With the use of telematics, motorists have the possibility to save money on their insurance premiums. There is also the potential to support sustainability, as traffic can become safer and adapted driving can become more resource-friendly, helping to reduce fuel consumption.

Younger car owners pay above average for their motor insurance cover, even if they drive carefully and safely. This is because, when viewed collectively, younger drivers run a higher risk of accidents due to inexperience, misjudgement and carelessness. The combination of a higher basic premium and a lower no-claims classification results in comparatively high insurance premiums.

With digitalisation, however, ICMIF member HUK-Coburg (Germany) has found a solution to this problem through its telematics product. This makes it possible to take individual driving behaviour into account when pricing a customer’s premium. Those who drive with foresight and adapt how they drive to the flow of traffic, for example, and who observe speed limits and avoid abrupt braking, pay less with the German mutual insurer.

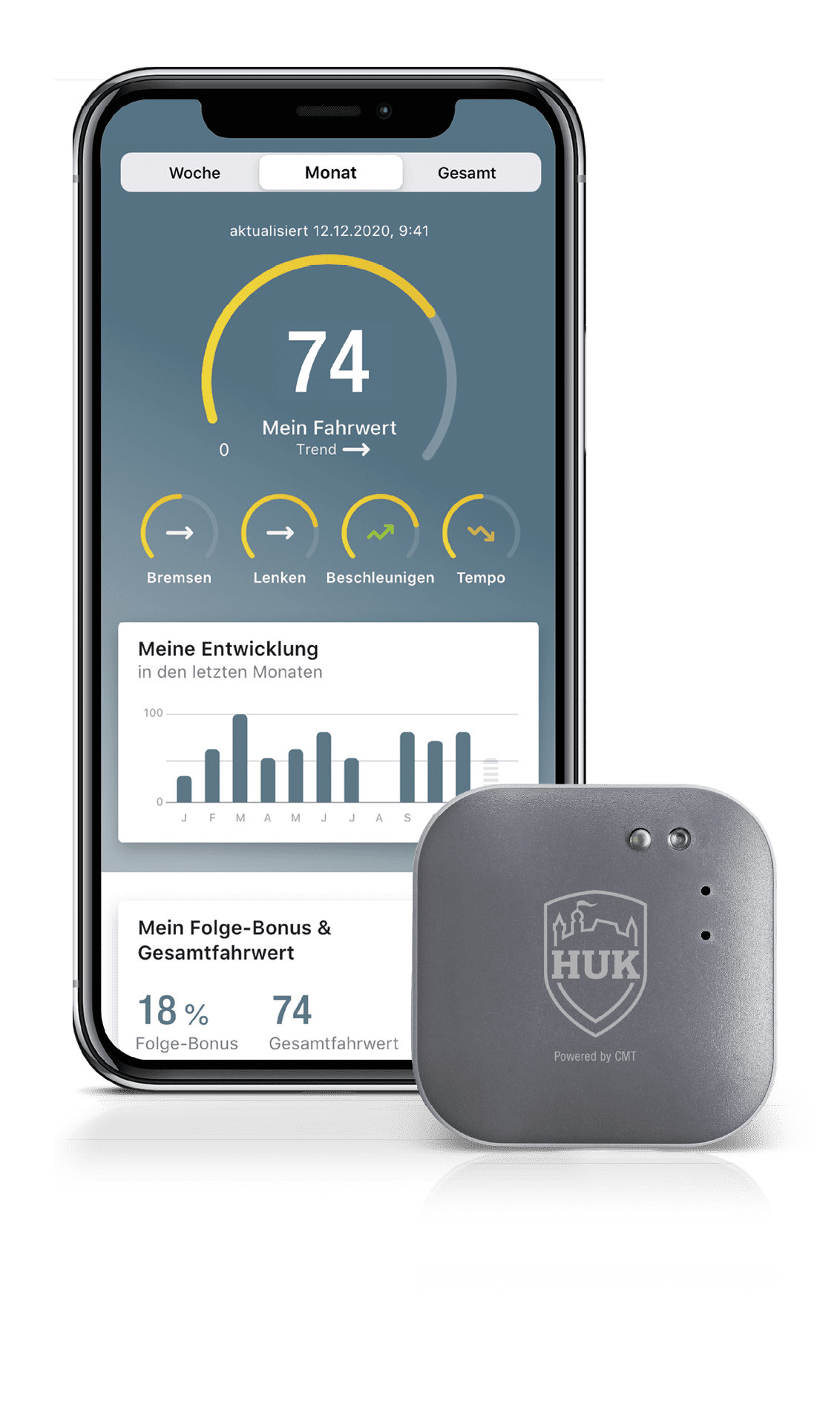

With a smartphone and a small telematics sensor (no bigger than a small sticker) driving data – such as speed, acceleration, braking and steering behaviour – is collected. The data is then forwarded via HUK-Coburg’s “HUK Mein Auto” smartphone app and analysed. On this basis, a value is determined, which reflects the driving style and determines the individual’s discount.

For those who choose HUK-Coburg’s telematics-based insurance cover, Telematik Plus, the starting discount is already 10%. Further savings – up to 30% – can be achieved depending on the individual’s driving style. The German rating agency Assekurata gave Telematik Plus the best rating in a comparison with similar insurance policies.

“Currently, 300,000 policyholders have opted for our telematics product, and the trend is rising,” explains Dr Jörg Rheinländer, Member of the Management Board of HUK-COBURG, which is also a market leader in Germany with 12 million vehicles insured. “While the telematics pricing was initially only meant for young drivers, all age groups can now benefit from it,” says Dr Rheinländer.

Apart from the financial advantages of lower pricing, the digital telematics system offers additional protection. “We know from evaluations of test groups that users have actually improved their driving style after taking out the special telematics rate,” says Dr Rheinländer. This is directly linked to the feedback provided by the system, which is a central component of the product. Every driver can check the route he or she has driven and see on a map where their driving manoeuvres were not ideal.”

Trends in road safety

After the first three years of experience with the telematics tariff at HUK-Coburg, initial trends and conclusions were drawn by analysing the 340 TB of telematics data – based on 1.6 billion of kilometres driven.

A clear trend can be seen in road safety: drivers with a poor score are many times more likely to have an accident than other drivers. Through the financial incentive to save on the insurance premium and through concrete feedback on one’s driving behaviour, the tariff can lead to a change in behaviour and thus contribute to an increase in road safety.

Telematics can also contribute to environmental protection: the tariff rewards a driving style in which the vehicle adapts to the traffic. Constant abrupt braking and rapid acceleration, such as in situations with heavy traffic, have a negative effect on the driving value. However, an anticipatory and adapted driving style not only saves insurance premiums, but also consumes less fuel and thus causes less CO2 emissions. Calculations validated by tests have shown that drivers with a low score use 10% more fuel than those with a high score.

Scientifically based evaluations are not yet available and are likely to be difficult to produce. However, HUK-Coburg considers its analysis to be so valid that they serve as a basis for future business strategy in telematics.

One example: In a pilot test before the product launch with 50 test customers who switched to the telematics product themselves after the market launch and drove over 100,000 kilometres with it, the driving values improved significantly: the test persons drove more carefully. This shows that telematics can bring about a change in behaviour and thus increase safer driving.

Although the figures are not representative, Dr Rheinländer, sees this as an initial trend: “Participation in telematics seems to motivate people to achieve better driving values. If this is confirmed, it will mean that the number of accidents can be reduced. That would be an important societal benefit.”

While telematics tariffs are already more widespread in some foreign markets, a tariff linked to driving behaviour is still relatively new for the German market. However, HUK-Coburg customers are very interested in telematics: About 10% to 20% now opt for a telematics tariff.

Debunking criticism of telematics

In contrast to other countries, telematics is often viewed with scepticism in Germany. Critics speak in particular of an unclear benefit, a non-transparent product, data protection problems and technical susceptibility to errors.

According to Dr Daniel John, Head of the Actuarial Department for Non-life Insurance at HUK-Coburg, all four points of criticism can be refuted: “The benefits are clear. If you drive appropriately, you can save on premiums by recording your driving data.”

He also said that accusations of a lack of transparency are not appropriate. “In the ‘General Insurance Conditions’, everything is presented in a comprehensible way. In addition, customers receive ongoing individual feedback in their app. Also, with regard to data protection, trust can be built up through transparency. A separate limited company with a separate data circuit processes the data collected pseudonymously in a separate data circuit from the insurer into a driving value. They are only used to assess the risk; there are no reductions or disadvantages in the event of a claim.” In addition, every customer is free to leave the telematics programme on a daily basis. The insurance then continues without telematics.

For Dr John, the fact that errors can sometimes occur in technical environments such as data transmission is something you have to live with: “In technology, there is no such thing as 100% perfection. We do have very good data for driving behaviour assessment, but with smartphones alone there are very many models and special features. In addition, settings such as GPS, Bluetooth, power-saving mode, etc are extremely important. The customer himself must also play a part in this.”

Dr John says: “At HUK-Coburg we do our best to constantly develop our product further. At the same time, however, the customer must also cooperate. Telematics only works when the customer works with us. In addition, customer feedback is of central importance, especially as a basis for the further development of the product.”

Telematics score: the most non-discriminatory pricing method imaginable

According to Dr Rheinländer, the telematics score is absolutely non-discriminatory. The target variable is the claims frequency or the claims requirement. Only behaviour counts and this can be influenced by everyone. Socio-demographic factors such as age, income, profession, etc. have no influence on the driving score. As Dr Rheinländer states, “Telematics treats everyone the same.”

The assumption that telematics is at the expense of conventional insurance portfolios is also wrong, according to Dr Rheinländer: “Telematics and non-telematics can be seen as two separate portfolios. Each of the two groups pays what is required for the group, so customers in non-telematics tariffs pay the appropriate price for their group and telematics customers do likewise.”

About HUK-Coburg

With over 12 million customers, HUK-Coburg is the largest insurer for private households traditionally offering competitively priced products in the lines of motor insurance, liability/accident/property and legal expenses insurance as well as private health insurance, life insurance and private pension insurance. With a premium income of EUR 7.8 billion in 2019, it is among the ten largest German insurance groups. Its traditional focus is on motor insurance: with more than 12 million insured vehicles, it is Germany’s largest car insurer. It is also one of the largest providers of home contents and personal liability insurance in the German market.