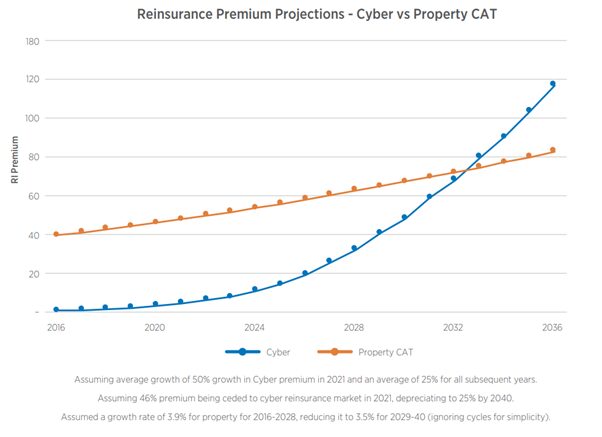

The growth trajectory of the cyber (re)insurance market will see it become comparable in size to either property or casualty by 2040 while exceeding property CAT in terms of annual reinsurance premium a number of years before. With the cyber ‘underwriting revolution’ well underway, Gallagher Re looks ahead to predict a second wave of growth for cyber. With decreasing loss ratios, restored profitability and confidence plus loss mitigation through technology-led solutions, cyber will become a true insurance ‘heavyweight’ where cyber reinsurance premium will ultimately outstrip that spent on either property CAT or casualty reinsurance.

In 2018, Gallagher Re (then Capsicum Re) wrote a white paper outlining an expectation that the reinsurance market will soon become redefined as PC&C (property, casualty, and cyber). Four years later, it seems this evolution is well on the way; the COVID-19 pandemic has evidenced society’s ever-expanding technological dependencies, the conclusion of the Lloyd’s non-affirmative deadlines is creating momentum for standalone cyber growth, and the demand for cyber cover is continuing to soar as our headlines are occupied with stories of cyber-attacks and new technologies.

So what next for the cyber market?

By 2040, we (at Gallagher Re) believe that cyber will be comparable in size to either property or casualty and will have long since exceeded them in terms of annual reinsurance premium. The white paper, CY-FI: The Future of Cyber (Re)Insurance, explores how we will get there.

From an underwriting revolution to a second wave of growth

First, we explore how the underwriting revolution that began in 2020 will continue into 2022. Furthermore the crunch in capacity against a backdrop of insatiable demand has led to a decoupling of premium and aggregate exposure.

This has enabled (re)insurers to leverage the full range of tools at their disposal (ranging from coverage to use of technology) as they look to deploy their budget against better quality risks. This underwriting revolution lays the foundations for future growth, as growing appetite for cyber risk will stem from its increasing profitability.

2023 could see the start of cyber’s second growth wave as decreasing loss ratios, greater confidence in underlying risk quality and limited actual losses from high profile cyber events raise confidence. Unlike other markets, where enormous capital injection would seem a symptom of a softening market, capital will bring positive changes within cyber. We explain how this will take the form of continued investment in the understanding and mitigation of potential losses through technology-led solutions.

From 2025, increasing clarity over cyber’s future as an insurance heavyweight buoyed by market confidence in the ability of data to predict claims will drive a ‘data arms race’ by reinsurers and cybersecurity vendors as scale is required to fully realise technology potential in loss ratio improvements.

We expect this convergence between technology solutions, cyber-security techniques, and reinsurance will create a virtuous cycle, as investors seek to protect their capital invested in the space. Concurrently, we outline how cyber can become the model class in regard to product innovation and diverse distribution, as it attempts to meet the growing capital base’s appetite.

This article is shared with the kind permission of ICMIF Supporting Member Gallagher Re. To download the full white paper CY-FI: The Future of Cyber (Re)Insurance click here.

Published May 2022

2030 and beyond – Welcome PC&C

Looking to 2030 and beyond is when we expect cyber will not only match property, but surpass it.

If the cyber market continues to grow at its current pace, it will double in size every three years. Meanwhile, there will continue to be heavy reliance on reinsurers with what we estimate to be approximately 50% of insurance premium currently ceded to the reinsurance market. The emergence of cyber personal lines and other product diversification will continue to drive the exponential demand growth, whilst new capacity will continue to emerge as loss ratios remain healthy.

This growth will also underscore cyber becoming the largest driver of volatility in the industry, and will require the balance sheets of third-parties to manage. Cyber presents a highly attractive market dynamic in the present, but will increasingly become a prerequisite for insurers of the future as it continues its exponential growth trajectory and subsumes connected lines of business.

The potential breadth, and depth, of cyber means an oversupply of capacity is almost an possibility, and so therefore is a ‘soft’ cyber market. As the class matures, it must be said that wider industry can perhaps learn from a peril and class like cyber. This is true in respect of the current ‘premium problem’, where premium and aggregate exposure are increasingly unrelated, as well as the new ground cyber is breaking as it breeds innovation in use of technology, product design and distribution.

Just as we did four years ago, we’ve foreshadowed an illustrious conclusion to cyber as it surpasses property in size. However, in all the greatest Sci-Fi adventures the conclusion never seems a certainty, with the journey crammed full of enticing plot twists and character defining moments.

We haven’t reached cyber’s conclusion yet, so this white paper remains entirely a work of fiction, but for now we’ll enjoy the next chapter in the most dynamic and exciting of classes.