Last month Co-op Insurance, a UK-based member of the International Cooperative and Mutual Insurance Federation (ICMIF), launched its new carbon offset programme. Co-op Insurance says this is a first for the UK insurance market. The programme will see the organisation offset a proportion of its motor and home insurance customers’ carbon emissions, as standard.

As of 23 February 2017, every customer who purchases a new motor or home policy directly through Co-op Insurance, will see 10 percent* of their motor or home carbon emissions offset through carbon reduction projects in the developing world which have added social and environmental benefits. This will last for the first year of the policy and will be at no extra cost to the policyholder.

The projects invested in are independently audited and verified to internationally agreed standards:

Where a customer takes out a motor policy Co-op Insurance will offset 10% of the customer’s car carbon dioxide (CO2) emissions in the first year by supporting the provision of cookstoves in Ghana that are said to be up to 50% more efficient than the stoves that people are currently using. This cuts fuel requirements, frees up time and reduces CO2 emissions. The cookstoves replace less efficient cooking methods such as open-burning of wood, coal or animal dung which cause more indoor pollution and release more greenhouse gases such as carbon dioxide and methane, as well as contributing to deforestation through the need for higher levels of wood for charcoal fuel

For each home policy, Co-op Insurance will offset 10% of customers’ home energy CO2 emissions in the first year by helping to fund LifeStraw water filters that provide safe drinking water to families in Kenya. LifeStraw water filters require no electricity, and mean there is no need to boil water to purify it. This cuts CO2 emissions whilst helping to protect families from waterborne diseases like typhoid, cholera and diarrhoea – the third leading cause of death among children and adults in Kenya.

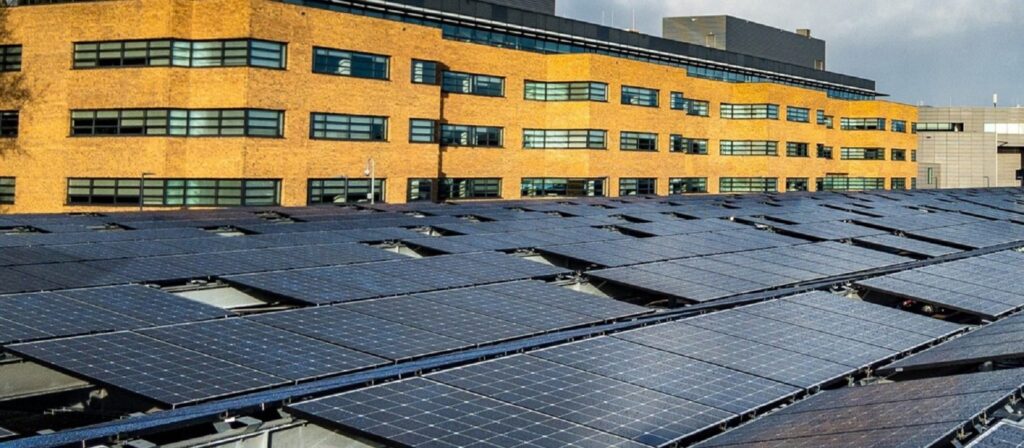

This launch, says Co-op Insurance, is one part of its commitment to do business ethically. According to the Co-op it sources 99% of its electricity from renewable sources (including its own wind farms) and has reduced its direct carbon footprint by 43% since 2006. It also offers an Ethical Policy for investment of customers’ insurance premiums. This covers human rights and international development, as well as issues of animal welfare and the organisation’s impact on the environment.

Since 2006 Co-op Insurance has been offsetting customer emissions through its specific ‘Ecoinsurance’ motor policy: through which Co-op members have offset more than a million tonnes of CO2 to date. This recent launch goes further says the Co-op with the inclusion of carbon offset as standard on all new home and motor policies purchased directly through Co-op Insurance.

Mark Summerfield, CEO of Co-op Insurance, said: “We were one of the first businesses to recognise and respond to the impacts of climate change, since then we have reduced our greenhouse gas emissions from our operations, purchased renewable electricity and have offset more than a million tonnes of carbon since we first introduced carbon offsetting on our products 10 years ago.

“We are now offering a carbon offset as standard on all home and motor policies in the first year, at no extra cost to our customers, and are making sure to choose offset projects that are checked to a stringent standard and have added benefits in the developing world, whether that’s contributing to the local economy, protecting people’s health, or reducing deforestation.

Robert Stevens, Head of Partnerships at Climate Care, said: “We are proud to expand our long-standing partnership with the Co-op – a business that continues to lead the way by placing values and ethics at the very core of its purpose. This new, ground-breaking offer not only enables Co-op Insurance customers to offset their carbon emissions, it will improve health and livelihoods in low-income communities across Africa.”

Source/image: Co-op Insurance