As a mutual insurer, Canadian ICMIF member The Mutual Fire Insurance Company of British Columbia only retains enough profits each year as required to support the organisation’s growth. At the beginning of every year, the company reviews its financial statements and investments to ensure it has exceeded the set financial conditions of its company charter and maintained a healthy company surplus.

After a thorough audit of the 2020 financial statements, ensuring the company meets all regulatory requirements and exceeds the company’s financial targets, the Board of Directors of Mutual Fire Insurance (MFI) has announced a premium refund for qualifying members.

Darin Lord Nessel, President and CEO of MFI, stated “The unpredictable challenges of 2020 provided MFI with an opportunity to pivot and succeed in ways we never thought possible before. It is wonderful to be able to share this success with our members.”

Mike Bose, Chair of the Board added “With prudent governance and strategic leadership, MFI is again able to share its profits with the members. I am proud of the team, our key partners, and advisors who have all contributed to a successful year.”

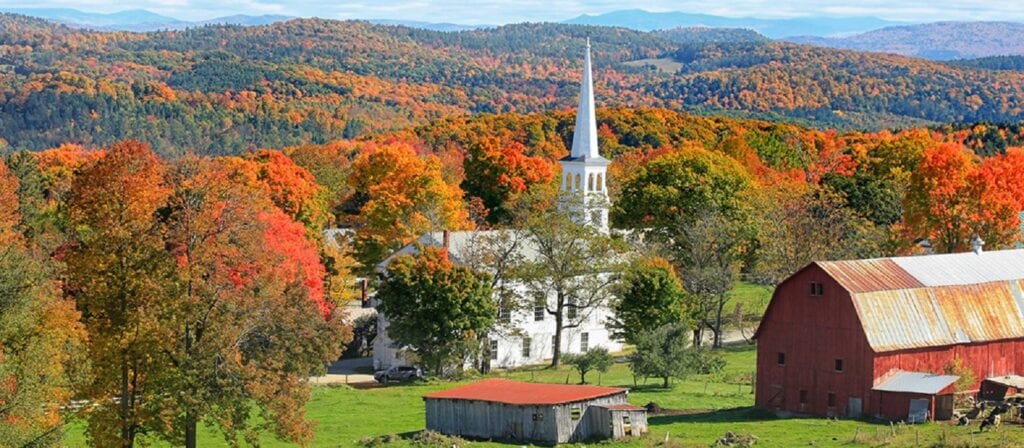

Founded in 1902, The Mutual Fire Insurance Company of British Columbia was the first mutual insurance company headquartered in the province. Today, the company provides solutions for farm, commercial, and home insurance needs from British Columbia to Ontario.

MFI is a dual policyholder structured mutual insurance company, as policyholders can choose to become a member for a small annual fee. Those that opt in to MemberPROTECT® enjoy a number of enhanced member benefits, such as a premium refund (if declared by the Board of Directors) after the first complete year of membership, AGM voting rights and the option to receive select coverages at no additional cost.

With this unique structure, MFI is committed to making people a priority by creating membership initiatives, investing in technology and supporting community projects.

The Mutual Advantage

MFI’s premium refund to qualifying members is just one of five elements of how it markets “The Mutual Insurance Advantage”:

- Long, rich history: Historically, people worked together by pooling resources to protect each other. The concept, and basis for mutual insurance, remains as relevant today as it did then—and MFI is proud to continue the tradition.

- Regional philosophy: By remaining regionally focused, MFI is able to gain an extensive understanding of the people and the communities in which it insures. Its focus allows for stronger underwriting and insurance products which suit the needs of its members.

- Protect not profit: Because MFI operates without the pressures of shareholders looking for quarterly returns, it only retains enough profits as required to support growth. Then, guided by its heritage and commitment to members through a shared purpose and mutual values, it returns excess premiums to its membership.

- Community commitment: MFI is invested in its members and is committed to making people its priority. Through annual donations, bursaries, scholarships, and charitable events, MFI is proud to give back to its communities.

- Expert in its field: With over a century of experience, MFI has become expert in the agricultural sector. It utilises past experience to create innovative solutions, giving policyholders the confidence that it understands their unique insurance needs.