ICMIF member Achmea (Netherlands) has been named as the second highest placed insurer in a ranking by the Dutch Association of Investors for Sustainable Development (VBDO). The ranking looked at the 80 largest pension funds and insurers in the Netherlands to examine just how sustainable their investments are, looking specifically at the impact of climate change.

Achmea came ninth in the overall ranking (which included both insurers and pension funds). Achmea says the organisation’s strategy is to contribute to a healthy, safe and future-proof society, which is why climate change is embedded in the company’s investment policy as an important priority.

Throughout 2019, VBDO examined the sustainability profile of thirty insurers and fifty pension funds with the investigation shining a spotlight on the policy, implementation, management and transparency of sustainable investment.

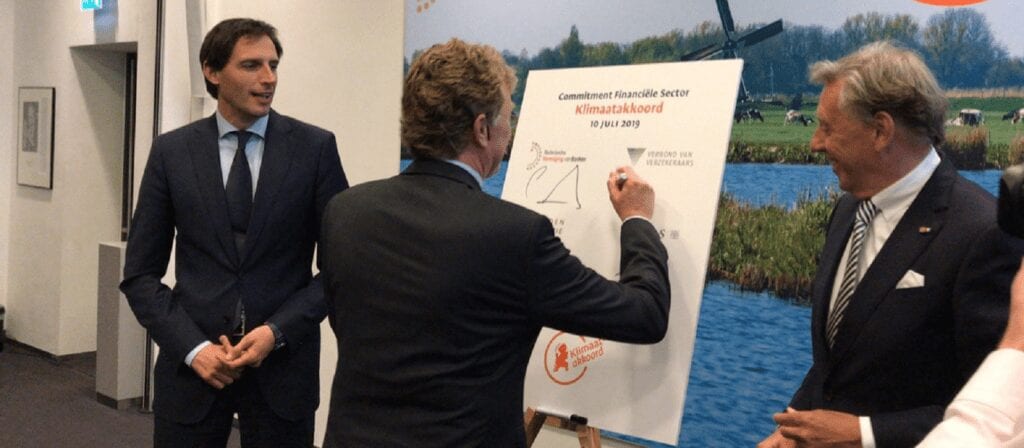

As a large institutional investor with managed assets of more than EUR 140 billion, Achmea says it has an influence on the companies it invests in. Last spring, Achmea tightened up its corporate responsibility policy and implemented further improvements. Climate being the key element in this. For example, Achmea recently announced that it would no longer invest in companies that generate more than 30% of their revenue from coal or from the extraction of oil from tar sands. The tightening of the company’s policy follows the signing of the Paris climate goals and the ambitions of the Dutch government in this regard. Achmea has also committed itself to the Climate Agreement in the past year.

Willem van Duin, Chairman of Achmea’s Executive Board said: “The fact that we were the second highest ranking insurer is on the one hand a great performance, but on the other it is above all an encouragement to continue as a socially responsible investor. As a cooperative insurer, we focus on long-term value creation and sustainable trading and investment is perfectly aligned with this. We aim to make a greater social impact with our investments. Our engagement programme, which involves us engaging actively with companies and entering into agreements to encourage them to operate their businesses more responsibly, is an important contribution to this.”

You can find the full report here.