Insuring the global economy against climate change will take more than developing an app. But combining insurance’s capital and skills with innovative technology will be a vital part of providing security in an uncertain future.

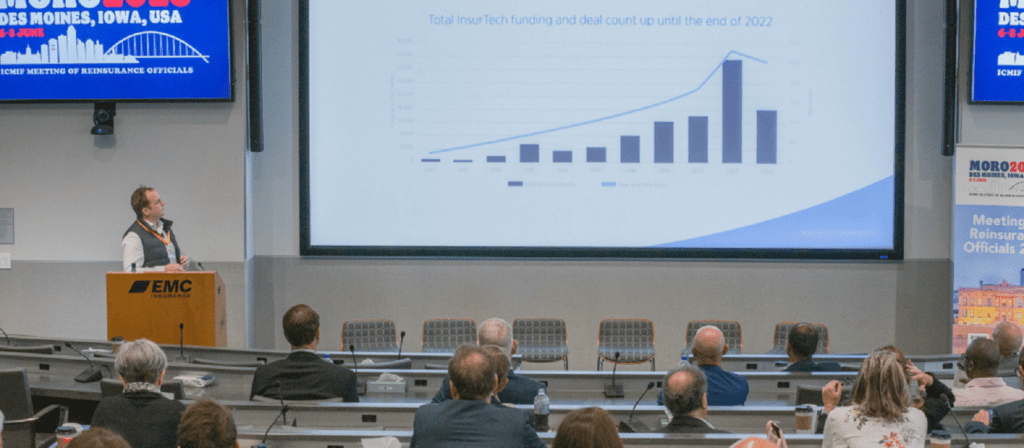

InsurTech has enjoyed vast capital inflows over the last decade, and although investment in InsurTech has slowed since a recent peak in 2021, investment in the first half of 2023 still reached USD2.3 billion, according to Gallagher Re's Global InsurTech Report for Q2 2023.

Such vast financing doesn't always translate directly into impactful contributions from InsurTechs to the industry’s efforts to tackle climate change. Much depends on how the InsurTech firm’s area of focus relates to climate change and how tailored its solutions are to insurance.

Successful InsurTech climate solutions require three things: stable funding, deep subject matter expertise and applicability to the insurance context. Insurance is a more expensive sector to launch in than other industries, with a journey to revenue that can exceed 24 months. InsurTechs that focus on clear commercial outcomes are gaining more traction than those trying to offer their technology (only) as a product. Making use of InsurTech solutions also requires the insurance industry to be willing to embrace the possibilities of technology and invest time in shaping it to suit.

InsurTech is itself a difficult term to pin down. There are specific insurance-related innovations focused on climate change, but there are also technologies that, while not purely related to insurance, could be impactful if properly integrated into the way the industry uses data, models and services to manage risk.

Using the term in its broadest sense, we can identify three broad categories under which technology has a vital role to play: data gathering; data analysis or modeling; and the transmission of this modeling and analysis into insurance markets.

Filling the data gap

Climate change is eroding the value of some existing data sets. Past patterns of weather and catastrophes are no longer holding, due to changes in frequency and severity. Technology, from satellite imaging to localized sensors, can assist in gathering new data sets at a far more granular level than has previously been possible.

An example of this technology is the Finnish microsatellite group ICEYE, which has 16 maneuverable satellites in orbit using radio imaging to map Earth’s surface, including through cloud cover. As its name suggests, ICEYE began monitoring polar ice cover, but its imaging is now being used to provide post-event imagery of catastrophe zones, to map flooded areas and wildfire spread, and to assess damage. It then uses artificial intelligence (AI} to convert the photos into digital data. Currently, this data is aimed at post-disaster response. But, as the datasets from such monitoring increase, they'll become useful in capturing emerging patterns of natural catastrophes.

It's in this area that AI, or more specifically machine learning, will be hugely significant. Machine learning allows climate effect models to learn and augment themselves as new data arrives and develop predictive capacity for a new and unknown environment. It's no exaggeration to say that machine learning will be the single most important technological advance in this field.

Mapping and modeling risks

The rise of "digital twins" has unlocked new insights into granular modeling. These computerized representations of landscapes, buildings, infrastructure and other assets can be used in simulations of the effects of extreme events on valuable assets. These simulations can improve insight into the steps that can be taken to build resilience and mitigate risks, leading to improved risk pricing.

Models that are more detailed can draw distinctions between separate locations that would previously have been regarded as homogenous — such as Fathom’s high-resolution flood modeling, supported by big data processing. Or, sensors can provide more granular data about the assets themselves. Aerial satellite imaging can identify roofing materials — such as terracotta tiles, asphalt or slate. The materials used in construction are a significant factor in modeling both the extent of likely damage from a natural disaster and the cost of replacement.

Predicting and mitigating losses will become easier and more sophisticated due to the application of this type of technology. And, by establishing the likely cost of losses, it will allow more appropriate pricing.

But the biggest potential lies in adapting models to changing or unknown risks. As the volatility of natural catastrophe risks increases, there will be a reduction in the ability of existing models to accurately capture these risks. InsurTech can fill that gap.

The article is reproduced with the kind permission of ICMIF Supporting Member Gallagher Re. For more information click here.

Authors: Andrew Johnston MA, Ph.D Global Head, Gallagher Re InsurTech, and Yingzhen Chuang, Global Head of Sustainability Risk

Published February 2024

An example is London-based FloodFlash, which provides parametric flood cover using smart sensors installed at the insured location. The sensors measure flood levels and, at a certain point, trigger a payout. This bypasses reliance on modeling based on historical events and trends, and all that is needed is agreement on an index of measurement and corresponding pricing.

These examples illustrate the types of technology that can fill the gaps in data, both for immediate application in catastrophe response and, equally importantly, in building the data sets for the climate risk and catastrophe models of the future. In terms of the entire global insurance market, these innovations remain small scale, but their potential to improve the insurance industry's response to trigger events and measure the impact of climate-related events is significant.

Pricing the unknown

Another set of InsurTechs will be crucial in helping the insurance industry evolve from its existing models and develop the techniques needed to price risk appropriately in a changing environment.

A major challenge for the reinsurance sector stemming from climate change is the uncertainty that changing patterns of loss and damage create in aggregated treaty reinsurance. The risk is that this uncertainty leads to a change in risk appetite and a decline in available capacity, which would increase the cost of cover just as the need for it increases.

InsurTechs focused on developing products and solutions for newer, less-familiar forms of risk can help here. The data and models they generate can be integrated into the market’s pricing of aggregated risk, ensuring the continued availability of cover at a price that's affordable for the insured and at a rate that's profitable for the insurance industry.

Some InsurTechs have pioneered the concept of carbon insurance, providing cover for potential risks from the purchase of carbon credits. This is an example where deep expertise in carbon markets has been combined with insurance industry knowledge to fix an emerging pain point - allowing capital to confidently flow towards the carbon removal sector that's tackling climate change.

Similarly, RepRisk offers a data-analysis service focused on spotting companies at risk from claims of “greenwashing” - misleading consumers and other stakeholders into viewing a company’s environmental footprint in a more positive light. As noted in our article Climate Litigation, greenwashing claims can lead to climate litigation actions against companies, which Directors' and Officers' (D&O) insurance policies may cover - so the industry has an interest in getting a handle on this risk.

InsurTech is no silver bullet for the climate challenge our industry faces, but it will be an essential tool. Grasping the opportunity will require businesses at all stages in the insurance value chain to take a longer-term view, to recognize the scale of investment and engagement required.

We're still at the early stages of InsurTech’s contribution to climate issues and risks, but the handful of examples we've mentioned are indications of how technology can cut through the uncertainty and allow insurance to bring its skills and capital to the fore.