According to data from the Climate Bonds Initiative the green finance market passed its most significant milestone yet with USD 1.002 trillion in cumulative issuance reached in early December 2020. Issuance originated from a record 67 nations & supranationals.

The energy sector comprised the largest component at USD 354.7bn, followed by Low Carbon Buildings with USD 263.5bn & Transport in third place with USD 190.7bn. Water infrastructure is in fourth place with USD 98.7bn, followed by Waste Management with USD 36.9bn. Industry, ICT & Land Use collectively total USD 40.8bn and USD 17.6bn is in Unallocated.

Total sovereign issuance is USD 71.5bn with the “Sovereign Green Bond Club” (where national governments issue sovereign green bonds) membership now counting 17 nations & the potential for 14 more new members according to the Climate Bonds Initiative.

The Climate Bonds Initiative says it has long held the view that achieving the vital first USD 1 trillion in annual green investment would be a pivotal climate finance milestone.

The USD 1 trillion in cumulative green issuance allows for a moment of reflection. In just over a decade, a significant amount of capital has been harnessed towards green and climate investment. A cumulative USD 1 trillion and multiple years of annual USD200bn+ new investment looks impressive.

But climate action goal posts have shifted a long way since 2007. The next cumulative green trillion cannot take another 10 or even 5 years. In a world now focused on transition, 2030 emissions reduction & ratcheting up climate targets, accelerating to reach USD 1 trillion in annual green issuance is the big investment goal the global financial system needs to be aiming for says the Climate Bonds Initiative.

Climate Bonds Initiative screens self-labelled debt instruments to identify bonds and similar debt instruments (including loans & sukuk) against a rigorous Methodology, assessing their eligibility for inclusion in the Climate Bonds Green Bond Database.

ICMIF and the Climate Bonds Initiative (CBI)

The Climate Bonds Initiative (CBI) is an investor-focused, not for profit organisation with the goal of promoting large-scale investments through green bonds. The aim is to accelerate a global transition to a low-carbon and climate-resilient economy in line with the COP 21 Paris Agreement and keep the global temperature rise this century to well below 2 degrees Celsius above pre-industrial levels.

The Climate Bonds Initiative runs the only international certification scheme for green bonds. This sets detailed green definitions and eligibility criteria for certification and has a robust pre-and post-issuance assurance framework. For different sectors there are requirements which assets must meet for certification and the standard acts as a screening tool so that investors can be confident that the funds are being used to deliver climate change solutions.

ICMIF is represented on the Climate Bonds Standards Board by our CEO Shaun Tarbuck who is supported by Steve Leicester, Chief Financial Officer. The Board governs the development of the Climate Bonds Standard & Certification Scheme. Board meetings are held monthly and are made up of independent members which collectively represent USD 51 trillion of assets under management. The Board is responsible for approving: –

- Revisions to the Climate Bond Standard including the adoption of additional sector criteria.

- Approved verifiers

- Applications for certification of a bond under the Climate Bonds standard

There is widespread agreement in the green finance sector that activating the mainstream debt capital markets to finance and refinance climate-aligned projects and assets is critical to achieving the international climate goals.

Steve Leicester says: “It is estimated that total global infrastructure investment is expected to amount to USD 90 trillion between now and 2030 and the CBI and all those involved in green finance agree that this needs to be low-carbon and resilient to climate change. This is where green bonds come into play. Green bonds are bonds with one distinguishing feature in that proceeds are earmarked for projects with environmental benefits, primarily climate change mitigation and adaption.

“Green bonds offer stable returns and long-term maturity, making them a good fit for investors’ needs (both public and private), particularly for long-term infrastructure investment.” Steve Leicester concluded.

In 2020, ICMIF hosted a Sustainable Investment Leaders webinar series, one of which, “Green bonds and why organisations should invest in them” featured Justine Leigh-Bell, Deputy CEO and Director Market Development of the Climate Bonds Initiative (CBI) who explained what green bonds are and how they provide a financing mechanism to build more resilient, sustainable and environmentally friendly communities for tomorrow. The webinar also featured Ylva Wessén, President and CEO, Folksam (Sweden) whose organisation is one of the world’s leading investors in green bonds.

ICMIF member Folksam (Sweden) is one of the world’s leading investors in green bonds and also a leading advocate in the UN-backed Net-Zero Asset Owner Alliance, where companies commit to carbon neutral investment portfolios by 2050.

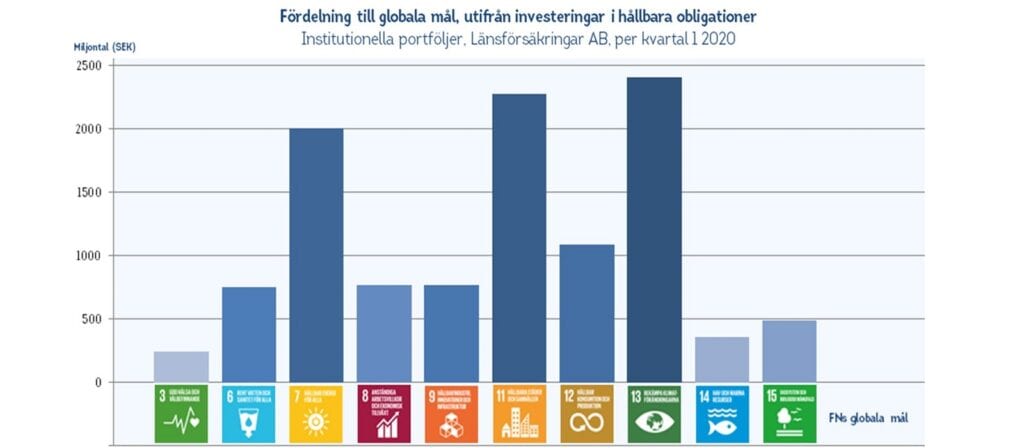

The 2020 ICMIF Sustainable Investments survey showed that 15 ICMIF members had invested a total of USD 5.6 billion in green bonds and social bonds. Folksam, Länsförsäkringar (both Sweden) and The Co-operators (Canada) leading the way collectively with USD 4 billion invested in these bonds between the three organisations.

The impact of the global pandemic means annual issuance in 2020 will stand at the second-highest year of issuance on record at over the USD220bn mark as of 13 December, but shy of the record-breaking 2019 figure of (USD266.1bn adjusted from initial USD255bn).