Swedish ICMIF member Länsförsäkringar has invested SEK 300 million in a social bond issued by the International Finance Corporation (IFC), part of the World Bank, to support those affected by Covid-19.

Kristofer Dreiman (pictured), Head of Responsible Investments, Länsförsäkringar AB, said: “The purpose of the bond is to support the work being done to manage the health and economic effects that result from the global virus outbreak caused by coronavirus”.

The IFC issued the bond under its social bond framework. Thus, the funds are earmarked for specific social projects such as health care, education and financing for small businesses. The bond amounted to SEK 3 billion and is a result of the World Bank’s commitment from the beginning of March to allocate up to USD 12 billion to support both countries and the private sector as a result of the virus outbreak.

“We want to support various actors and countries as they take measures to minimize the tragic effects of Covid-19 as far as possible. In the long term, private capital can complement public investment and help secure jobs and reduce the health/economic effects of the virus outbreak,” said Dreiman.

In addition to Länsförsäkringar, a handful of other institutional investors also participated in this social bond.

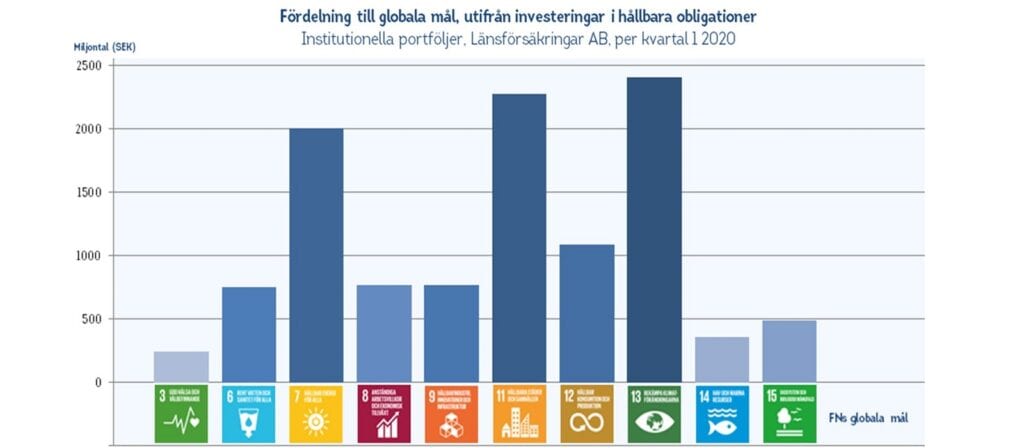

The investment is made from the institutional portfolios linked to Länsförsäkringar Liv, Sak and Fondliv, which are managed by the Asset Management function within Länsförsäkringar AB. The investment will form part of Länsförsäkringar’s sustainability work and also contribute to one of the United Nations Sustainable Development Goals – Objective 3 – for good health and well-being, one of Länsförsäkringar’s priorities in their efforts towards supporting the global sustainability goals.