We are pleased to share this latest guest blog which was written by Moses Ojeisekhoba, Chief Executive Officer Reinsurance at ICMIF Supporting Member organisation Swiss Re. The article was first published in Insurance Post on 1 June 2021. The article is shared here with the kind permission of Swiss Re.

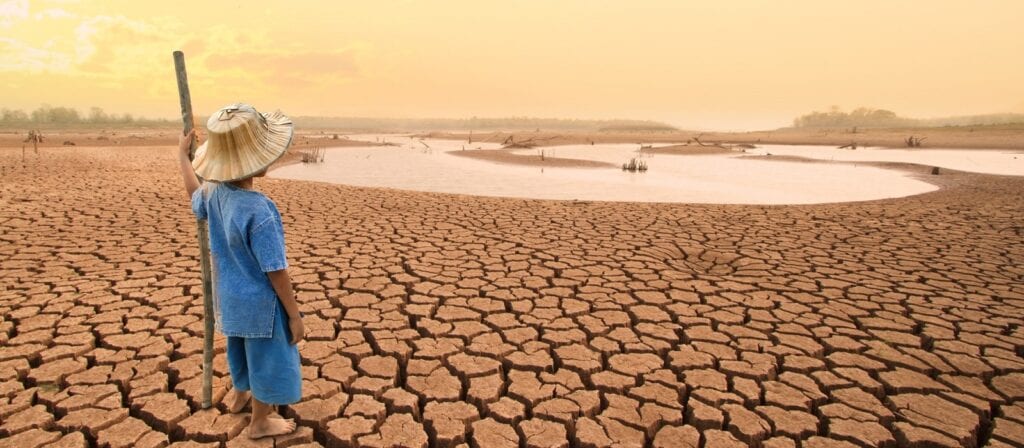

I was born in a small village called Avbiosi in Nigeria. It lies in an area home to many small farming communities whose livelihoods are heavily reliant on agriculture – and on the whims of Mother Nature.

I spent many summers on the farm with my grandparents and other relatives, and over time the destructive impact that climate change was having increasingly began to manifest. Recurring droughts and flooding often damaged maize, yam, cassava and cocoa crops, putting the resilience of communities at risk and threatening food supplies.

This experience is not unique to Avbiosi and is instead common across Nigeria and the entire African continent. Generations are feeling the brunt of global warming with devastating consequences. If temperatures continue to rise as projected, future generations will face even greater challenges. Climate change doesn’t just affect the natural environment; it also affects our health, prosperity and the wellbeing of whole societies.

Against this backdrop, the Swiss Re Institute conducted new research to assess the overall economic damage climate change could cause in countries representing 90% of global GDP. The analysis shows that no country will escape damage. However, some countries will be worse hit than others and have less capacity to adapt.

Regions which are expected to power future growth − for example, Southeast Asia and parts of Africa − will be the worst affected. These regions are also home to countries with high rates of population growth and sadly, poverty.

Tackling extreme weather and transition risk

Carbon-intensive agriculture is still the backbone of many developing economies, which face an uphill struggle to transition and diversify to greener alternatives. As mentioned, extremes of weather are already taking their toll on this sector. Similarly, fossil fuel-dependent nations – also frequently among the world’s poorest – face significant transition costs.

Nigeria is again a case in point. Besides agriculture, its economy is heavily dependent on oil and gas production, which accounts for 10% of GDP and 86% of total export revenue. Weaning its energy system and export dependency off fossil fuels while shifting towards more sustainable sources will be an enormous task – and come at great cost.

While the link between climate change and natural catastrophes is only starting to be understood, we can observe a clear upward trend in the frequency and severity of both primary perils – such as hurricanes – and secondary perils, such as wildfires and thunderstorms.

Urbanisation and development in high-risk areas, particularly along the coast and near wild land, are putting more people and properties in harm’s way. As a result, the large protection gap – the difference between total economic and insured losses – continues to grow. For natural catastrophe losses, it stood at USD 109 billion in 2020.

Re/insurers are at the heart of the solution

Although these trends are alarming, it’s not too late to turn things around. What’s needed is decisive action. Global re/insurers play a key role in helping to decarbonise our economies and mitigate climate risk. Closing the protection gap will be central to this effort. This includes supporting governments, businesses and local communities by providing more accurate risk assessments, particularly for secondary perils.

To achieve this, we’re leveraging data and technology to evolve our models. Currently, our systems are still too heavily influenced by historic data which doesn’t accurately reflect the reality now or in the future. Our new partnership with radar satellite-based flood monitoring provider ICEYE is an example of a more forward-looking approach.

Re/insurers can also play an important role in advancing the development of nascent technologies and low carbon alternatives by providing essential coverage to allow innovation to thrive. Traditional insurance products are already supporting growth in the renewable energy industry. At the same time, a new generation of sustainability solutions – innovations such as revenue insurance covers for no-sunshine or no-wind or for electric vehicles – are accelerating the energy transition.

Supporting the growth of entirely new technologies like carbon capture, storage and removal is equally important as it is ambitious. It’s estimated that the carbon removal industry will reach the size of the current oil and gas industry by 2050. And there’s a real opportunity to leverage our existing risk knowledge to serve this emerging industry with insurance offerings. However, carbon removal alone cannot replace the need to move away from fossil fuels.

A global carbon tax could be an important tool to incentivise low-carbon behaviour and decision-making. At Swiss Re, we decided to put this idea into practice on a corporate level, becoming the first multinational company to announce a triple-digit real carbon levy on both direct and indirect operational emissions such as business travel. The levy will gradually increase from USD 100 per tonne of CO2 to USD 200 by 2030. The same logic could be applied on a wider scale by the insurance industry, using such a carbon levy to aggressively finance green technologies.

Our actions now shape our children’s world

As a society, we are all more risk-aware now than we were at the start of 2020. With the pandemic still a long way from being confined to the history books, it is very easy to see how our interconnected world exposes us all to more risk.

So, with more extreme weather and catastrophes coming down the line, re/insurers are pushing against an open door when it comes to the need to improve societal resilience. Nigeria’s farming communities may be among the most immediately affected, but there is growing appreciation at all levels that this is an issue that affects us all.

As an industry, we need to help improve understanding of the risks we all face, and support efforts to mitigate both the physical and financial impacts of climate change.

As countries look to a sustainable pandemic recovery, and with the UN’s climate change conference COP26 on the horizon, 2021 could be a pivotal year. We have a unique opportunity now to shape and drive action that will benefit us all – and secure a prosperous and sustainable future for our children and grandchildren.