Using data from the German insurance market, this article investigates whether the organisational form of a property-liability insurer influences its risk taking. The transfer and transformation of risk is approached differently in stock insurers and mutual insurers. Stock insurers have the ability to raise additional capital due to their easy admission to financial markets, while mutual insurers are unable to access capital markets in order to refinance. Examining the asset and liability sides of balance sheets for 62 German insurers, it concludes that stock insurers take higher risks, both in underwriting and in investments than mutual insurers. These findings are relevant to customers, investors, and regulators, as they provide insights into the fundamental differences between stock and mutual insurers.

Research motivation and hypotheses

The German insurance industry is characterised by the coexistence of different organisational forms of insurance companies. Two organisational forms, which differ fundamentally in terms of organisation and derived managerial implications, dominate the German property-liability insurance market. Non-profit mutual insurance associations (mutuals) and for-profit joint-stock companies (stocks) are responsible for over 96% of gross written premiums in the German property-liability insurance market today.

In stocks there is a clear separation of the owner, manager, and customers. Among these corporations, the incentives of customers and owners contradict each other. Owners desire the management to maximise the company profits while policyholders seek inexpensive insurance coverage. All claims paid out to policyholders have a direct negative effect on the profit of capital investors.

The groups of clients and investors are merged in mutuals. Policyholders are owners and customers of the firm at the same time. There is no conflict between the goal of profit maximisation of the owners and cost reduction of the customers, as the company’s residual profits are ultimately transferred back to the policyholders.

These fundamental differences and their incentive implications hint at a difference in behaviour of the company’s management. A prominent characteristic of stock insurers is their ability to raise additional capital due to their easy admission to financial markets. While mutuals are unable to access capital markets to refinance, stocks can easily raise capital to improve liquidity, which has direct behavioural implications. This points to the likelihood that the transfer and transformation of risk, is approached differently in both types of insurance companies. As stock insurers can pass on risks to other investors via capital markets, they can bear more risks compared to mutuals which are constrained by their restricted access to capital. As the customers are also owners in mutual associations they bear the residual business risk and show the tendency to promote less risky firm activities.

The initial step of this analysis examines the behavioural differences between the organisational forms by investigating the corresponding risk behaviour. The influence the legal form of an insurance company has on the way the firm deals with risk is also analysed with the prediction that stocks are connected to riskier business activities and mutuals act more carefully than stock companies.

Data overview and methodology

In 2018, 205 property-liability insurance companies were operating in the German market. 193 out of those 205 insurance companies are stocks or mutuals. All companies that write over EUR 50 million of net annual premiums are included in our dataset. Claim payments and hidden reserves, the difference between market values, and the conservative German Commercial Code book values act as risk indicators for the two dimensions of our analysis.

A particular feature of the German insurance industry are group structures characterised by profit-transfer agreements. Many stock companies are not publicly traded but held entirely by a mutual on a superordinate level. Those stocks are not independent in their business decisions but experience a high level of strategic governance from the holding company.

In our analysis, those stocks, which are predominantly owned by a mutual, are assigned to the organisational form of the controlling firm. This results in the analysis of 39 stock and 23 mutual insurers, collectively responsible for EUR 53.44 billion gross premiums written in the German property-liability insurance industry in 2019.

To determine the different risk preferences of the two organisational forms, we use three methods. First, we define risk indicators and divide the investment instruments and business lines into two categories, more risky and less risky. Second, we observe the average composition of the underwriting and investment behaviour of mutuals or stocks over time. Third, we implement logistic regressions to determine deviations in the risk preferences between the two organisational forms.

This article was written by Frederick Schuh, Research Assistant at the Department of Business Administration, Risk Management and Insurance Studies at the University of Cologne (Germany); with data analysis by Lukas M Noth, Quantitative Portfolio Manager, DWS Group and MSc Business Administration and Finance Graduate, University of Cologne (Germany).

Published February 2023

The article is summary of an academic paper, Ownership structures and risk taking in the German property-liability insurance market, written by the authors and that was originally published in the Journal of Co-operative Organization and Management (Volume 10, Issue 1, June 2022). This paper was the winning submission for the inaugural ICMIF Young Scholar Award (see below).

For more infomation, please contact Frederick Schuh.

Results

We are using the volatility of hidden reserves as a risk proxy for assets. The weighted average volatility of hidden reserves is highest for ‘equity investments’ with a standard deviation of EUR 16.10 million, while ‘fixed-rate investments’ possess a standard deviation of EUR 4.07 million. These values mostly meet our theoretical expectation.

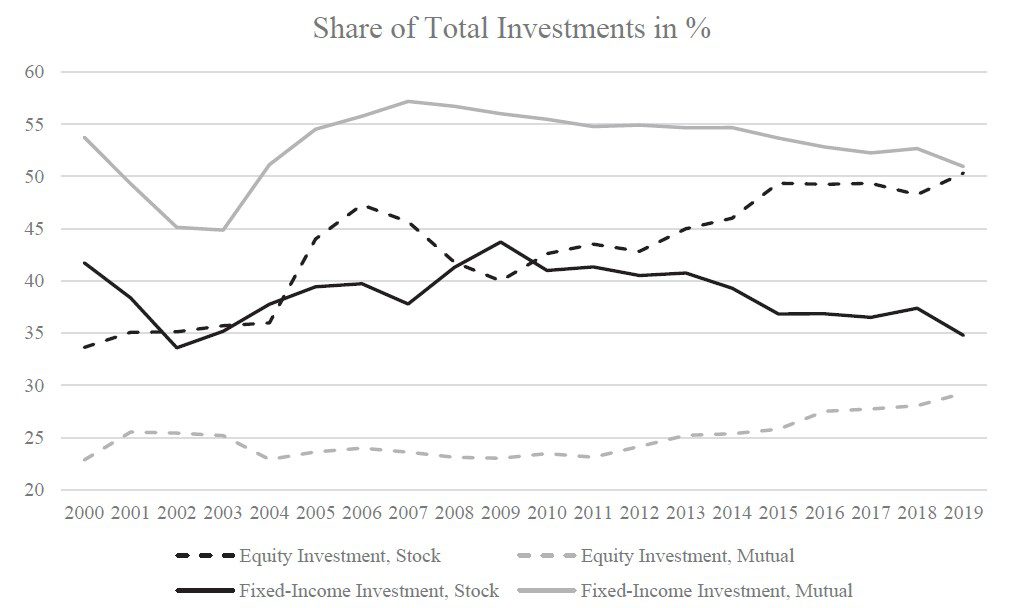

Comparison of investment composition by ownership form

Stocks invest substantially more into equity and less into fixed-rate instruments compared to mutuals. According to our hypothesis, stock insurers should use a riskier asset composition than mutual insurers. Our regression analysis shows: The sign of the parameter estimates for equity investments and fixed-rate investments are both negative. Therefore, companies investing strongly into ‘equity’ and ‘fixed-income instruments’ are expected to be stock insurers. For example, a company with a 1% higher share in ‘equity investments’ is up to 4.3% less likely to be a mutual insurer. The difference between the parameters of ‘equity investments’ and ‘fixed-rate investments’ is not significant. The seen difference in investments seems to be rather driven by the larger size of stock insurers than by risk preferences.

We now examine the risk implications of the underwriting activities. We empirically estimate the riskiness of underwriting in different lines of business using the standard deviation of the loss ratio. In line with theoretical considerations, we find ‘property’ to be a rather risky business line, with a standard deviation of EUR 134.17 million. ‘Automotive’ possesses by far the highest volatility in the sample expressed by a standard deviation of EUR 363.37 million. We identify ‘household’ and ‘fire’ as the least volatile business lines, with a standard deviation of EUR 22.00 and 50.26 million respectively.

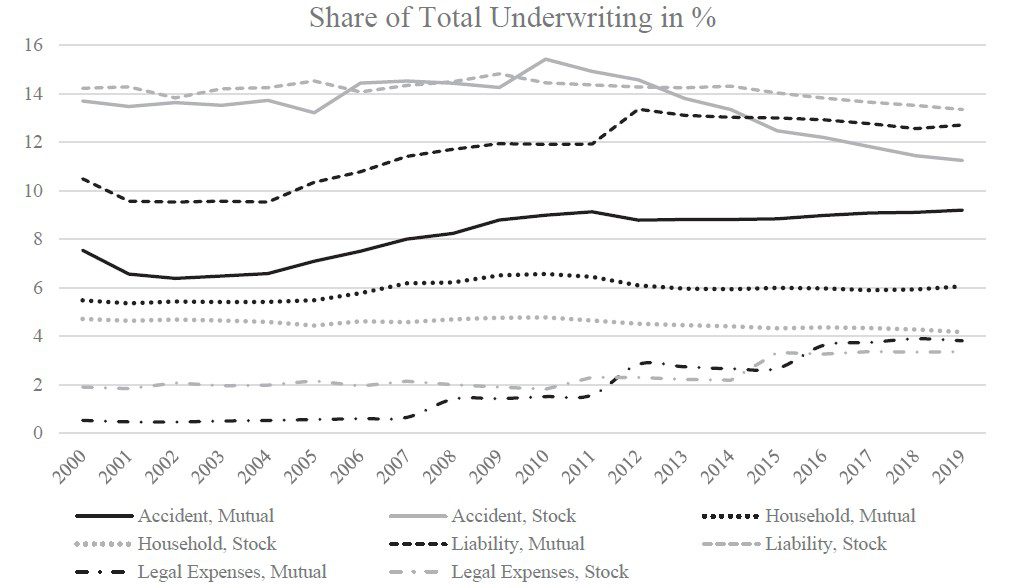

The two organisational forms vary by their business line concentration and composition. A clear difference between the underwriting composition of stocks and mutual insurers over the observed period is visible.

Comparison of underwriting composition by ownership form

According to our risk hypothesis, we expect mutual insurers to rather concentrate on less risky business lines as identified before. We expect the parameter estimates of ‘fire’ and ‘household’ to be positive and the ones of ‘property’ and ‘automotive’ to be negative.

Our regressions shows that the sign for the underwriting class ‘fire’ is positive and significant as expected. A company with a 1% higher share in fire insurance is, c.p. 1.14% more likely to be a mutual than a stock insurer. The parameter estimate for ‘household’ is negative but very close to zero. The parameters for ‘property’ and ‘automotive’ are negative and significant.

Discussion

Our results show that in the German property-liability insurance market there is a fundamental strategic difference in underwriting and investment between stock insurers and mutuals, with stocks tending to act in a riskier way than mutuals. On the investment side, stocks exhibit a proportionally higher investment in more volatile asset classes, but this difference can be explained by size. In the underwriting dimension, mutuals write more business in less risky business lines, as characterised by the volatility of claim payments. Stock insurers underwrite proportionally more business in riskier business lines, e.g. property insurance.

The results are consistent with the existing findings for the U.S. insurance industry, although our results appear to be less significant. These differences could result from the development of the respective financial markets. The USA showed finance-led economic growth since its inception, whereas Germany was characterised by a fragmented financial economy with highly specialised mutual insurers. Today, the large U.S. financial markets show high investor protection while Germany is a civil law country with a comparatively underdeveloped capital market and low investor protection. In addition, many German insurers possess roots in chambers of craft or professional associations that introduced a social security system for their members. The long historical roots of the German mutual insurers are apparent today. These companies often still follow conservative business models and offer the same products as in their early days.

Our analysis creates opportunities and implications for further research. We were unable to conduct a more granular examination of the investment strategies of the insurance companies as the annual reports according to the German Commercial Code do not publish in depth data concerning the asset mix. Further research into insurance companies changing their legal form from stock to mutual (or the other way around) could be used to determine if this change initiates a shift of risk preferences which could in turn provide further insights into the causal relationship of organisational form and risk preferences.

In 2022, the authors of the academic paper Ownership structures and risk taking in the German property-liability insurance market from which this article is based on, were announced as the winners of the ICMIF Young Scholar Award.

ICMIF Young Scholar Award

ICMIF launched the new bursary award of EUR 10,000 for the most promising young scholar(s) (under 35 years of age) in the field of mutual and cooperative insurance in 2022. The bursary was launched in conjunction with the Mutual Insurance Conference (MIC) organised by the Mutual Research Network and which took place on 24 October 2022 in Rome, immediately before the ICMIF Centenary Conference, also in Rome (25 to 28 October).

As the world’s only global network from cooperative and mutual insurers, ICMIF’s aim is to encourage young scholars to get involved in studying how mutuality is a strategic enabler and true authenticator of a purpose-led insurer.

The winners were chosen from submissions from young scholars in response to the MIC call for papers, or optionally a recently published scientific article (2020-2022), a research plan of their PhD thesis, or a research project plan that relates to cooperative and mutual insurers.

Photo shows (left to right)

Antti Talonen, Associate Professor, Tampere University (Finland) and member of the Mutual Research Network; Frederick Schuh, Research assistant at the Department of Business Administration, Risk Management and Insurance Studies at the University of Cologne; Liz Green, Executive Vice-President, ICMIF; Lukas M Noth, Quantitative Portfolio Manager, DWS Group and MSc Business Administration and Finance Graduate, University of Cologne; and Shaun Tarbuck, Chief Executive, ICMIF.