2020, pushing up claims outlays and affecting the long-term evolution of average premiums. While claims declined in many regions in 2020, this was not the case everywhere, and the decrease in claims was generally much lower than the observed decreases in claims frequency for part of the year.

Globally, COVID-19-related insurance losses are currently estimated at anywhere between USD 50 billion and 100 billion (EUR 41-82 billion). While it will take time for the full effects of the pandemic to materialise, Guy Carpenter is able to give here a very first indication of how the European motor insurance industry fared in this exceptional year.

The preliminary figures confirm that each European market and each line of business has seen different effects from the pandemic. While there are some common trends across markets and business lines, COVID-19 has, if anything, exposed the unique role insurers play in each individual economy and the distinct way in which insurers’ products and services are tailored to national market characteristics and dynamics.

In 2020 and 2021, in response to the COVID-19 pandemic, most European governments put in place unprecedented restrictions on travel and movement, including border closures, lockdowns for most of the population, closure of schools, workplaces, shops, leisure and sport facilities. Those measures resulted in significantly reduced traffic volumes, and motor insurance claims were much lower than normal.

In June 2021, the European Transport Safety Council (ETSC) assessed the impacts that lockdowns had on road deaths in Europe in 2020. A road death in the EU is defined as any person killed immediately or dying within 30 days as a result of a road collision.

Out of 32 countries for which data is available, 26 registered a decrease in road deaths in 2020 compared to 2019. Bulgaria ranked first, with a 26% reduction in the number of road deaths between 2019 and 2020. Switzerland registered a 21% increase, with rises of 18% in Luxembourg and 15% in Estonia.

Road deaths in the EU collectively went down by an unprecedented 17% in just one year. Yet, the exceptional 2020 results are to a large extent a consequence of COVID-19 lockdowns and there is no guarantee of continuation.

Motor Insurance Directive Update

The first EU Motor Insurance Directive was adopted in 1972, to protect victims of motor vehicle accidents and facilitate the free movement of motor vehicles between member states.

Subsequently, the insurance industry adopted constant innovations to address the evolving needs and demands of consumers, and the European Commission initiated a review of the Motor Insurance Directive in 2016 through various consultations. The proposal to amend the directive was made in 2018.

After nearly three years of legislative process, in June 2021 the European Parliament and the Council reached a provisional agreement on the revision of the Motor Insurance Directive providing more protection, transparency and smoother cooperation throughout the EU.

The amended rules will better protect injured people when accidents occur in any EU member state, including domestic victims of an accident caused by a driver from another EU country.

- The rules harmonise minimum amounts of cover across the EU:

– Personal injuries: EUR 6,070,000 per accident or EUR 1,220,000 per injured party;

– Property damage: EUR 1,220,000 per accident. - The agreement also introduces mandatory use of a Single Claims History Statement and obligations to inform citizens how they can apply for compensation.

- EU drivers will be able to compare prices, tariffs and coverage offered by different providers more easily thanks to new free-of-charge and independent price comparison tools.

- To tackle uninsured driving, the amended directive allows cross-border insurance checks on vehicles. However, such checks should be non-discriminatory as part of regular checks, and not require the vehicle to be stopped.

- To avoid overregulation, the amended rules allow nonroad vehicles (such as garden tractors, mobility scooters, toy cars) to be excluded, as well as excluding electric bicycles from insurance obligations. Also excluded are vehicles intended exclusively for motorsports.

The deal will need formal approval by the Parliament and Council. Once approved, the directive will enter into force 20 days after its publication in the EU Official Journal. The new rules will start to apply 24 months after the entry into force.

Other ongoing trends

The pandemic has modified habits, behaviours, social relations and mobility in work. It has pushed companies to evolve to new organisation models and new interaction models with clients. Some of those changes will be lost once we leave the pandemic behind, but others are destined to endure and define a “new normality.” No doubt, some segments of the population will rely even more on digital connections for work, education, health assistance, daily trade and essential social interactions.

The pandemic has created the environment for a strong push toward a green and sustainable transformation of the economy. In July 2020, the EU announced its support for economic recovery in all member states by injecting almost EUR 2.2 billion into 140 key transport projects.

These projects include support for sustainable transport, such as the deployment of alternative fuels infrastructure, including the installation of 17,275 charging points on the road network. The projects will receive funding through the Connecting Europe Facility, the EU's grant scheme supporting transport infrastructure.

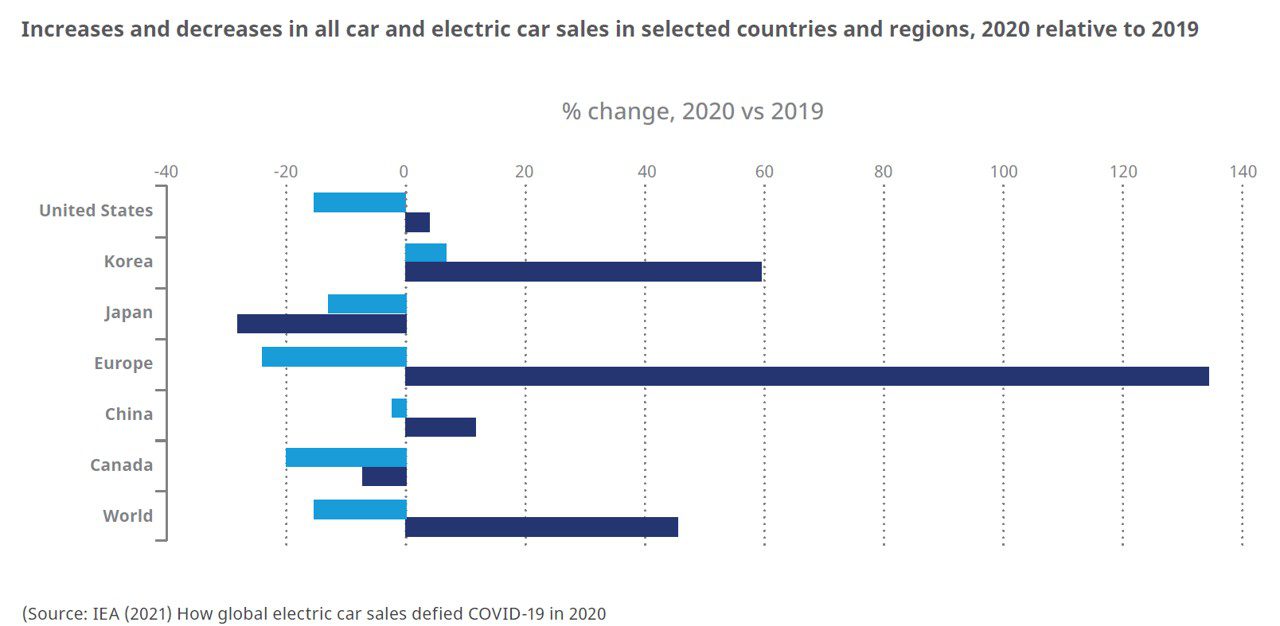

The International Energy Agency (IEA) has identified that during 2020, sales of electric cars in Europe more than doubled over 2019 levels. Many large markets, such as France, Italy, Germany and the UK, actually had significantly higher electric car sales than in 2019 throughout almost each month of 2020. Economic and supply-chain disruptions as a result of the pandemic have affected all business sectors worldwide. The insurance industry is no exception— issues range from employee and business-continuity concerns to customer-care considerations to the financial outlook of the global insurance industry itself. Responding to these challenges may require a shift in priorities and the associated redeployment of capital to fund innovation and faster recovery.

The lower interest-rate environment has particularly affected long-tail business:

- Although profitability is mainly derived from underwriting, technical reserves are in part dependent on assumptions about long-term inflation and interest rate projections, such that falling interest rates can require insurers to add to these reserves.

- If inflationary pressures were to increase further as economies recover from the pandemic, this could lead to a fall in long-term real interest rates. If this were the case, then we could expect it to increase the cost of long-tail claims and claim care costs, with a knock-on effect for the underlying pricing and reserving of motor classes.

- This impact could affect all losses with bodily injury components and would have many effects, one of which would be to reassess reinsurance pricing.