Findings in the latest Reinsurance Market Report from ICMIF member Willis Re (released Monday 23 April) show that shareholders’ equity in 34 reinsurance companies tracked in the Willis Reinsurance Index[1] was up 7.8% to USD 371 billion at year-end 2017.

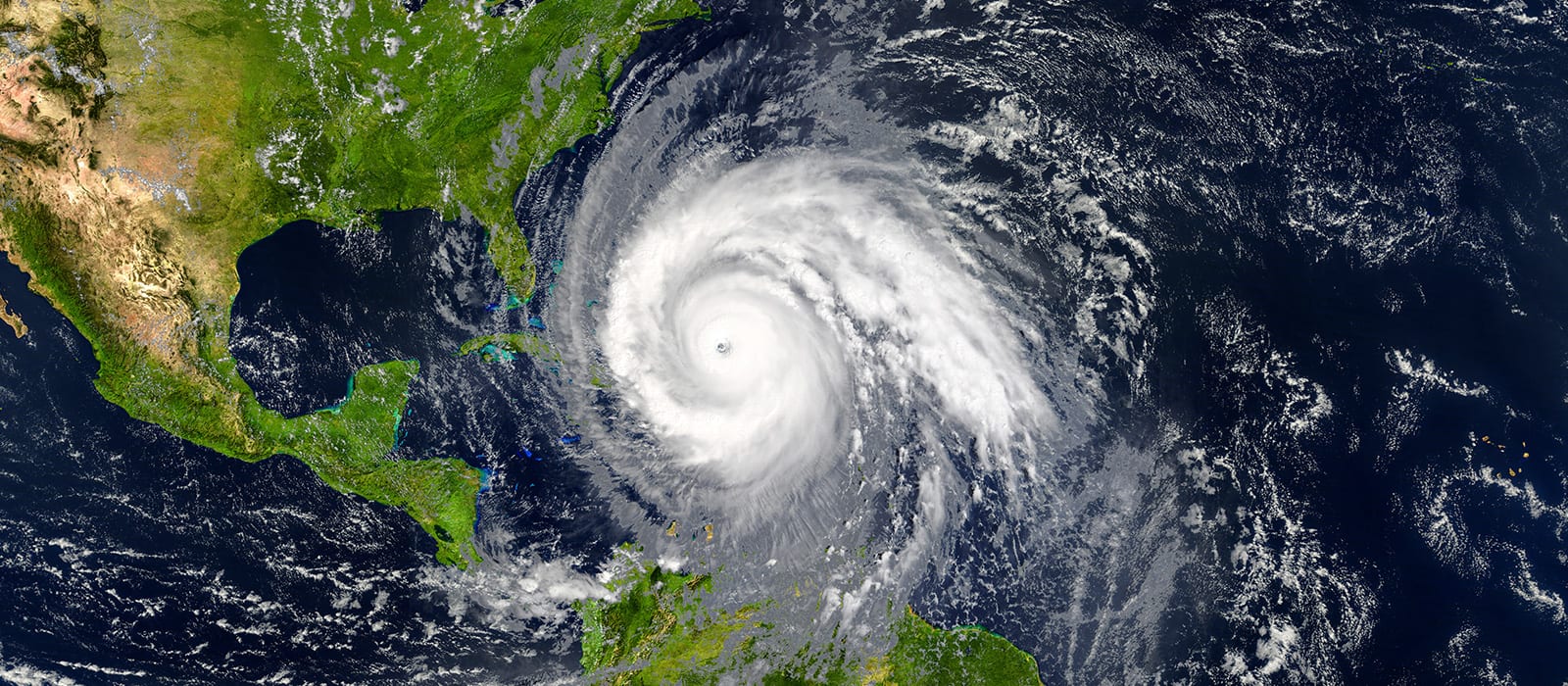

The report states that this increase occurred despite catastrophe losses, which led to a weighted combined ratio for the tracked reinsurers of 104.8%, up 10.4 percentage points from the previous year. Alternative capital also increased to USD 88 billion (year-end 2016: USD 75 billion), despite the draw-down of some catastrophe bonds and collateralized reinsurance and retrocession layers in the wake of the 2017 Atlantic hurricanes.

The rise in equity was driven, the report says, by unrealized investment gains of USD 34.7 billion. However, when National Indemnity is excluded from the group, the total shareholders’ equity was roughly stable, at USD 343.7 billion.

James Kent, Global Chief Executive Officer, Willis Re, said: “2017 was one of the worst years on record for insured natural catastrophe losses. However, today the global reinsurance market is able to deploy more capital than at the same time last year. When a few exceptional transactions are considered, total reinsurance capacity is roughly stable, despite the hurricanes, earthquakes, wildfires, and other events which brought misery to millions of people in 2017. That’s a significant achievement for the reinsurance market, and a testament to its strength.”

He continued: “The pressure on traditional reinsurers from alternative capital suppliers is stronger than ever, as many participants in this market cleared their first true major test. This increase in alternative capital, as well as the global reinsurance market having more capital to deploy, is continuing to dampen price increases in the mid-year renewals.”

Download the full report: The Willis Re Reinsurance Market Report is a biannual publication providing in-depth analysis of the size and performance of the reinsurance market. Analysis is based on the Willis Reinsurance Index group of companies. In 2017 The Index includes 34 companies from across the globe.

[1] The Index relates to those companies listed within Appendix 1 of the report.