The need for robust insurance risk and capital management has never been more important for the mutual/cooperative insurance sector to ensure that it is well-positioned to deal with the challenges triggered by the pandemic and the resultant global recession. To this aim, ICMIF and Peak Re partnered in March/April 2021 to conduct a survey to better understand the risk and capital management needs and challenges of ICMIF members.

Introduction

The past one and half years have been anything but normal, and uncertainty remains elevated in the near term. Despite several vaccines having been authorised for emergency use, the roll-out of mass vaccination remains bumpy, hampered by supply constraints, a reluctance to vaccinate, and a recent resurgence of infection in key emerging markets. Throughout this unprecedented crisis, insurers have continued to support households, enterprises and societies through the provision of risk covers and paying claims. The pandemic is yet another occasion to show the value of insurance as a shock absorber to cushion the financial stress on households and corporations from catastrophic events. Nonetheless, the pressures on insurers are unrelenting, arising from dislocations of financial markets, economic recessions, lower interest rates, and a fast evolving risk landscape. The need for robust insurance risk and capital management has never been more important.

This much is true for mutual insurance – one of the oldest forms of insurance, which is estimated to have accounted for 26.7% of global insurance premiums in 2017, up from 24.0% in 2007.1 Globally, there are over 5,100 active mutual insurance organisations serving 992 million members or policyholders.2 Given the importance of the mutual segment and the protection they offer to members/policyholders, it is imperative that they are well-positioned to deal with challenges triggered by the pandemic and the resultant global recession. To this aim, Peak Re partnered with the International Cooperative and Mutual Insurance Federation (ICMIF) to conduct an online survey in March-April 2021 to understand mutuals’ risk and capital management needs and challenges. This article summarises the key findings.

Definition and scope of the survey

According to ICMIF, “mutual and cooperative includes organisations whose legal status may not be classified as such in their national law, but whose structure and values reflect the mutual/cooperative form, i.e. companies which are owned by, governed by and operated in the interests of their member policyholders. These include limited companies owned by people-based organisations, fraternal benefit societies (fraternals), friendly societies, Takaful providers, reciprocals, non-profits, exchanges, discretionary mutuals, protection and indemnity (P&I) clubs, community organisations and foundations”.3

We conducted the online survey in March-April 2021, with the majority of respondents being mutual insurers, and the rest being cooperatives, mutual holding companies and other mutual/cooperative forms. Over half of respondents are based in Europe (57%), followed by the Americas (27%) and APAC (17%). The sample includes both small and large entities – 47% of respondents have annual premiums of less than USD 200 million, while 37% have above USD 1 billion. Motor is their main line of business, followed by property/fire and personal accident & liability insurance.

To download a PDF of this article, click here.

This article was written by Clarence Wong, Chief Economist, Peak Re.

Questions related to this article can be addressed to Clarence ([email protected]). Other questions non-related to this articles can be addressed to Andy Souter, Director, Global Markets and Co-Head of P&C ([email protected]).

The original article is provided in English only. Any translation to other languages via the ICMIF website have not been done by Peak Re, and therefore Peak Re are not liable or accountable for those translated versions.

Key findings

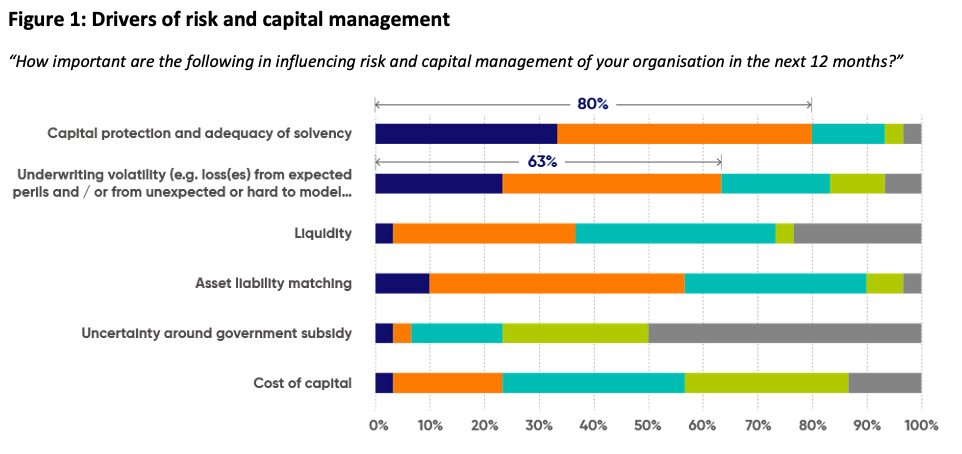

The survey found that mutuals, when asked about their risk and capital management requirements in the next 12 months, focused on capital protection and maintaining adequate solvency capital (see Figure 1). They also stressed the need to manage underwriting volatility. These findings indicate lingering concerns over the financial fallout from 2020, both in terms of volatile asset values and large COVID-19 insured losses4.

Source: ICMIF-Peak Re Risk and Capital Management Survey 2021.

Remaining liquid and achieving target asset-liability matching are considered “very important” or “important” by one-third to half of respondents. To the extent that duration matching is a key consideration in insurers’ cash-flow, thus impacting on their liquidity position, the two drivers are closely intertwined. The relatively short-duration of respondents’ underwriting portfolio, which is dominated by motor and property risks, also highlights the importance of having a strong liquidity position.

Cost of capital is mostly considered neutral or not important as a risk and capital management driver. This being the case since mutuals do not need to directly compensate investors for the use of capital, as in stock companies. Government subsidies (or uncertainty around thereof) are also considered by most as not important. It could be the case that mutuals are confident the support from states will continue, or many are simply not dependent on government subsidies.

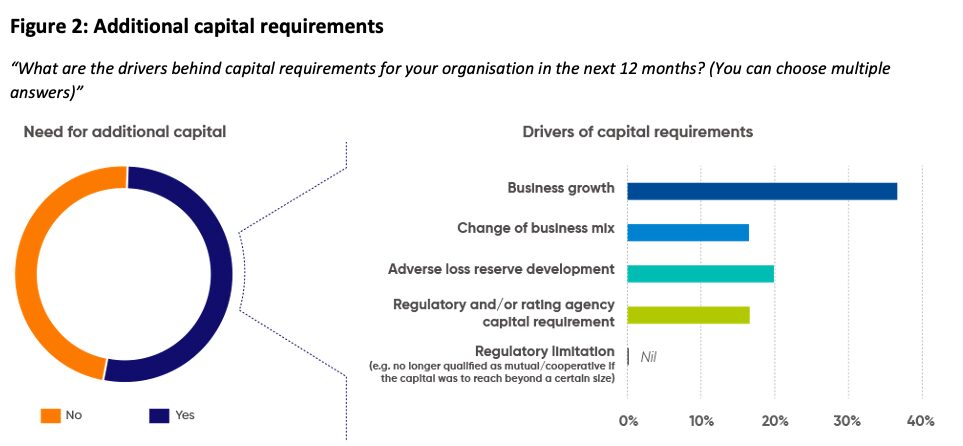

Close to half of respondents do not see any need for additional capital in the next 12 months (see Figure 2). In contrast to stock insurers, which are typically very active in capital management, for reasons ranging from acquisition to lowering of funding cost, mutuals look to be relatively comfortable with their current capital position/adequacy.

Source: ICMIF-Peak Re Risk and Capital Management Survey 2021. RHS bar chart refers to share in the total sample.

For those who expect additional capital needs, the prime reason is for business growth and expansion. A higher proportion, around one-third, of respondents are keen on new business opportunities probably in light of an unfolding global economic recovery and heightened risk awareness. As the post-pandemic “new normal” gradually takes shape, there will be increasing demand for new products and solutions to address existing and emerging risks. Meanwhile, use of capital for defensive reasons remains, though at a more muted level, for example, to deal with adverse reserve development, and regulatory and/or rating agency capital requirements. Similar to earlier observations about their indifference to government subsidies, mutuals do not see the need for additional capital to remain qualified (as mutual or cooperative in certain jurisdictions).

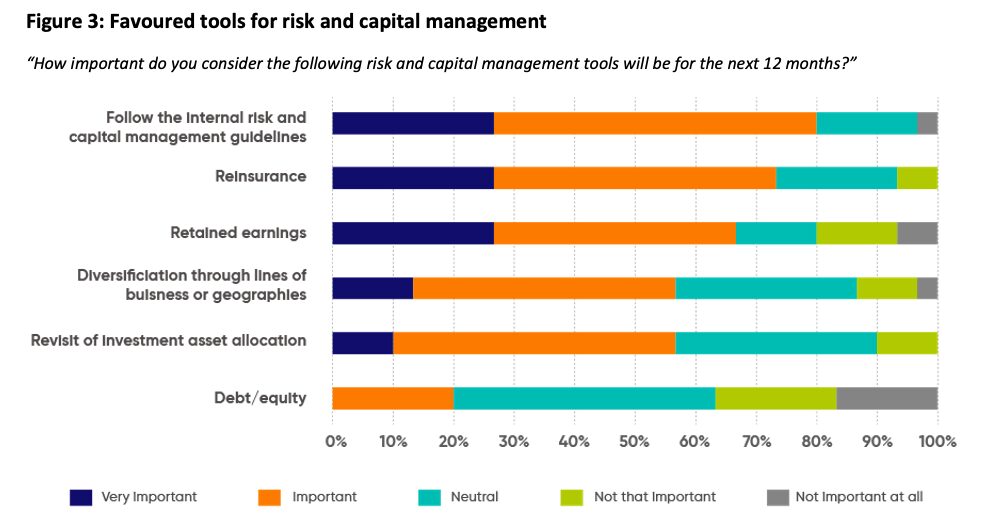

“Follow the guidelines”, “reinsurance” and “retained earnings” are most mentioned as “very important” or “important” tools for mutuals to manage their risk and capital targets (see Figure 3). In comparison, “debt/equity” is generally relegated to a lower ranking, as mutuals typically have limited access to capital markets. Other tools, including “revisit of investment asset allocation” and “diversification through lines of business or geographies”, are largely regarded as either important or neutral.

Source: ICMIF-Peak Re Risk and Capital Management Survey 2021.

The result shows that mutuals have more flexibility in using their retained earnings for capital and risk management. On the other hand, they have limited access to the debt and equity market. This could leave them potentially with few options if low investment returns and unfavourable underwriting results hamstrung earnings. Being cognizant of this limitation probably explain mutuals’ focus on having adequate solvency capital and reduced underwriting volatility. The observation that “reinsurance” is one of the favoured tools of mutuals highlights their appreciation of outward reinsurance as a risk and capital management tool, whereas inward reinsurance can be taken to effect geographical and portfolio diversification.

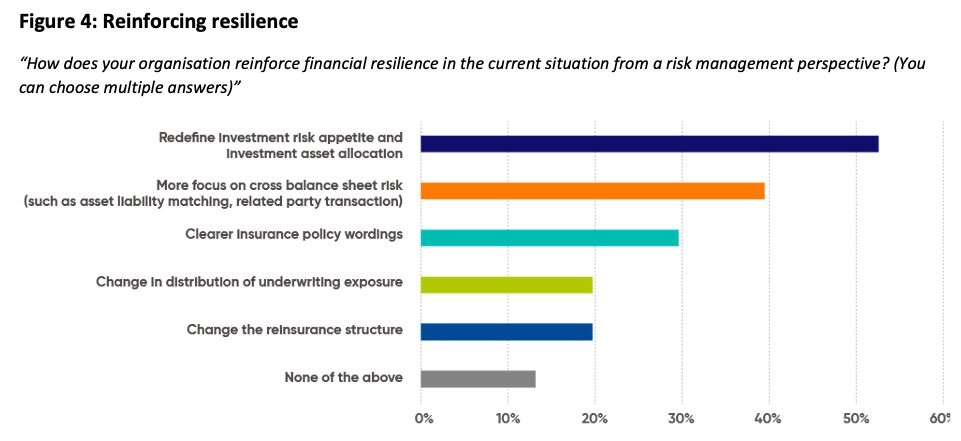

When it comes to improving the resilience of risk and capital management, over half of the respondents would focus on redefining their investment risk appetite and asset allocation (see Figure 4). Earlier studies by ICMIF showed that mutuals’ investment portfolios are tilted towards bonds (59.8%), followed by stocks and shares (17.5%) and mortgages and loans (12.6%). The current low interest rate environment could prompt more mutuals looking for alternative assets with better yields.

Source: ICMIF-Peak Re Risk and Capital Management Survey 2021.

Overall, working the balance sheet harder seems the preferred option, relative to improving underwriting results (e.g. policy wordings, risk exposure and reinsurance structure). It could reflect an already high level of confidence and readiness in underwriting, though some respondents still see the need for enhancement, particularly in the clarity of policy wordings.

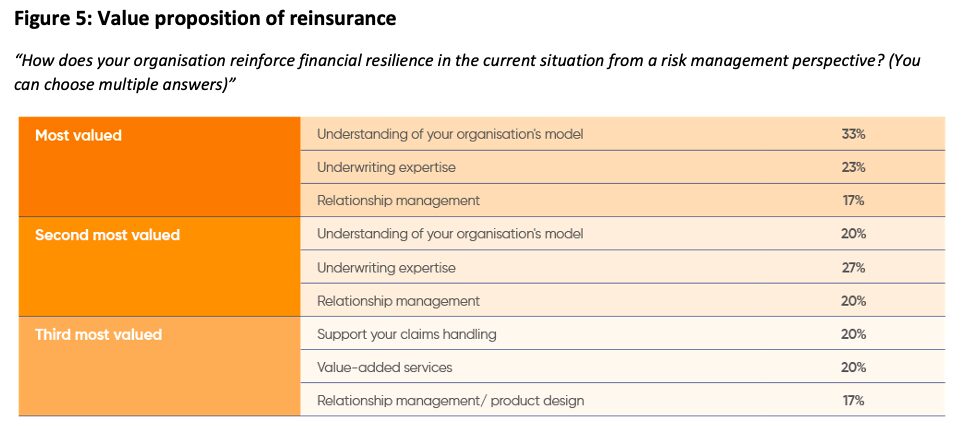

Mutuals value reinsurers who understand their organisation’s model, which in turns influences their risk appetite, capital drivers and risk management (see Figure 5). Meanwhile, similar to most stock insurers, mutuals also value reinsurers’ underwriting expertise and focus on relationship management.

Source: ICMIF-Peak Re Risk and Capital Management Survey 2021. Percentage refers to the share of respondents selecting the answer.

In comparison, supporting mutuals’ claims handling is least mentioned. That mutuals policyholders are also member-owners means claims fraud/delay is usually not a major concern. At the same time, product design is deemed less important and value-added services (VAS) is something nice to have.

Conclusion

Mutuals represent an important segment of the global insurance market. Over the past decade, they have expanded their market share and serve close to 1 billion people globally, while providing policyholders with an alternative business model through which to access insurance. The pandemic and economic recession are threatening mutuals with higher claims and volatile investment returns, but the crisis has also reinforced the value of insurance and mutuality. Through this survey, we hope mutuals are able to gain an insight into the broader industry and better understand the various considerations and concerns that exist within the mutual community. In doing so, it is clear that while some financial levers, such as equity and debt, are not always readily accessible to all mutuals, whilst a number of important tools remain at mutuals’ disposal from a risk and capital management perspective.

1 Source: Global Mutual Market Share 10, ICMIF Financial Insights.

2 ICMIF Financial Insights, op. cit.

3 ICMIF Financial Insights, op. cit. In this report, “mutual” is used to denote all different forms of cooperatives and mutual insurers. Noted that results in this report are not weighted.

4 Estimates of COVID-19 insurance losses are still developing, whilst one latest estimate the total at near USD 38 billion. See “COVID-19 insured loss reports rise 21% in last quarter, near $38bn”, 7 April 2021, Artemis.

Peak Re provides the information contained in this document for general information purpose only. No representation or guarantee can be made as to the correctness or suitability of that information or any other linked information presented, referenced, or implied. All critical information should be independently verified for correctness and Peak Re accepts no responsibility, and shall not be liable for any loss which may arise from reliance upon the information provided.

All information and/or data contained in this document is provided as at the date of this document and is subject to change without notice. Neither Peak Re nor its affiliates accept any responsibility for any loss occasioned to any person acting or refraining from action as a result of any statement, fact, text, graphics, figure or expression of belief contained in this document or communication.

All rights reserved. The information contained in this document is for your internal reference purpose only. No part of this document may be reproduced, stored or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise without Peak Re's prior written consent. Any other information in relation to this document, whether verbal, written or in any other format, given by Peak Re either before or after your receipt of this document, is provided on the same basis as set out in this disclaimer.

This document is not intended to constitute any advice or recommendation, and should not be relied on or treated as a substitute for advice or recommendation relevant to any particular circumstance.