With the changing climate, natural catastrophes are becoming more frequent, and the intensity for certain perils is likely to increase, severely affecting several countries in Asia. The insurance industry is capable and well-resourced to develop the technology and products needed to cover the varying protection gap across the region. Insurance innovators designing new solutions, such as bespoke microinsurance or parametric-based products, must meet people’s needs and balance affordability. The industry can also work in partnership with governments to create public-private solutions.

The insurance protection gap is generally defined as the difference between total and insured loss costs. Globally, 2021 total losses from natural disasters were estimated to equal approximately USD 280 billion, of which approximately USD 120 billion, or 43%, were covered by (re)insurance. This gap was smaller than many previous years because a higher proportion of losses occurred in the US, which has one of the most developed insurance markets in the world, with high penetration.

The protection gap varies significantly among high-, medium- and low-income countries. In Asia, on average, the protection gap is estimated to be approximately 90%, using historical records as well as analytical analysis. The Lloyd’s report on the protection gap placed several Asian countries in the top ranks, based on estimates of the relative insurance gap cost, with Bangladesh, Indonesia and Philippines holding the top 3 places, respectively.

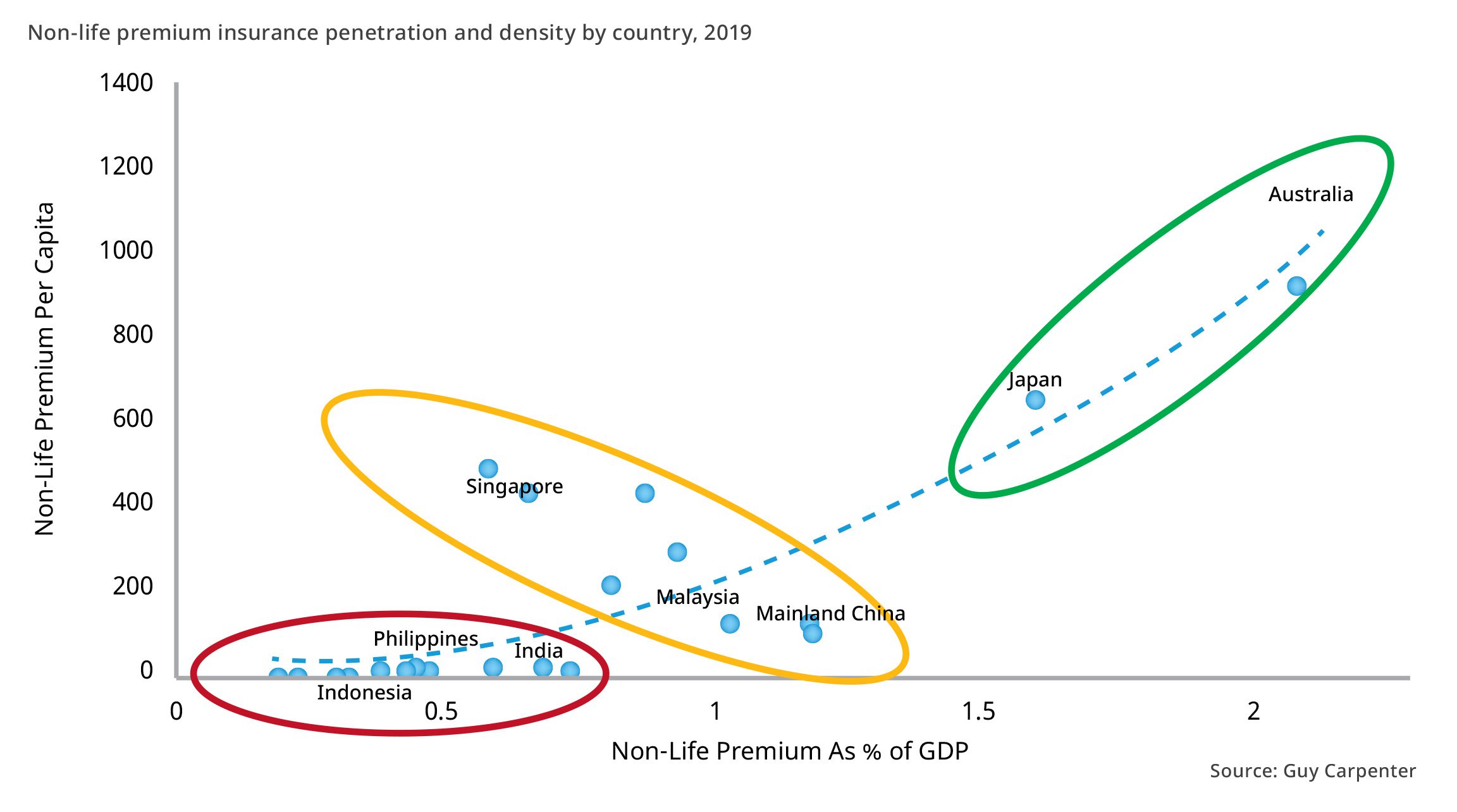

The figure below depicts insurance penetration by displaying the property-casualty premium as a percentage of gross domestic product (GDP) measured against premium per capita. The plot shows the differential level of protection gap in Asia Pacific—South Korea was excluded, as its insurance penetration is the highest (almost at 5%), an outlier within the Asia context.

With the changing climate, natural catastrophes are becoming more frequent, and the intensity for certain perils is likely to increase, severely affecting several countries in Asia. Urbanization and subsequent unplanned urban development and expansion are escalating in several Asian cities. These dynamics are expected to accentuate the challenges associated with the protection gap.

To measure this protection gap, the most appropriate approach is to use the uninsured portion of the economic losses, due to the lack of data and details. However, it is worth noting that this gap may be smaller in actuality, because a portion of these economic losses is neither desirable nor economically credible to be considered for insurance coverage. Hence, these losses would be excluded. These portions of losses may include risk retentions, deductibles and coverage limits associated with the insurance policies. Additional components of these losses are unmeasurable risk, moral hazard and adverse selection, as well as the more suitable self-funding approach by individuals for the high-frequency/low-severity losses.

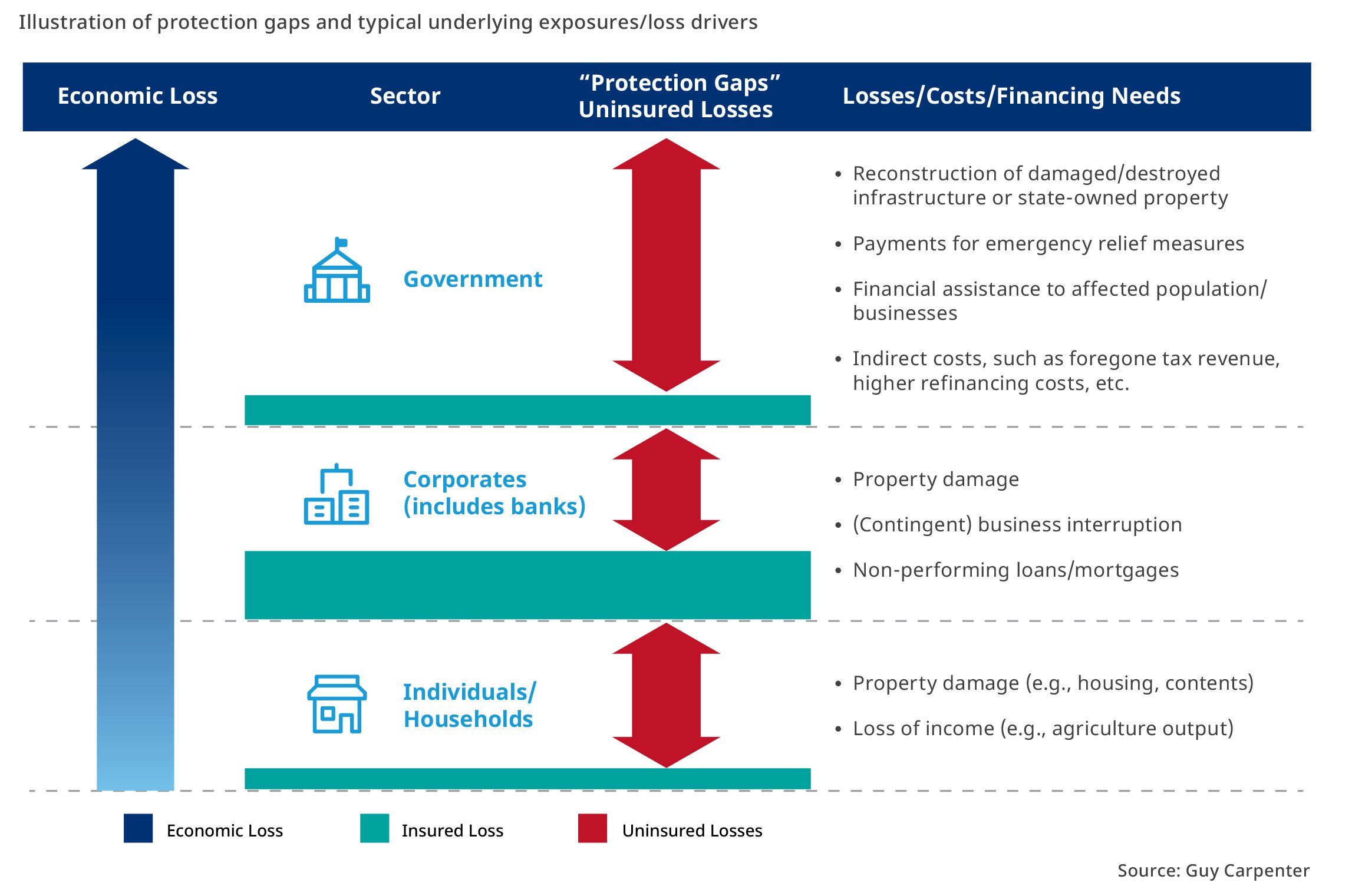

The size of the insurance penetration gap may differ by sector, subject to the exposures that are affected, as shown in the figure below. For example, corporates and manufacturing industries usually tend to insure their physical properties and production sites as part of their risk management framework. However, residential homeowners may consider insurance to be an additional expense or simply may not be able to afford adequate protection, so the size of the protection gap is usually much larger.

Nevertheless, a large component of losses that is not covered by insurance ultimately may need to be assumed by governments and taxpayers. The public sector assumes an increasing share of climate costs around the world, particularly in developing countries, where private insurance for both businesses and individuals is less prevalent. Financing gaps, if not rectified, often may create long-term fiscal instability for governments. It is imperative to understand the key challenges associated with the prevailing protection gap in Asia and put forth innovative solutions to bridge it.

Challenges

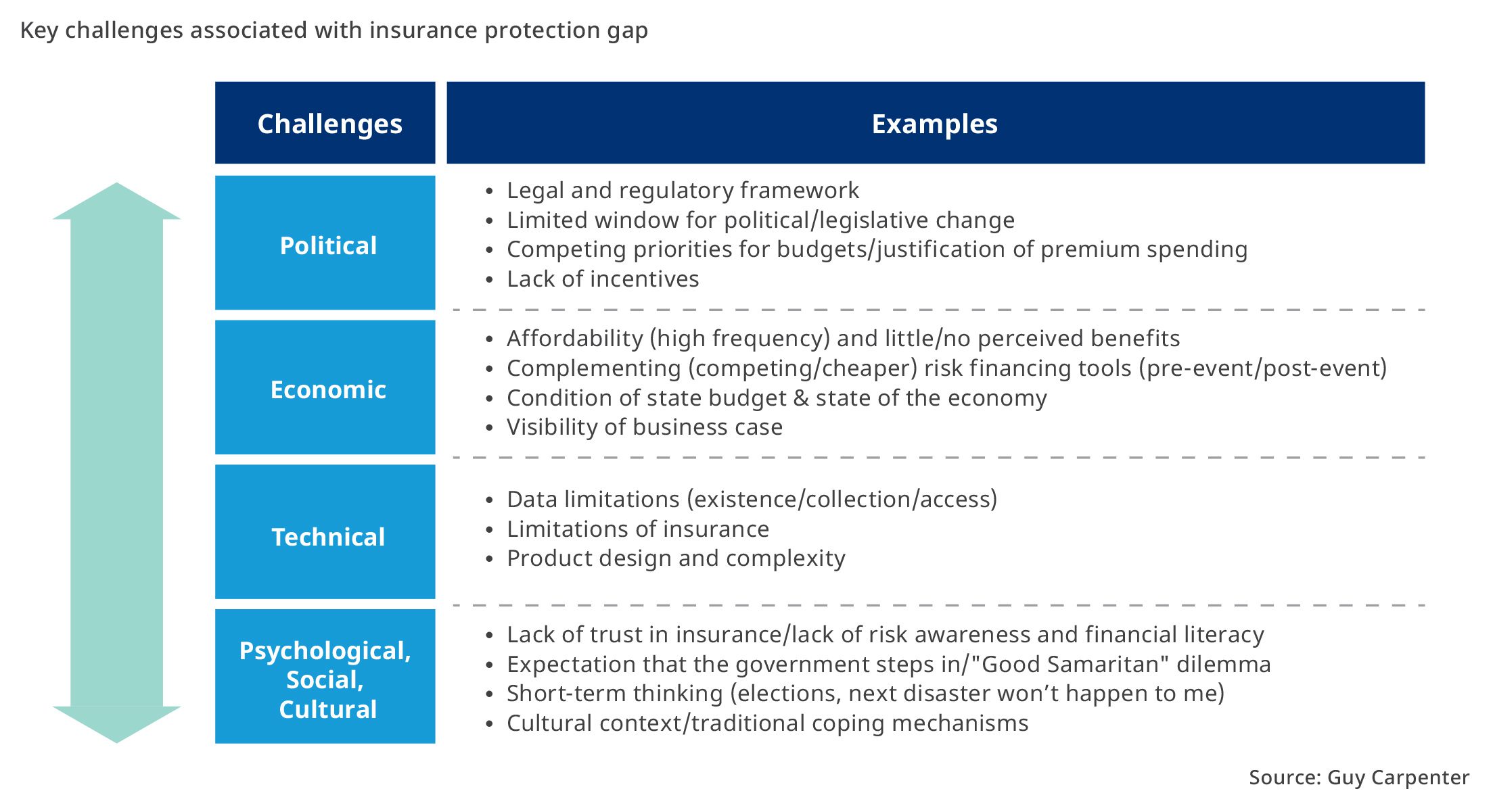

There are multifaceted challenges associated with the protection gap. Broadly, these can be segregated into political, economic, technical and social disciplines.

The political challenges include the limited will and incentives to implement the necessary policies to reduce the protection gap. In the economic context, affordability, whether it is the individual or the state, remains one of the biggest barriers to using insurance. There are also technical hurdles, due to the lack of data and tailored products with the ability to address the affordability issues, win the confidence of buyers and eventually increase insurance penetration.

The lack of trust in insurance, societal and cultural beliefs such as, “the next disaster will not happen to us,” or the assumption that the government will step in to assist, limits the usage of insurance. Additionally, most of these challenges intersect each other, adding to the complexity. For example, investments in mitigation measures may not earn the same goodwill for public officials as the provision of post-disaster relief.

Pandemic revealed substantial protections gap, helped spur creative solutions

The outbreak of the COVID-19 pandemic and associated lockdowns highlighted significant vulnerabilities in the health and financial security of many economies. Businesses of all sizes and sectors were impacted by the crisis resulting from the substantial protection gap. There were no instruments in place for future pandemics.

With recognition that the risks were too large to be assumed by the private insurance sector alone or governments alone, several public-private initiatives were begun, such as the introduction of the Pandemic Risk Reinsurance Program in the US or Chubb’s Pandemic Business Interruption Program.

Marsh McLennan quickly established over 30 national “Pandemic Re” teams to support discussions at national levels around the design and delivery of pandemic risk insurance solutions. All these initiatives are at different stages, but more significant is the effort put in place to develop solutions for one of the largest economic losses ever seen, using public-private partnerships.

This article is shared with the kind permission of ICMIF Supporting Member Guy Carpenter. To download the full report, Natural Catastrophe Protection Gap in Asia Calls for Collaborative Innovation, click here

Published September 2022

Solutions

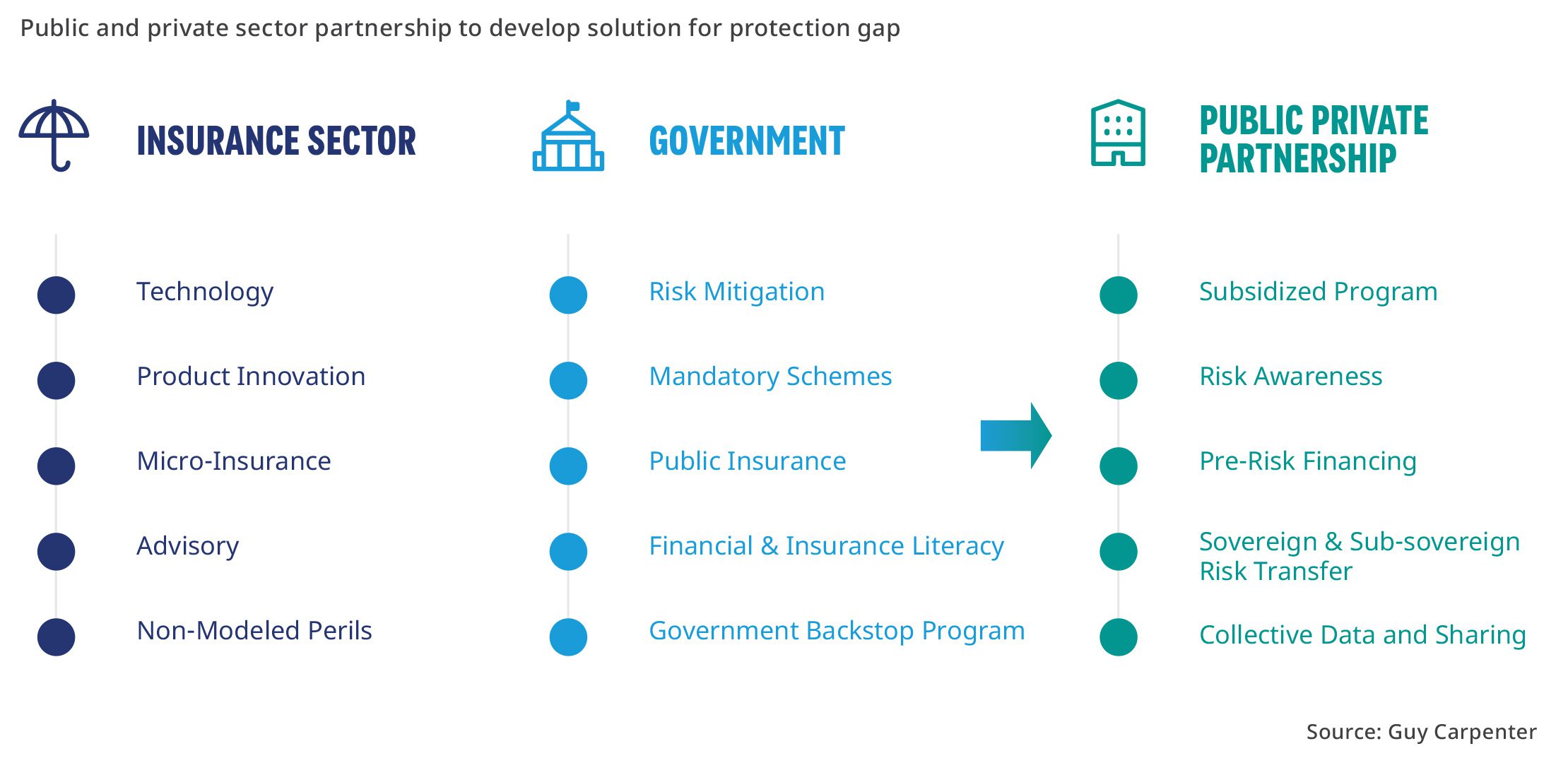

From sovereign nations to individuals, there is a wide range of protection gap financing needs. Government needs may include access to immediate payments for emergency relief measures or forgone tax revenues, while for individuals they may include loss of property or income. The available solutions to bridge the insurance protection gap need to be expansive and extend from the micro level (individuals) to the macro level (sovereign states). A collaborative approach between the public sector and private-sector insurance industry is crucial, especially in regions where the insurance protection gap is wide.

The insurance industry is capable and well-resourced to develop the technology and products needed to cover the protection gap. Industry innovators must meet people’s needs and balance affordability. Bespoke micro-insurance products are one example that can provide much-needed relief after a disaster. Parametric-based products and solutions are evolving, with a focus on reducing the basis risk. They provide immediate relief after a severe event, and they can be developed for and employed at any level—macro to micro. An important role of the industry is to build trust in insurance by advising and educating the public.

Risk mitigation remains among the most essential tasks for governments. It helps to reduce losses, and aids in the availability and affordability of insurance. Government schemes, such as mandatory insurance for specific sectors and perils, and public insurance initiatives are also effective in reducing the protection gap. However, it is the cooperation between the private and public sectors, through public-private partnerships, that may be the most-effective solution. Government distribution networks and infrastructure can be used by private institutions to channel their products and solutions. The government, in partnership with the private sector, may develop subsidized schemes, helping individuals obtain necessary protections. With the support of the insurance industry, governments can introduce ex ante solutions at sovereign and sub-sovereign levels. Another example of a public-private partnership is the establishment of a (re)insurance pool with a government guarantee.

Guy Carpenter’s Public Sector Center of Excellence is a global unit focused on helping governments and other public entities find innovative solutions to unfunded liabilities. The practice delivers reinsurance and capital market solutions and supporting risk analytics that focus on this gap, quantifying and helping to predict the magnitudes of risk taken by different parties.

Selected regional examples from emerging economies in Asia

Southeast Asia Disaster Risk Insurance Facility (SEADRIF)

The Southeast Asia Disaster Risk Insurance Facility (SEADRIF) is the first regional program in the Association of Southeast Asian Nations (ASEAN) to address disaster risk financing comprehensively. It brings risk identification, reduction and preparedness, as well as insurance, and aids in creating resilient event recoveries. While ASEAN countries are heavily exposed to a variety of natural catastrophe risks arising from earthquakes, floods and tropical cyclones, as well as secondary perils such as tsunami and volcanoes, regional catastrophe risk insurance markets are still underdeveloped in terms of non-life catastrophe insurance penetration.

Developed as an initiative by the ministers of finance and central bank governors from ASEAN+3 countries, SEADRIF was established in July 2019 as a multi-functional regional platform for ASEAN nations to access financial, analytical, advisory and knowledge services. The platform also provides products to strengthen financial resilience against disasters and climate shocks.

The first financial product offered by SEADRIF Insurance Company, a licensed direct general insurer in Singapore, is a catastrophe risk pool for Lao People’s Democratic Republic and Myanmar. The pool leverages joint reserves and offers market-based finite and parametric catastrophe risk insurance solutions to provide liquidity in the aftermath of disasters such as severe floods. At the request of member countries, SEADRIF is also exploring the development of other disaster-risk financing solutions, such as a joint risk pool for public assets and infrastructure of ASEAN countries.

Philippines Catastrophe Bond for Earthquake and Typhoon

Issued by the World Bank, the first-ever sovereign catastrophe bond in Southeast Asia provides the government of the Philippines with USD 225 million in protection against earthquake and tropical cyclone risk over 3 years. The Philippines’ disaster-risk financing and insurance strategy follows a multi-tiered and multi-layered approach by addressing disaster-risk financing needs on national, local and individual levels. It also combines different financial instruments, including dedicated disaster funds, contingent credit lines and risk transfer to the international reinsurance and capital markets.

The Philippines’ catastrophe bond, which was listed at the Singapore Exchange in November 2019, has been another milestone for the Philippines government in executing its disaster-risk financing and insurance strategy. It constitutes a landmark transaction marking a number of firsts, such as being the first catastrophe bond ever directly sponsored by an Asian sovereign, the first catastrophe bond listed on an Asian exchange and the first World Bank bond ever listed in Singapore. This World Bank-issued catastrophe bond recently triggered a payout of USD 52.5 million to the government of the Philippines after AIR Worldwide determined that super typhoon Rai (locally known as Odette) breached the trigger for wind.

Indonesia State Asset Insurance Program (ABMN)

As a part of the Indonesian government’s strategy to build resiliency against natural disaster, the vice president of the Republic of Indonesia launched the Disaster Risk Financing and Insurance (DRFI) Strategy for Indonesia in 2018. The strategy aims to obtain timely, targeted, sustainable and transparent disaster-risk funding schemes.

One of the government's priorities is to protect state and regional assets. To facilitate this, a legal framework was established to provide insurance covering state assets.

To ensure the proper insurance coverage and premium, a state asset management information system is in development to capture data around risk and claims. The state insurance pilot project started with a disaster insurance program for the buildings of the Ministry of Finance, which were insured with a total value of IDR 10.84 trillion. A consortium of 50 general insurance companies and 6 reinsurance companies will provide insurance at a premium of IDR 21.3 billion.