We are pleased to share this latest guest blog from Max Tiong Oon Choon, Head of Innovation at ICMIF member organisation NTUC Income (Income) in Singapore. The article was originally written by Max and shared on his LinkedIn page and it is reproduced here for the benefit of ICMIF members as a great example of the development process of a truly innovative product by a thriving social enterprise. The article is shared here with the kind permission of Income.

“If we want to live in a world where everyone and anyone can have some form of insurance coverage regardless of their financial capability, what would we need to create? Since we’re at it, why not create something fun that ties in with everyday living?”

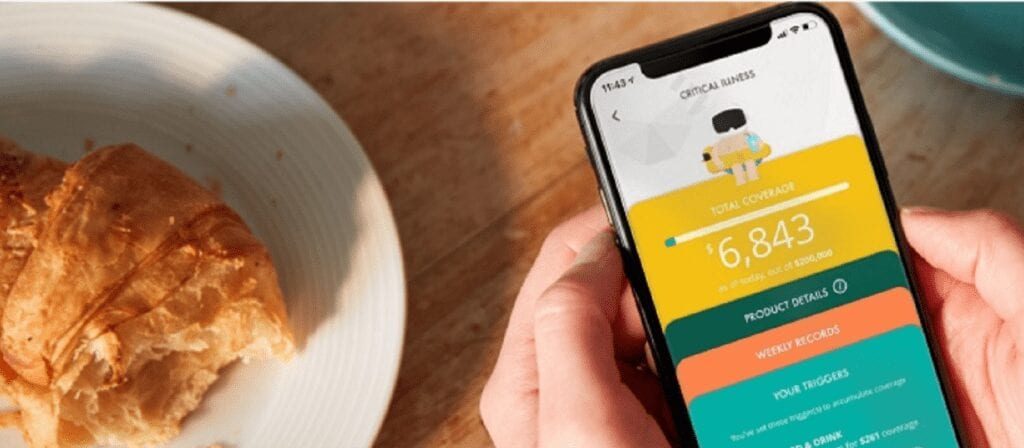

And so, we did! After 10 months of consumer research, iterations, data analysis and sheer hard work, we finally announced the official launch of SNACK by Income – a truly refreshing experience to insurance and protection. SNACK is the first bite-sized, stackable insurance that integrates seamlessly into everyday lifestyle activities.

Imagine, every time you go for a jog, redeem a meal, take public transport or pay with your credit card, you’ll automatically build up your insurance coverage “invisibly” without having to even think about it. In an unfortunate claimable event, you would have up to SGD 200,000 worth of death or total disability benefit for your family.

Being people-focused and customer-centric

Purchasing insurance is a very personal journey and almost everyone we spoke to had a different experience of their own when it comes to getting themselves covered. We researched. We interviewed. We talked (a lot). When we introduced the SNACK concept to interviewees for our first phase of user validation, we were worried that it might seem like we’ve over-simplified insurance and diluted the importance of it given how it’s so easy to purchase it just by going about their daily activities.

However, the results were encouraging – our interviewees loved the concept and wanted us to launch soon so that they could start paying it forward to themselves. “Paying it forward to myself” was an exact interviewee verbatim that stuck with me since then. Instead of the “wait till later when I have a stable income to start buying insurance” mindset, people can now take charge of and protect their future as early as they can. We now have a responsibility to make this wish come true!

Looking back when we first started the project, we did not know where this path would lead us. Having been in innovation for almost a decade, most would think that I would be comfortable with the uncertainty that comes along with it. But each time we embark on projects that might change the face of the industry, I still get chills down my spine not knowing what I’ve gotten myself into.

The challenge with conducting such customer interviews is to keep an entirely open mind about our existing boundaries – be it technology, strategy and regulatory. Our goal was to find a gap to fill.

With the insights we gathered, we realised that what we needed was not just a new insurance product, but an entirely different way of purchasing insurance via a business model that grants the flexibility to consumers as to when, how much and how long they want to get covered for, thereby targeting an emerging customer mindset and providing an untapped customer experience.

Diversity of thinking: Learning from the people around you

I can still remember the tingling feeling I had when we first presented the SNACK proposition of stacking micro policies via paying micro premiums to our senior management. Questions like “Is this too crazy?” and “Is this the right time?” kept popping into my head. Recalling the first conversation with our C-suites, we discussed how innovation can sometimes be seen as disrupting our own business. We agreed that if we didn’t do it, someone else would do it and that might just be too late for us.

Today, our senior leadership team has empowered the entire organisation with the role of innovating today’s business, thus evolving our role to even more exciting frontiers so that we can #BeTheChange and identify tomorrow’s innovative business models. With SNACK, we knew we had an idea, but was it good enough? Keeping to our belief of innovation being people-centric, we kept an open mind and gathered thoughts from people around us with diverse experiences including partners from other industries.

Sometimes, to innovate, we are required to admit more about what we don’t know than what we actually do. In fact, I’m learning from my team members daily. (They are that awesome!)

To me, we had the perfect team to develop SNACK at the Income Digital Transformation Office (DTO). Inclusivity and diversity in people, perspectives and experiences are key in steering and propelling our digitalisation journey at Income. We don’t just involve insurance subject matter experts but rather, our team also comprises designers, bankers, entrepreneurs and business developers who take innovative thinking to the next level to launch new innovations that reimagine the future of insurance.

Technology doesn’t drive innovation, people do

After months of research and planning, we knew it was time to bring SNACK to market and there was no better way than to premiere it at the Singapore FinTech Festival 2019 to get first-hand feedback from consumers about what they thought of SNACK. We’ve since been fine-tuning the product with our strategic partners, ZhongAn Technology and MonstarLabs Singapore, who share the same vision of making insurance simpler and more intuitive, and partnering like-minded digital leaders from EZ-Link, VISA, Fitbit, Burpple and Foodpanda to bring the concept of providing accessible insurance embedded in our lifestyles to everyone in Singapore.

SNACK by Income is not the brainchild of any particular individual. It’s a flame that is collectively sparked by everyone in the team. Each project we’ve undertaken since DTO’s inception gave us the inspiration to create our next product targeting different consumer groups and ecosystems. Our first surge-pricing protection with Droplet, airfare price-hike protection with PinFare, integrating an insurance pay per trip model with GrabCar, GrabFood and GrabExpress, and pushing the boundaries of usage-based motor insurance with Carro to new heights, became the stepping stones for us to develop SNACK by Income today.

As we continue to leverage InsurTech to enable us to create innovative digital business models, the key to tying all of any innovation together is the people. DTO is only as strong as the team that makes it who we are, the digital ecosystem partners that share a vision with us, and the technology partners that collaborate with us with the collective goal to not only redefine insurance for the future, but also bridge protection gaps meaningfully.

#SNACKbyIncome #BeTheChange

Read more about SNACK by Income in our news story from June 2020 here.

This year, Income celebrates the organisation’s 50th anniversary of making insurance accessible, affordable and sustainable in Singapore. Read more here.