Rapid digitalisation in the insurance industry, propelled by COVID-19, which has led to an increased reliance on machine intelligence (MI), encompassing both artificial intelligence (AI) and machine learning (ML). This shift necessitates a substantial amount of high-quality data to train algorithms, calling for a robust data strategy. Swiss Re is at the forefront of this transformation, developing AI-driven underwriting solutions to enhance customer experiences and streamline processes. Their Magnum Pure platform exemplifies the integration of AI and ML in underwriting, providing scalable, data-driven risk assessments. However, challenges remain, including the underestimation of resources needed for integrating MI into existing systems and the necessity for a holistic firm-wide data strategy.

COVID-19 has forced consumers and businesses to embrace virtual, contactless transaction modes to minimise infection risks. This trend has accelerated the digitalisation process across multiple industry sectors, especially those processing vast amount of personal data like financial services. Insurers have also accelerated their partnerships with digital ecosystems, providing them access to new customer segments and potentially more consent data. With more digital touch points and curated data, insurers are starting to embrace machine intelligence enabled solutions that enable granular data-driven risk and customer insights and further automate their decision processes. Machine intelligence (MI) - an umbrella term referring to both artificial intelligence (AI) and machine learning (ML).

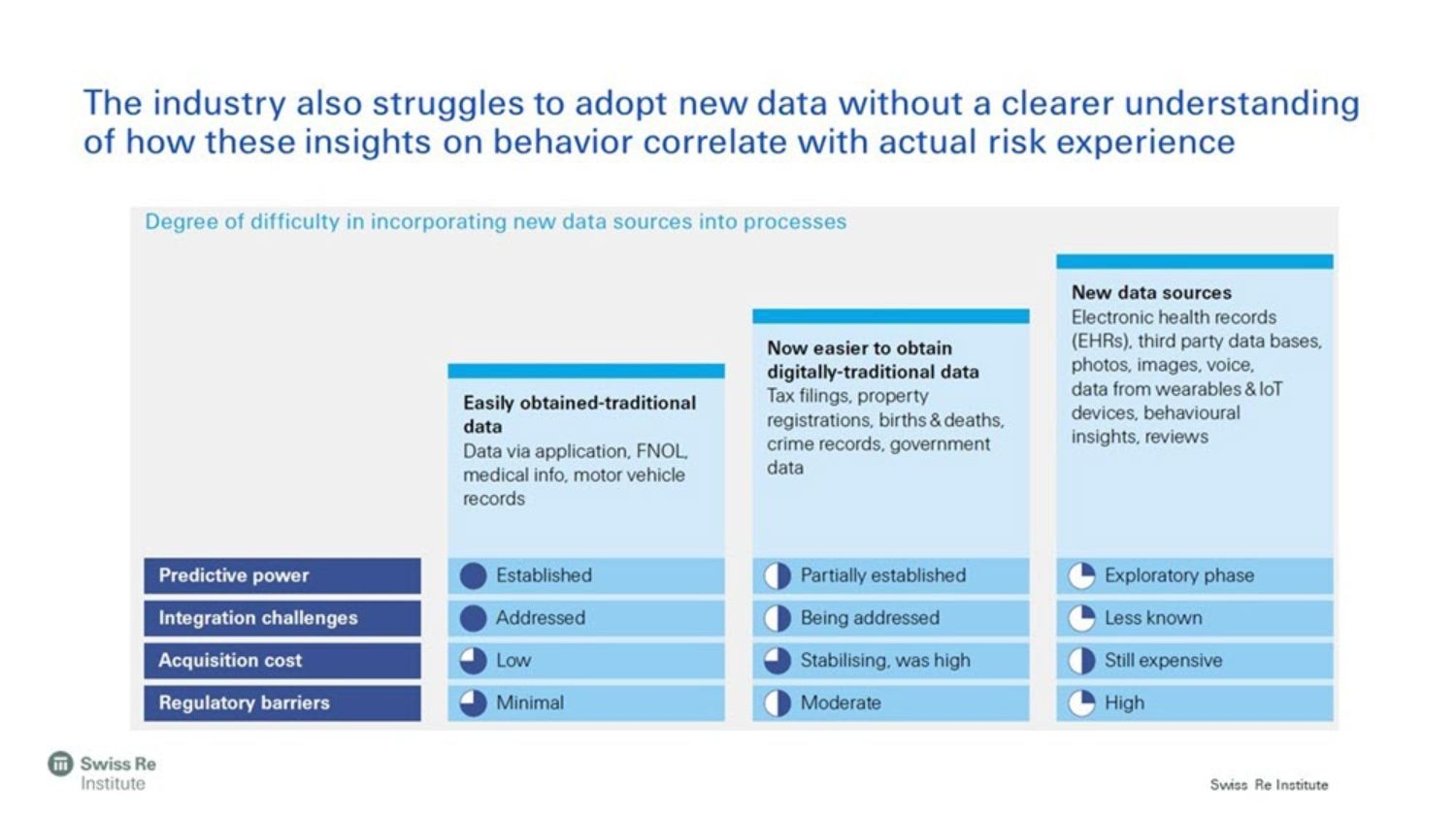

Challenge to adopt new data sources

To offer enterprise-scale transformative benefits, many MI approaches require large amounts of high-quality data that are complete, clean and timely to train algorithms. This calls for a production-ready data strategy. In certain case, MI solutions could also help fill data gaps, generating synthetic data, using algorithms to augment existing data sets or adopting data privacy preserving techniques across ecosystems such as federated learning. Without these capabilities, the performance of models or algorithms has proven to be slow and costly when compared with existing human-centric processes. If deployed correctly, the models or algorithms can deliver substantial return on investment.

Each data set offers a different degree of value when integrated and assessed for MI Insurance scenarios. We see the industry struggle to adopt new data without a clearer understanding of how these insights correlate with actual risk experience - an obvious area of focus for actuarial data science for the years to come (see below):

This article was written by Yannick Even, GDS Analytics Business Partner, Group Data Services, and Jonathan Anchen, Head Market Intelligence, Swiss Re Institute, and is reproduced with the kind permission of ICMIF Supporting Member Swiss Re.

To access the full in-depth article, including interactive graphics, please visit this Swiss Re Institute webpage.

Published June 2022

If we pick insurance underwriting for example, supervised learning can complement and eventually streamline certain processes. These include smarter triage and routing that may be more efficient than relying solely on current business rules, eg, triage between depths of investigation (full vs. simplified underwriting). This could include accurately waiving additional evidence (lab tests, physician statements) or allocating referrals to the right level of underwriting staff (junior underwriter vs. medical officer) for more efficient assessment.

AI-driven predictive models can simplify customer journey

Swiss Re has recently developed data-driven underwriting solutions using Machine Intelligence to help insurers address specific objectives to continually improve consumer experience. In a recent project, we delivered AI-driven predictive models that can triage Life & Health underwriting and simplify the consumer journey (for more than 60% of existing customers) using Machine Learning to segment existing customers based on their risk levels. If insurers are still in the data accumulation phase, we enable them with evidence-based research and proxies for underwriting assessment.

To maximise the efficiency, these AI models have also been integrated into Magnum Pure©, our Life & Health automated underwriting API and cloud-based solution platform, to orchestrate and utilise both Human and Machine Intelligence at scale. With Magnum Pure©, this expert-backed, AI and machine-learning enabled risk assessment solution can be easily deployed across multiple distribution channels and within Point-of-Sale tools.

We also support insurers on their data-driven transformation across the value chain providing risk insights with pricing analytics, claims analytics and portfolio deep dives. As insurers access more (digital) data points from their customers, opportunities exist to connect and analyse the potential for offering customised protection solutions in combination with external data sets (from digital partners or public sources). We also use Natural Language Understanding (NLU) techniques to transform unstructured data, mainly from legacy insurer systems or partners, to bring those valuable data/forms back into curated data pools to be leveraged by MI enabled processes. One of the largest risk and insurance data pools worldwide for property & casualty insurance is our Swiss Re Impact+, a plug and play platform creating data driven actionable insights with embedded MI models & processes.

Resources needed to integrate are underestimated

In Swiss Re's experience, system design and management often fall short when insurers attempt to implement MI into existing cross-functional processes. Insufficient resources are dedicated to integrating models and algorithms into existing workflows to transform the customer journey. In an interview with Swiss Re Institute, one insurer seeking to eliminate unnecessary underwriting questions said it leveraged banking transaction data to offer accelerated underwriting to prospects. The MI-enabled underwriting model performed well in classifying individuals into the relevant segments. The marketing department, however, did not invest (yet) in a propensity-to-buy exercise to take full advantage of the new underwriting system.

Machine Intelligence viability should not only be assessed on the basis of initial small-scale proof-of-concept pilots of models/algorithms. The criteria to evaluate performance should be more holistic and include integration of direct (development and running - ie. ML Ops) and indirect (organisational and opportunity) benefits and costs.

While chief data officers and scientists have become common-place at insurers, a firm-wide data strategy, which is part of business priorities, is the key to harvest the full power of data across an organisation. Data strategy also include data quality controls and flow cycles as well as adequate underlying technology to support sustainable value at scale with MI enabled solutions. System design, deployment plans and success criteria should focus on business workflow context, decision support and enterprise productivity.

Regulatory risks regarding tech-linked innovation in insurance, in particular around data privacy and use (ie. fairness and transparency), also need to be considered. A good example is the Veritas initiative driven by MAS in Singapore, with Swiss Re actively participating within the consortium of 27 companies, to address implementation challenges in the responsible use of Artificial Intelligence and data analytics. The aspirational fairness, ethics, accountability & transparency assessment methodology, published by MAS last February, provides checklists to support financial services organisations throughout the MI development life cycle. This is illustrated by use cases such as the one we described on predictive underwriting.

Many hurdles exist in the industry to scale deployment of MI solutions today. These include limited innovation management and empowerment, slow feedback loops to validate model performance (such as for mortality risk), as well as lack of strategy to acquire and retain data, partners, and talent. The list can go on, but we also see the industry, from the board level to operations, starting to look more strategically at data and Machine Intelligence.

To successfully transform their enterprises with MI-enabled technology, we recommend that insurers focus on the salient, non-model characteristics of end-to-end enterprise deployment such as data strategy, culture change including upskilling all workforce, prioritisation by business value of MI use cases, integrated data-driven decision process and tools, just to name a few. Most importantly, an MI project needs clear and understandable communication across all facets, to secure senior management buy-in.

The Swiss Re Institute harnesses Swiss Re's risk knowledge to produce data driven research. For more, please read the Swiss Re Institute sigma 05/2020, titled "Machine intelligence in insurance: insights for end-to-end enterprise transformation" and sigma 01/2020 titled "Data driven insurance".