In this CEO interview, Fumio Yanai, President of Zenkyoren (Japan) discusses how Zenkyoren is adapting to meet the needs of its members in the face of extreme weather events and climate related disasters, how technology is influencing Zenkyoren, and the value of the ICMIF global network.

Can you tell us some of the ways Zenkyoren is helping members to secure their livelihoods? How does being a cooperative help Zenkyoren in doing this?

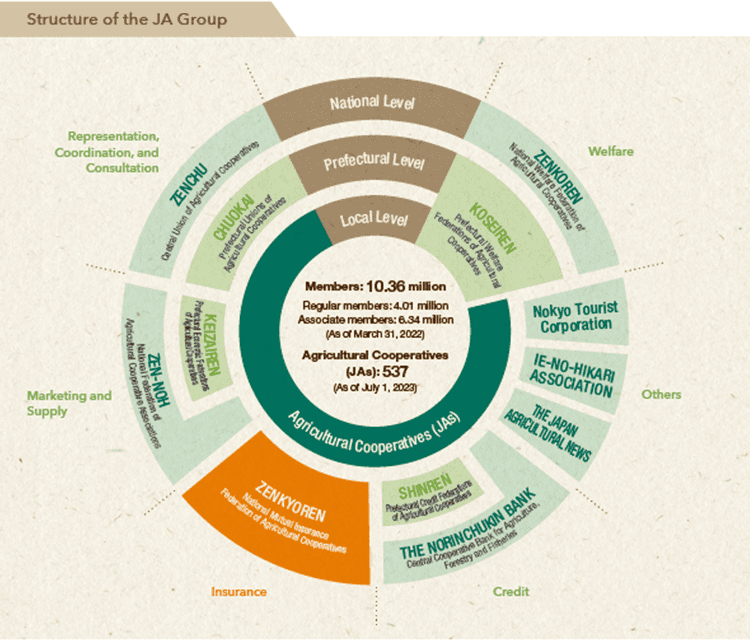

Zenkyoren is a member of Japan Agricultural Cooperatives (JA) Group. Since the era when people in Japan were poor, especially in rural areas, the JA Group has been providing comprehensive services such as agricultural guidance, marketing and supply, credit, and insurance in order to build a society where people can thrive by helping and supporting one another, based on the spirit of cooperatives whose motto is one for all, all for one. Today, Zenkyoren together with 537 JAs supports the lives of about 10 million members (households) nationwide.

For more than 70 years since JA Kyosai1 was initiated, we have been working on insurance provision centered on people, homes, and vehicles as well as community contribution activities as inseparable businesses. Our business purpose is to build local communities in which people can enjoy secure and affluent lives by providing peace of mind and satisfaction under our fundamental approach of implementing the concept of standing closer to every person living in rural areas, delivering comprehensive security, and connecting with agriculture and local communities more broadly and deeply.

1. JA Kyosai: A mutual insurance business jointly run by JAs and Zenkyoren. Please refer to P.07 in Annual Report 2023 https://www.ja-kyosai.or.jp/about/annual_report/pdf/2023annual.pdf regarding each role of JAs and Zenkyoren in the JA Kyosai business.

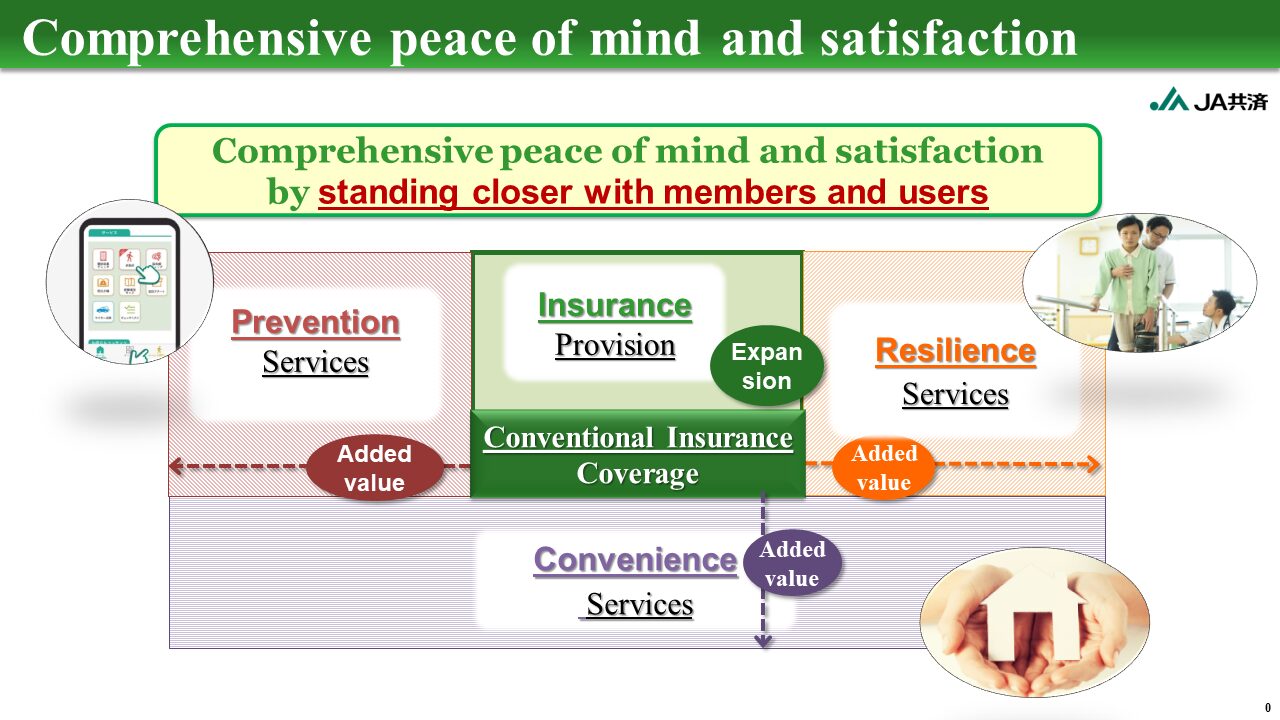

In recent years, we have been engaged in not only insurance provision but also various activities such as risk awareness and prevention, risk avoidance and mitigation of recurrence, provision of useful information, and so on. We are delivering comprehensive peace of mind and satisfaction by standing closer to everyone through these activities.

In addition, in order to assist various local activities related to living and agriculture, in each circumstance, we are involved in activities for agricultural promotion such as food education and agricultural work efficiency, activities for livelihood such as livelihood assistance and environmental conservation, activities for people such as health management/promotion and nursing care/welfare, activities for homes such as disaster relief and disaster and fire prevention, and activities for vehicles such as traffic accident prevention and social reintegration assistance.

In order for these activities to be sustainable into the future, we recognise it is necessary to continuously develop our activities so that they respond appropriately to changes in the business environment and implement various transformations based on our current approach of standing much closer, delivering and connecting more and more.

What are the pillars that make up Zenkyoren’s strategy and how does this relate to your purpose? How is your organisation adapting for the future?

Mission of JA Kyosai

- JA Kyosai meets the trust and expectations of members and policyholders by providing security and satisfaction through business activities based on the philosophy of mutual aid that agricultural cooperatives strive for.

- JA Kyosai helps members and policyholders to secure and improve their living standards by providing comprehensive coverage of people, homes, and vehicles with the best securities, prices, and services.

- JA Kyosai contributes to the development of local communities where people can enjoy secure and affluent lives by actively pursuing its business activities.

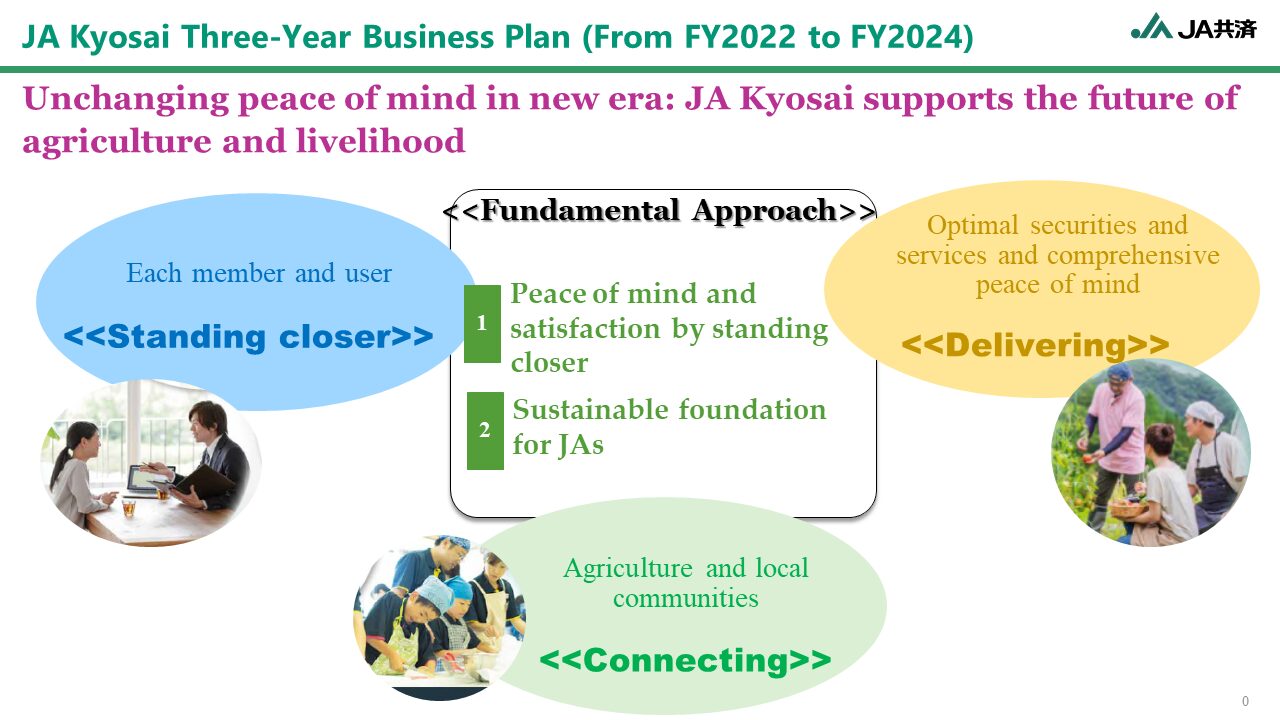

In order for us to realise the mission of JA Kyosai as above, we are developing our activities for providing comprehensive peace of mind and satisfaction and various community contribution activities. When we formulate our business strategy and develop its specific measures, we share our long-term vision for the 10-years ahead and draw up a mid-term plan for every three years and implementation plan for every year to address the changing business environment.

Under the current three-year business plan, we have introduced a slogan of Unchanging peace of mind in the new era - JA Kyosai supports the future of agriculture and livelihood together with local communities, and we are proceeding with our initiatives based on the fundamental approach of providing peace of mind and satisfaction by standing closer to members and users and building and strengthening a sustainable business foundation for JAs through implementation the concept of standing closer to members and users, delivering comprehensive security, and connecting with agriculture and local communities broadly and deeply. We aim to protect lives and properties of members and users and to contribute to agriculture and local communities continuously through the implementation of these initiatives.

It is our mission to create a sustainable community where people can live in good health with a sense of security, and there is no end in this regard. Therefore, we have to implement varieties of reforms in order to improve our fundamental approach of standing much closer, delivering and connecting more and more than ever before.

What do you see as the biggest risks to cooperative insurance in Japan?

Risks surrounding Japanese cooperative insurance in the changing environment include:

- Rapid changes in our social structure due to low birthrate, aging and population decline,

- Decline in rural areas in opposition to urban concentration,

- Frequent occurrence of natural disasters due to the change in the global environment and high frequency of earthquakes all over Japan.

In addition to these risks, JA Kyosai business has another type of risk with the weakening of the foundation of agricultural production from the decrease in the farming population.

We need to develop appropriate business activities continuously in response to these changing business environments.

What do you think will be the biggest challenges faced by the insurance sector in the next 10 years? Do you think cooperative insurers will have an advantage over stock companies in their ability to look long-term?

Large-scale natural disasters have occurred one after another around the world and as average temperatures reached a record high this year, global warming expressed as global boiling is progressing. Against this backdrop, natural disasters including forest fires, typhoons, floods are becoming more serious around the world and large-scale earthquakes are also occurring. In Japan, natural disasters including heavy rainfalls caused by typhoons and large earthquakes are occurring all over the country.

In these circumstances, there is no choice but to identify global warming and the intensification of natural disasters as the biggest challenges that will be faced by our industry over the next ten years. Once a natural disaster occurs, it causes serious damages not only from the natural disaster itself, but also the second or/and third damages to the lives of the people living there and to their surrounding environment. That is why we must tackle with the natural disasters by way of not only insurance provision but also disaster prevention and mitigation as well as the building of resilient communities in order to minimise these damages.

With regard to the difference between cooperative insurance (Kyosai) organisations and stock company insurers, while stock companies cause creation of disparity because their ultimate goal is to generate profits and to return them to shareholders, on the other hand, Kyosai organisations help to remove disparity because the business model emphasises the value of mutual aid by sharing its risks among itself as the concept of supporting each other and assists in realising a society that leaves no one behind. We can also recognise the difference in insurance products. For example, there are varieties of rates region by region, based on the occurrence risk in home insurance products provided by stock companies, which bring about widening a regional gap. On the other hand, the rates provided by Kyosai organisations are identical nationwide, which help to embrace any regional gaps. I believe that our business model is excellent approach to social issues in this respect.

As the number and severity of extreme weather events and climate-related natural disasters increase, how is Zenkyoren adapting to meet the needs of its members?

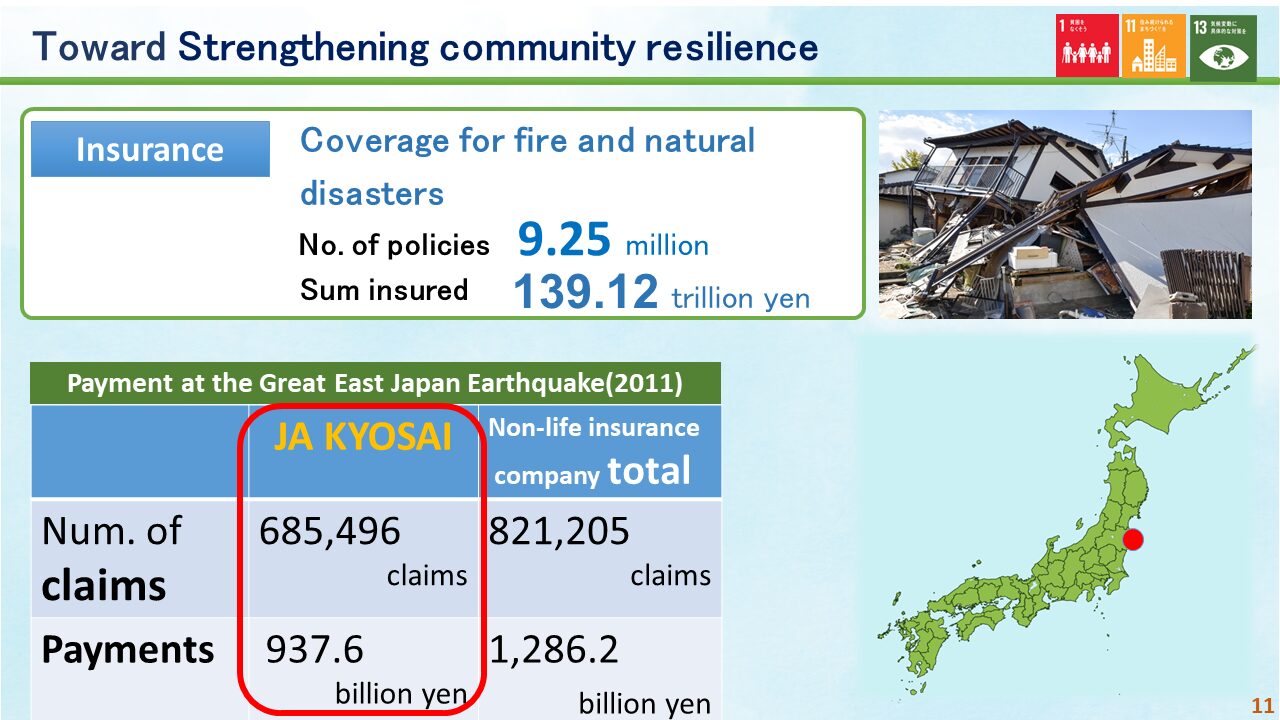

Japan is well-known as a country where earthquakes frequently occur and it suffers from many natural disasters such as typhoons and snowstorms too. For this reason, JA Kyosai provides insurance products against fires and natural disasters of which the total number of policies in force has currently reached about 9.25 million. Our payment for the Great East Japan Earthquake in 2011 represents as a symbol how JA Kyosai responds to the needs of our members. The table below shows the comparison of payments for the earthquake between JA Kyosai itself and all non-life insurance companies. This large amount of our payment demonstrates how JA Kyosai had provided securities by standing closer to people's lives and contributed to recovery of local communities.

As for the recent abnormal weather, the recent payment history for our Building Endowment Policy (except for the Great East Japan Earthquake) indicates that there have been many more natural disasters since 2016. Given this environment, this is precisely why , it is necessary for Japan to build sustainable local communities that are resilient to disasters and we are keen to enhance the capacity for post-disaster recovery. We have learned a variety of lessons from the Great East Japan Earthquake and implemented various measures. In order to build disaster-resilient and sustainable communities, it is essential to implement both initiatives of disaster preparedness and post-event assistance.

We are undertaking various activities for disaster prevention and mitigation in our disaster preparedness initiative. Recently in a TV commercial for JA Kyosai, we introduced the spirit of mutual aid (supporting each other), which is our philosophy, through farmers who are connected by bonds of Kyosai. This TV commercial shows the advertising slogan of Kizuna (strong tie between people) by expressing farmers’ warm and positive feelings when they become aware of Kyosai by chance. A Japanese farming village is an example of a community which has been supporting each other since a long time ago. JA Kyosai has also a business philosophy of supporting each other with the motto One for all, all for one. The TV commercial emphasises the belief of becoming prepared by supporting each other to viewers.

TV commercial “Kizuna (strong tie between people) becomes preparedness”

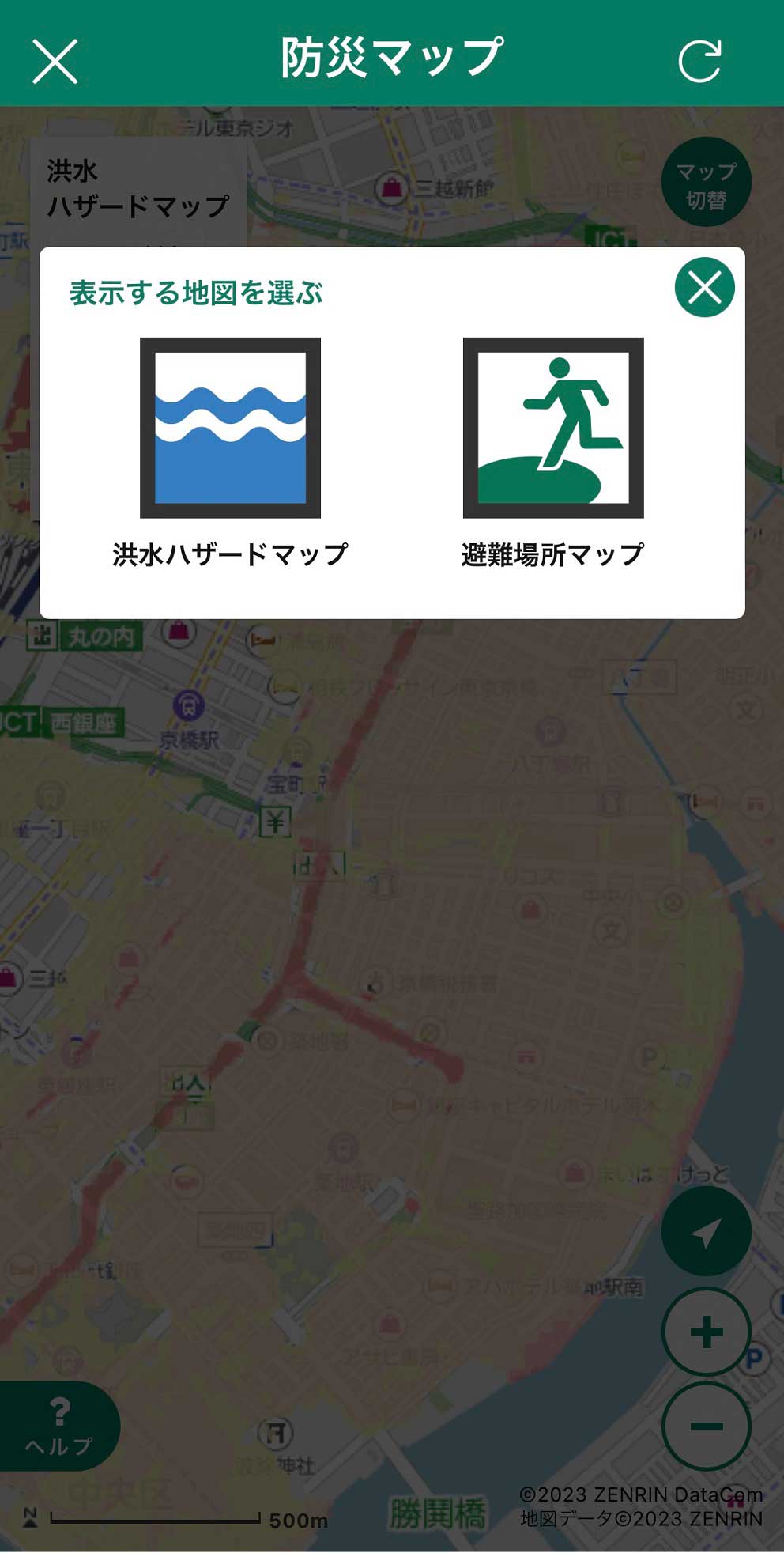

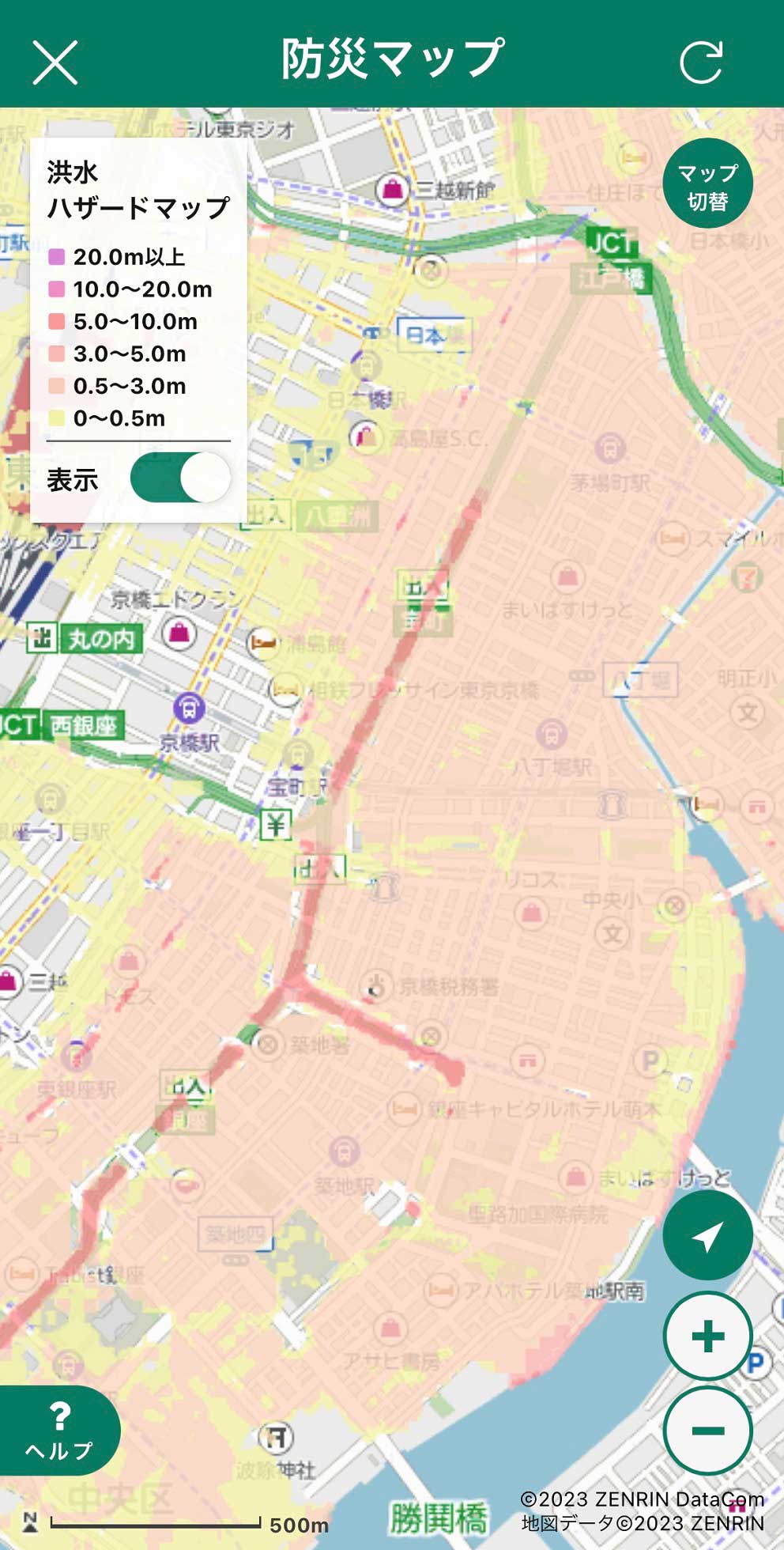

In addition to the TV commercials, we also conduct daily disaster preparedness activities in order to minimise the damages, such as educating people about the risk of natural disasters through visits by JA staff, disseminating disaster prevention alerts and providing disaster prevention information such as evacuation maps utilising the JA Kyosai App, and allowing people to experience a simulated earthquake at local events.

As far as strengthening post-disaster assistance is concerned, we have established a framework that enables prompt claims payment regardless of a large-scale disaster occurring anywhere in the country. We are also working on enhancing resilience of our organisation by building a solid crisis management system such as the improvement of Business Continuity Plan (BCP) so as to maintain the trust and meet the expectations of our members and users.

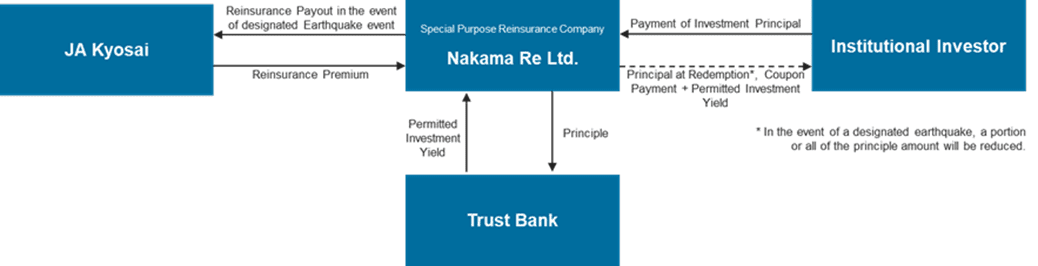

In addition, in order to ensure the claims payment, we are strengthening our solvency by accumulating reserves and purchasing reinsurance as we monitor payment capability for large-scale disasters in our Enterprise Risk Management (ERM). For our reinsurance strategy we are utilising traditional reinsurance as well as issuing catastrophe bonds (Cat Bonds) for investors.

Mutual trust between JAs and people in local communities is indispensable for proceeding both of the initiatives. The solid mutual trust leads to expand a circle of policyholders, to make prompt payments and follow-up services, and to enhance resilience for local communities. I believe that this mutual trust connected by our strong bonds helps the livelihoods of people and JA Kyosai business to be sustainable and this virtuous circle will create a disaster-resilient and sustainable community.

Zenkyoren recently issued the Nakama 2023-1 bond, Japan’s first Cat Bond to incorporate information disclosure regarding SDGs and ESG investment initiatives, can you tell us a little more about this and why was it important to you to issue this bond?

Some natural disaster risks in Building Endowment Policy which JA Kyosai provides as a long-term insurance coverage for homes and their contents are transferred to third parties by purchasing traditional reinsurance and issuing Cat Bonds as a part of our risk diversification in order to maintain sound business management even in the occurrence of natural catastrophes.

In addition, based on JA Kyosai’s mission to contribute to the development of local communities where people can enjoy secure and affluent lives and the Sustainable Development Goals (SDG) Policy of the JA Group which includes addressing shared global challenges such as environmental issues, we are progressing our environmental, social, and corporate governance (ESG) investments to solve environmental problems and contribute to achieve the SDGs.

We understand that in recent years many investors in Cat Bonds are increasingly interested in issuers’ initiatives for SDGs and ESG investments.

In the context of these circumstances, Zenkyoren issued Cat Bonds in April 2023 that disclose information on our initiatives for SDGs and ESG investments to express our proactive stance on environmental issues and the SDGs for the first time among Japanese Cat Bonds issuers.

Signatory of the PRI

Yanai with the Cat Bond team

How is technology influencing Zenkyoren?

By leveraging the latest technologies such as big data and AI, we can improve our operational efficiency and convenience of services for users. These will not only create new insurance products and services, but also bring about significant changes in insurance promotions and administrative procedures. Advances in technology lead to the creation of entirely different kinds of insurance products and great changes in communication with members and users. While the number of face-to-face communication and administrative procedures will decrease, more virtual communication will be needed through the use of smartphones and personal computers. In order to make better insurance proposals that meet the needs of members and users and to improve efficiency of administrative procedures, it is necessary to procure specialised tools and systems.

In the Kyosai and insurance industry, an evolutionary phase for using technology has already been entered, passing through the introductory stage. This trend must accelerate further into the future. The utilisation of technology is the key factor for differentiating itself from competitors and improving customers’ satisfaction.

In light of these circumstances, it is necessary for JA Kyosai to strengthen technology utilisation for realising more user-oriented, promotion activities by combining face-to-face visits (which is our strength) and virtual contact so as to stand closer, deliver and connect with members and users more than ever.

How does the ICMIF global network provide value for Zenkyoren?

I appreciate ICMIF as only our closely-related global network association for providing us with information on the global trends in our sector as well as our challenges and solutions by showing us practical case studies. Since my assignment as Zenkyoren’s President in 2017, I have given various levels of our staff, including young leaders, the opportunity of participation in global networking of ICMIF and AOA.

I have received reports from many participants that “there are organisations with the same philosophy around the world, and I was given many perceptions by my friends I met and encouraged by their attitude of working hard toward their goal” along with innovative case studies learned in the various ICMIF events. It is really valuable for us to feel our value and think about our future not only by words but also by experience.

In order to fulfill our mission, JAs as well as Zenkyoren must remain sustainable organisations. To this end, our staff is always thinking about what we should do for members and users and taking actions accordingly. However, if we just think in narrow terms, there might come a time when we get stuck. That’s why it is important to participate in a global networking event composed of the same sector which provides us with an opportunity to absorb innovative and new ideas. I expect those who have participated in events to make a proposal by using the learnings that leads to energising our organisation. The participation of younger generations in particular is favorable for building up a broad and long-term network with ICMIF members and enhancing the sustainability and energisation for our organisation.

For the next generation of leaders, what do you think are the most important leadership characteristics and capabilities needed to be a senior leader in the future? How is Zenkyoren helping to develop those future leaders?

We believe it is necessary to implement all kinds of transformation to improve leadership capabilities as well as to share the organisation's philosophy and to carefully maintain it.

In order for us to permanently fulfil our role of the JA Kyosai business in protecting the lives and properties of our members and local residents, all of our staff members must share our philosophy that represents the fundamental values common to our business and organisation, and implement all business initiatives and operate with consistency.

In addition, in the midst of rapid change of environment in the current world, I think we need leaders with capabilities who can not only carefully maintain the philosophy that serves as a compass of our business and organisation, but who also possess a self-sustained and independent spirit that is not enslaved by long-standing practices, to capture timely changes, to draw up a vision for the next generation, and to create new values for our business.

As my message to our staff, I always emphasise the importance of the courage to change what should be changed and power to protect what should not be changed (what should be protected).

For this reason, in order to nurture employees to share our mission and values, here at Zenkyoren we have established a specific standard of conduct and a career design policy to support the employees in self-sustaining growth and work on fostering the next generation of leaders.