The Unipol Group founded the Reputational & Emerging Risk (R&ER) Observatory as an instrument for protecting the group’s reputation and strategy. The R&ER Observatory contributes to the creation and strengthening of Unipol’s reputational assets and strategic positioning over time, generating a competitive advantage and anticipating future trends in order to prevent emerging risks and seize new business opportunities.

Anticipating change is essential to prepare the Unipol Group today for the risks and opportunities of tomorrow. In fact, it is more and more important to anticipate changes because the speed of change has increased significantly; and important to adopt an integrated view as changes are increasingly interconnected.

The creation of the Reputational & Emerging Risk (R&ER) Observatory in 2014 was part of Unipol’s objective to adopt a strategic and proactive approach to the management of reputational and emerging risks. The organisation wanted to take more of holistic approach that considered not just the risks, but also the opportunities.

This holistic approach aims to protect Unipol’s reputation and strategy, while at the same time, contributing to the creation and strengthening of reputational assets and strategic positioning; generating a competitive advantage and anticipating future trends so as to seize new business opportunities.

The value brought to the Unipol Group by the R&ER Observatory is the guarantee of a window on the future, that is openness to signs of change in the various dimensions of the external context – i.e. social, technological, environmental, and political aspects – as well as the competitive environment, providing a 360-degree overview of emerging trends in order to ensure adequate protection from related threats and, at the same time, seize new opportunities in advance and guarantee an effective safeguard of emerging reputational risks by ensuring a continuous alignment of the Unipol Group’s responses to the stakeholders’ expectations.

The strategic value for a predictive model

The objective of the R&ER Observatory is to promote “integrated thinking”. This is achieved through both the interpretation of the external environment by analysing not only technological but also social, environmental and political changes and their interconnections; and in the analysis of the company’s internal response that encompasses the various business areas and phases of the value chain.

The strategic value of this approach provides a systemic and structured approach to integrate the various external perspectives. Unipol has an overview of the external context allowing it to rapidly identify any signs of change. It also brings these trends closer the business of the insurance sector by specifying the impacts for each phase of the value chain and each functional area.

The R&ER Observatory is proposed as a tool for reflection and a stimulus for the various departments at Unipol in identifying and preparing for the challenges of the external environment during strategic planning and subsequent monitoring. This allows it to provide responses in line with stakeholder needs and to develop and promote resilience.

It also helps Unipol to consolidate its prominent position on an international scale and in its commitment to play a leading role by anticipating and guiding the upcoming developments of future society.

Published March 2021

The methodological framework

A focus on risk management underpins the philosophy of the R&ER Observatory in its holistic approach to risks and opportunities.

The keystone of the R&ER Observatory is its “Internal-External Alignment”. The internal perspective is integrated with the external perspective in order to ensure constant alignment between stakeholder expectations and Unipol’s responses today (for reputational risks) and tomorrow (for emerging risk).

Materiality is the concept used to filter topics: over time, Unipol’s response is aligned with stakeholder expectations regarding currently material issues and expected material issues in the next five years.

The R&ER Observatory uses a predictive model to identify the issues of the future before they happen. Through structured listening of various sources and the use of mature and tested algorithms, it is able to generate quantitative and qualitative trends relating to its “Tree60” - a “tree” consisting of 360 topics to offer a 360-degree overview of the insurance sector and surrounding external environment.

A structured process was defined for the management of emerging risks intended to: identify the most material emerging trends and their related risks and opportunities; assess the extent of Unipol’s strategic control; define mitigation plans; and carry out constant monitoring and updating.

The R&ER Observatory serves as an outer layer of Unipol’s reputational risk management framework. It provides a reference point that makes it possible to contemplate material impact(s) in a broader context, as well as anticipating social, cultural, technological, environmental, and political changes destined to influence stakeholder expectations.

The R&ER Observatory is founded on four key pillars:

-

Establishment of a technical board

Its composition guarantees multi-disciplinarity from various corporate functions to ensure an integrated and synergetic approach and to overcome potential organisational barriers.

-

Involvement of business managers

Business managers are systematically involved in line with the objective of creating a strategic tool to support organisation-wide development.

-

Use of a predictive model

The Observatory makes use of a consolidated predictive model based on the Meeting Point methodology, developed by sociology professor Egeria Di Nallo. The adoption of a predictive model that is based on a “telescope” - and not the “rear-view mirror” - is essential for the adoption of a forward-looking approach to anticipate future risks and opportunities. To obtain an even longer-term view, it also uses methods based on futures studies for the purpose of building future scenarios in the long term.

-

Integration of the stakeholder perspective

The stakeholder (external) perspective is integrated in the risk management system in order to enrich the internal vision of management.

The Emerging Trend Radar

The R&ER Observatory fuels the Unipol Group’s Emerging Trend Radar (see below), which maps the most material emerging trends for the organisation and that should be kept under observation and monitored.

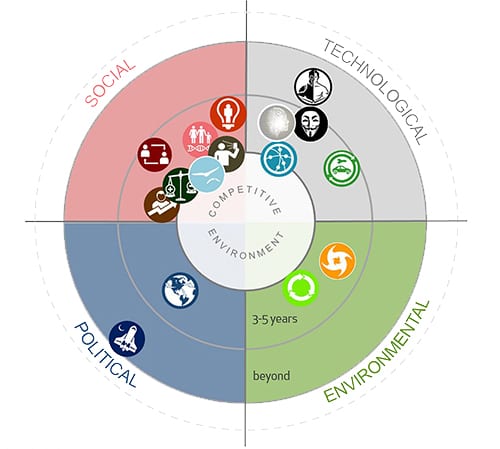

In the context of the Emerging Trend Radar, each topic is classified based on:

- its prevailing nature: the radar is divided into four quadrants that correspond to the four dimensions of the external environment: social, technological, environmental and political (STEP);

- and level of maturity: in the innermost circle the radar includes the emerging themes that are material for the insurance sector within the next five years; and in the outer circle the emerging themes that will become material after five years.

The R&ER Observatory aims to monitor the evolution of the emerging macro trends identified as well as the early signs of any new topics “to watch” and new macro trend to be included in the Radar.

There are 16 emerging macro trends for the insurance sector. Initially (in 2015) the top 10 emerging macro trends were identified, in terms of their impact on the insurance sector and the Unipol Group in a five-year horizon. Between 2015 and 2020, six additional trends were added.

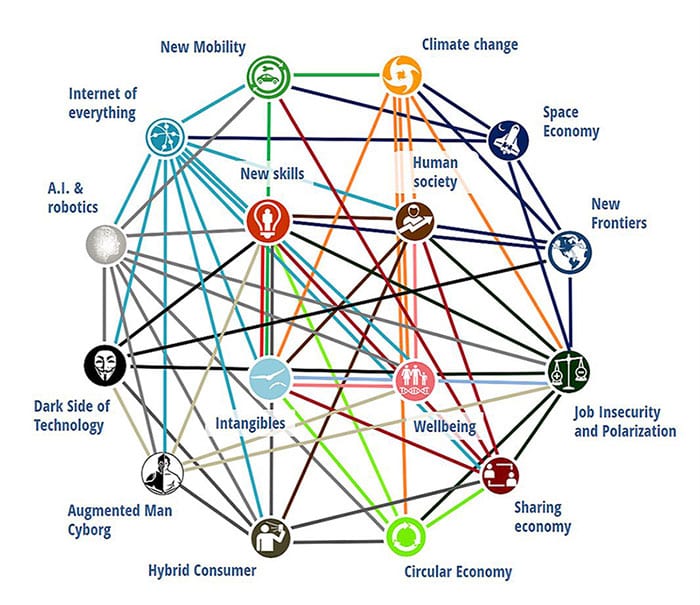

The Interconnection Map (see below) provides a systemic view, highlighting how the macro-trends are connected to each other and may generate driving trends causing a potential domino effect.

16 emerging macro trends for the insurance sector

This includes the evolution from ownership to access, forms of collaborative consumption (propensity for usage/ownership, propensity for sharing, social streets, open source, crowdfunding, cloud technology, pay per use...) and peer-to-peer (P2P) trust favoured by digital reputation systems or guarantee tools, such as insurance or forms of “industrialised” trust, such as Blockchain.

This concerns the hybridisation of the relationship with customers into a customer journey with no discernible difference between actual and virtual reality. It includes the following themes: web vitality, mobile Internet, virtual mobility, “onlife”, perpetual connectivity, access to “anytime, anyway, anywhere” services, e-commerce, domestic time, access hours to financial services, time management savings, cyberspace credibility and security.

This macro-trend also analyses the emerging figure of the “prosumer” in terms of role, behaviour and values. In this context, it focuses on the phenomenon of the transition from “feedback” to “feedforward” and on the evolution of the insured-insurer relationship in view of creating an “us”.

This includes the themes of fear, sense of vulnerability, unemployment and job insecurity, social polarisation and tensions. Social polarisation is explored in its many forms, which have extended from the economic and financial dimension to other more intangible dimensions with impacts in terms of access to opportunities and “future enablement”. It also includes the themes of downsizing and money management savings.

This includes aspects linked to population longevity and aging (longevity, management of the elderly, silver economy, value of children, fertility), progressive generational change with a gap between the various generations and the “power of the youth”, trends linked to immigration and multiculturalism (cultural and religious blending), evolution of family units and social networks (extended families, unmarried couples, singles, parent-child relationships, grandparent-grandchild relationships, women’s empowerment, work-life balance, pet affection, household and gender liquidity).

This concerns the increasingly important theme of health, understood in a more holistic sense as psycho-physical well-being. It includes the phenomenon of health being increasingly tailored to the patient, touching on topics such as developments in biotechnology, omics sciences, “P4” medicine (personalised, preventive, predictive and participatory), the “quantified self” phenomenon, “well-aging” and, in the area of personalisation and prevention, circadian rhythms, lifestyle and food habits, therapeutic freedom, addictions. It also includes the growing significance of chronic and mental illnesses, as well as the theme of drug resistance. It addresses the issue of public-private (multi-pillar) integration and the rebalancing of welfare actions between the State, the Market and collaborative economies.

This concerns the need for new skills to adapt to changing trends and new organisational paradigms based on agility and resilience. It includes the themes of skills gap, lifelong learning, remote working and organisational agility, resilience, blending of skills and enhancement of diversity. In this area, it focuses on the growing importance of learning from the external environment by acquiring “clocks functioning at multiple speeds”.

This includes the metamorphosis of assets from tangible to intangible, the evolution of needs from the sphere of security to that of self-realisation and enrichment of assessment and reporting metrics with environmental, social and governance (ESG factors) factors in view of a long-term sustainability. In this context, it focuses on the growing importance of reputation, understood as trust capital, in which ethics play a central role.

This includes the themes of the Internet of Things (IoT), in particular focusing on the black box but also on other household-related devices (home automation or Smart Home and smart cities), businesses, people (health and welfare) and big data. In the area of threats, it includes the theme of personal data protection (privacy), in addition to data security and cyber-crime. It includes the emerging themes of Industry 4.0 and the new computational frontiers.

This concerns the new mobility models, the evolution of mobility-related technology and its impact on the insurance sector. It includes new mobility behaviours, from micro-mobility to the “Mobility-as-a-Service” (MaaS) model and the evolution of car technology, focusing in particular on driverless cars.

This concerns the phenomenon of our society’s transformation into a “smart economy” or “oracular society” driven by predictive algorithms, thus creating new opportunities and new challenges. It investigates ethical dilemmas and the man-machine relationship.

This concerns the dark side of technology, which is increasingly emerging after a phase in which technology has expanded massively and pervasively. It manifests itself in many forms, from techno-addiction and dangers for the youth, to fake news and fake videos, to ethical issues related to the man-machine relationship, hacking risks and privacy intrusion.

This concerns the phenomenon of the empowerment of man through an increasingly symbiotic man-machine relationship, being explored in various areas: for the purpose of treatment (on the side of both the patient and the doctor), work, ubiquity, up to the future frontiers of augmented man for the enhancement of physical and cognitive functions and the emergence of a cyborg “species”. It includes the themes of virtual reality and augmented reality.

This includes the following themes: climate change, extreme climate events, greenhouse gas emissions, dispersal of animal species, insects and microorganisms, spread of new diseases (for the part related to climate change).

This concerns the transition from the traditional model with a linear shape, Take-Make-Waste, and that generates waste, to a new model with a circular shape, where, thanks to the distinction between biological and technical cycles, waste is eliminated “by design” because everything becomes nourishment for one or the other cycle, returning back to the circle of value through regeneration, reuse, recovery, sharing or recycling. “Circular production chain”, “Recovery and recycling”, “Life-cycle extension”, “Sharing platforms”, “Product as a service” are circular business models. To be accompanied by a new thought process, also circular, which does not separate and fragment but is capable of viewing the economy, the society and the environment as closely connected and interdependent systems.

This concerns internationalisation both in view of a growth and consolidation strategy of the insurance business and in view of support to corporate and SME customers (need to provide risk protection and management services on an international level and support for the development and internationalisation process of SMEs) and retail customers (e.g. education abroad). It includes the risk of contagion, Europe’s sentiment, the growing political instability and the transition to a multipolar order, as well as the spread of disease resulting from globalisation. It focuses on global governance in the face of emerging challenges and the risk of fragmentation of frontiers, cyberspace and space supremacy.

This concerns the economy of Space, in particular with reference to the generation of enabled innovative products and services (referred to as “downstream”), such as advanced telecommunications, navigation and positioning, integration of space Big Data with terrestrial Big Data, environmental and climate monitoring, weather forecasting, space tourism, mining (space mining) and protection from the risk of impact of asteroids with the Earth and other cosmic threats, such solar storms. In this area, it focuses on nano-satellite technology and on growing access for the private sector.