Swedish ICMIF member Länsförsäkringar AB has announced this week that it has adopted a new climate goal within the framework of its climate-smart vision. The climate goal means that the mutual insurer’s own investment portfolios* and funds must be climate-positive by 2045.

Fredrik Bergström (pictured), CEO of Länsförsäkringar AB says: “The goal means that we have further developed our climate-smart vision and that we are involved in financing the change for the climate that Sweden, the EU and the world need to do to achieve net-zero emissions globally by 2050 through our investments. We are now continuing our work to achieve the new climate goal in order to contribute to society’s solution to the climate crisis.”

Bergström continues: “Our previously set goal of halving the climate footprint for our own investment portfolios and funds by 2030, in line with the Paris Agreement’s 1.5-degree goal, remains. This is an important sub-goal for our investment portfolios and funds to be net positive by 2045.”

Examples of completed Länsförsäkringar AB activities in line with the new climate goal:

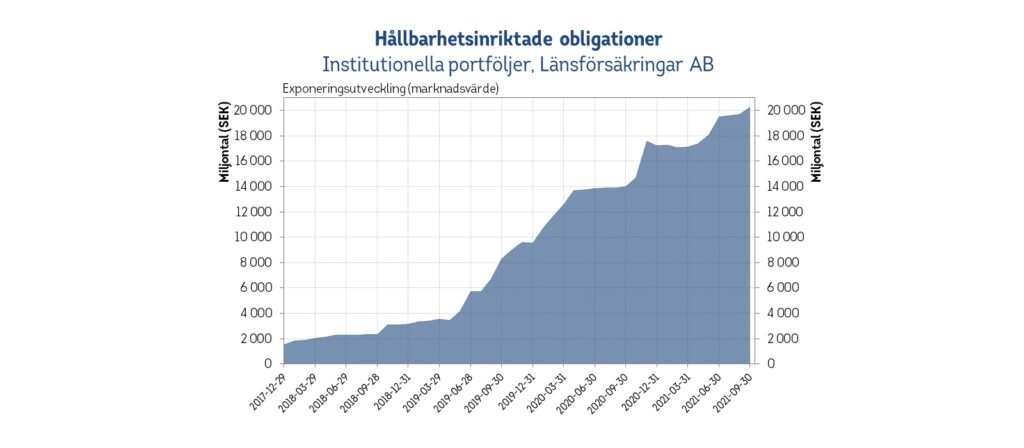

- From 2018 until the third quarter of 2021, Länsförsäkringar AB has increased investments tenfold in sustainability-oriented bonds within our own investment portfolios to a value of more than SEK 20 billion (16 percent of assets under management). These bonds finance, among other things, renewable energy, green infrastructure and climate adaptation projects.

- Länsförsäkringar AB began phasing out coal companies in 2015 and have since gradually tightened the exclusion criteria for mining and power companies that use coal, companies operating in unconventional oil (oil sands) and gas (“fracking”), and oil and gas companies operating in exploration and extraction.

- Länsförsäkringar AB has introduced conversion criteria in the administration to promote power and energy companies that have set scientifically based climate goals and that are considered to be in climate change.

- Länsförsäkringar AB has participated in company dialogues and various investor initiatives with the aim of reducing companies’ carbon dioxide emissions, including the Climate Action 100+ initiative, which targets the 100 largest greenhouse gas emissions globally. The purpose of the dialogues is for the companies to reduce their emissions and set science-based climate goals.

- Länsförsäkringar AB has voted in favour of climate-related shareholder proposals at the companies’ AGMs.

- The mutual has changed the management of several funds and its own investment portfolios, which has reduced their carbon footprint over time.

- Since 2016, the mutual has launched five of its own sustainability-oriented funds, including the fund Länsförsäkringar Global Klimatindex. The assets under management in these funds amount to approximately SEK 50 billion.

- On behalf of pension customers, Länsförsäkringar AB has launched several responsible and sustainability-oriented externally managed funds.

- On behalf of pension savers, Länsförsäkringar AB has developed a new process for continuously developing and evaluating the fund offering based on sustainability and climate criteria, and has moved capital to more responsible fund alternatives. This has led to 85 per cent of pension savers’ capital now being in funds that promote sustainability and have sustainability as a goal**.

- At its fund marketplace, Länsförsäkringar AB has launched more tools to make it easier for customers to find funds from a sustainability and climate perspective.

* Länsförsäkringar AB’s life insurance, guarantee insurance and non-life insurance portfolios

** Based on the Disclosure Regulation designation of Articles 8 and 9 – products.