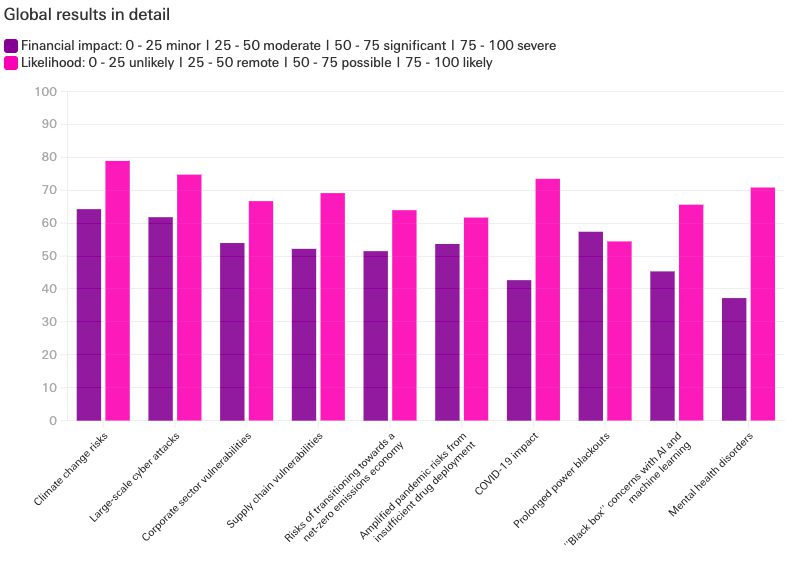

In a new survey by the Swiss Re Institute of the emerging risks and trends for the (re)insurance industry, respondents rated climate change risks, large-scale cyber-attacks and corporate sector vulnerabilities as the top three business threats for insurers.

Although the COVID-19 crisis was the most talked about danger this past year, professionals from the insurance industry and large corporations as well as academics rated climate change as the No. 1 emerging risk. Climate change risks are losses from primary perils, such as tropical cyclones, and secondary perils, which include heatwaves or intense rain, based on estimated financial impact and likelihood to materialise.

Large-scale cyber-attacks ranked second. In third place were corporate sector vulnerabilities, which develop through debt build-up due to favourable credit conditions. Other top emerging risks include risks in transitioning to a net-zero emissions economy, "black box" concerns with AI and machine learning, and mental health.

The survey listed 12 emerging risks and included a question on the financial impact of COVID-19. Roughly half of the respondents found the pandemic's impact as likely but moderate over the next 10 years.

1. Climate change risks

"The risk of rising sea levels, greater wildfire prevalence, and greater storm intensity will continue and will shape third world development, global preparedness and a greater commitment of corporate profits to fit this preparedness." - Survey respondent.

2. Large-scale cyber-attacks

"The increasing volume of data and use of digital connectivity means potential entry points are also increasing. That said, protection tools are also increasing in sophistication. Companies that are diligent and intentional in protecting all aspects will fare better but could still be impacted." - Survey respondent.

3. Corporate sector vulnerabilities

"This is already happening. There is a growing need to go back to the basics on the financial behaviour of corporations. If this does not happen, the crisis will be global and systemic again." - Survey respondent.

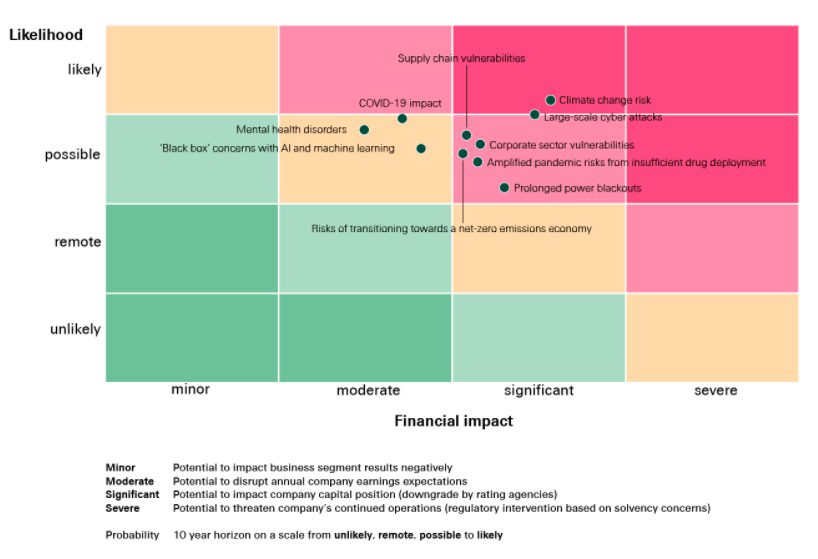

Overview of top 10 surveyed risks

The risk map below shows that seven out of 10 risks surveyed have the potential to significantly impact insurance companies. While the risks were rated separately, interaction and accumulation are likely. Climate change, for example, may move the geographic range of some diseases globally and increase the probability of a severe disease outbreak. The severe disease outbreak threat is already impacted by insufficient drug deployment.

1. Emerging physical climate change risks

Climate change, in combination with economic growth and rising urbanisation, is most likely contributing to an increasing number of small- to medium-sized losses stemming from secondary perils. This could impact the profitability of certain lines of business if not monitored and priced accurately.

The rise of so-called secondary perils, such as heatwaves, droughts, water scarcity, wildfire as well as intense precipitation events, in contrast to primary perils, such as tropical cyclones and European winter storms, has been observable already.

The climate change impact on physical risks can occur at various levels of severity over a long time period. Increased temperature variability and the resulting heatwaves can not only affect agriculture, productivity, water resources, health and mortality, but can also increase the risk of conflicts in certain regions.

Physical climate change risks in combination with the economic value concentration in exposed areas may potentially lead to:

- an increase in frequency and severity of relevant secondary perils

- higher severity but lower frequency for capital intense NatCat events

The following area in the (re)insurance industry could be affected:

- annual insured losses could rise if they become increasingly affected by secondary

- perils, which are usually smaller in scale but occur with a relatively high frequency

2. Large-scale cyber-attacks

As companies' cloud computing and infrastructure systems are increasingly connected to the internet, their exposure and vulnerabilities to cyber-attacks are growing. State-related actors can play a role in the background, giving attacks a new quality in respect to impact and frequency. The volume and sophistication of malicious internet activity has increased substantially.

There is a growing potential for large cyber-attacks to affect many companies at the same time through common internet infrastructure or the use of a major cloud provider. The resulting potential for critical infrastructure breakdown in areas like power, gas, water and strategic industrial sectors – e.g. telecommunications – poses a growing accumulation risk.

Large-scale cyber-attacks can lead to:

- property damage (e.g. fires, explosions, flooding if pumps don’t work, etc.)

- business interruption in all areas from production and health to the general services industries

- Life & Health losses if water supplies and sanitation are affected

- a disruption of financial markets which rely on communication

- a disruption of financial services operations because transactions are not possible

The following areas in the (re)insurance industry could be affected:

- property/specialty covers

- cyber insurance

- liability/casualty lines

- Life & Health lines

- financial insurance lines (e.g. credit risk if production is interrupted for a long time)

- insurance assets

- insurance industry operations

3. Corporate sector vulnerabilities

Corporate friendly financial conditions have extended the corporate credit cycle. This has led to further financial risk-taking by some firms with continued build up of debt. The rising debt has led to an increase in the vulnerabilities of the corporate sector.

The International Monetary Fund (IMF) estimates that in a material economic downturn half as severe as the global financial crisis, corporate debt owed by firms that are unable to cover their interest expenses with their earnings could rise to the levels seen during the global financial crisis. This could result in losses at financial institutions with significant exposures to highly indebted nonfinancial firms — a development that could amplify macroeconomic shocks.

Monetary authorities might try to support but there is little leeway left for traditional rate cuts. Thus, they may also adopt more innovative approaches such as "helicopter money". While such policies might be effective at supporting asset prices for a time, their efficacy in stemming a downturn is untested. Furthermore, they will also lead to higher uncertainty and could lead to the buildup of financial imbalances.

Re/insurers' investment portfolios would suffer from credit spread widening, higher defaults and lower equity valuations in a correction phase. If continued monetary/fiscal expansion is successful in extending the economic and corporate credit cycle, the current low interest rate environment may last for many more years to come, thereby depressing re/insurers' investment income.

As we move towards an ever more interconnected economic landscape and optimised just-in-time production, business interruption exposures increase significantly. Protecting income and profit streams has become a top priority for many companies. Awareness of potential interruption from non-physical damage related triggers, in particular cyber, is increasing rapidly.

Supply chain networks can reach a degree of complexity that poses severe difficulties in terms of monitoring and assessment. Consolidation activity within industries can lead to highly exposed suppliers supplying a large fraction of players within an industry. Ongoing optimisation and value concentration (e.g. in single manufacturing plants) can create a highly efficient system but can come at the expense of creating highly exposed links in the supply chain.

Interrupted supply/value chains can lead to:

- loss of income/profit

- loss of market share

- loss of contracts/competitive advantage

- reputational damage

- increased compliance requirements going forward

- supply shortages

The following areas in the (re)insurance industry could be affected:

- increasing business interruption (BI) exposures

- increasing BI vs. property damage claims ratio

- broader coverage sought by clients (cyber, non-damage BI)

- property/specialty covers and cyber insurance

- liability/casualty lines (for food recalls, contamination, etc.)

- Life & Health if medical supplies are in short supply

- financial insurance lines (e.g. credit risk if production is interrupted for a long time)

- (re)insurance assets.

The effects of climate change are already evident and shaking up our risk landscape: warmer average temperatures, rising sea levels, melting ice caps, longer and more frequent heatwaves, erratic rainfall patterns and more weather extremes. To keep global warming well below 2 degrees Celsius, it is vital to reach net-zero greenhouse gas (GHG) emissions.

This requires:

- significantly reducing GHG emissions in all sectors

- removing the remaining emissions (so-called carbon removal)

One key area for action is the transition from fossil fuel-based energy systems to renewable energy-based systems. A transition to a net-zero economy will generate a new digital smart energy supply chain. This means new, partly untested technologies and interfaces. As interfaces are often the trigger for loss events, this can increase the loss propensity of systems. In addition, the complexity of energy grids can lead to unknown outcomes and potentially higher loss severity. The new energy supply chain will also require political, technological and behavioural changes in all areas.

The following areas in the (re)insurance industry could be affected:

- immediate impacts mostly to P&C and specialty lines

- (re)insurance assets, due to stranded assets and the potential to contribute to the transition through respective asset management

- operations, if insurers strive to have net-zero emissions themselves.

The potential size and impact of future pandemics may be amplified by a lack of vaccine and antibiotic supplies. This is most likely the result of shrinking profit margins for these product classes, which are contributing to deterring pharmaceutical companies from development efforts. Societal resistance to vaccinations may further increase the pandemic risks.

The management of diseases like SARS, EBOLA or ZIKA have demonstrated that quick responses are key. Lack of preparedness in medical systems, inadequate healthcare staffing and missing resources highlight the additional challenges in addressing the spread of infectious diseases. Monitoring of the emergence and spread of new infectious diseases is particularly important since climate change may move the geographic range of some diseases globally.

If not contained, a local occurrence can quickly develop into a regional epidemic or global pandemic. This can lead to:

- increased mortality and healthcare costs

- a slowdown in economic output since travel and distribution may be curtailed to stop the outbreak

- in a severe case, a shrinking population translating into a shrinking GDP

The following areas of the (re)insurance industry could be affected:

- increasing mortality rates in Life & Health covers

- pandemic coverages for health insurers could be triggered

- impact on financial markets and asset prices through potential reduction in economic output

- shrinking population and (re)insurance markets.

The impact of the COVID-19 pandemic on the insurance industry started materialising soon after the first outbreaks, mostly related to the sudden halt of global economic activity due to strict lockdowns and the rise in mortality. Since the outbreak of the pandemic, we have learned a lot about what COVID-19 can do to people’s health, to economies and social systems, but many unknowns still remain. Emerging uncertainties become more pronounced the further out one projects into the future.

The pandemic has led/can potentially lead to:

- financial support keeping potentially unviable companies alive and distorting the market

- populations being impacted differently by the pandemic, leading to growing income and wealth inequalities

- long-term health impacts from COVID-19.

The business impact of COVID-19 could be:

- shrinking of (re)insurance markets through erosion of the middle class

- further claims resulting from the pandemic

- negative impact on investment results through higher defaults and lower equity valuations

- Further claims in Life & Health covers if long-term health consequences prove to be substantial.

Long-lasting power blackouts can be triggered by natural catastrophes (including solar storms), and intentional (cyber risk) or unintentional man-made events. Power blackouts become more likely when energy grids operate at capacity limits or are poorly maintained. Adding to the complexity and interdependency are alternative energy supplies and the digitised parts of a grid interacting with older installed infrastructure.

Power blackouts can lead to:

- property damage (e.g. flooding if pumps don’t work, fires if sprinklers don't function,

- mechanical damage if an electric engine loses power while moving objects, food wasting in storage etc.)

- business interruption in all areas from production and transportation to healthcare and the general services industries

- a disruption of financial markets which rely on power for communication

- a disruption of financial services operations in the affected regions because transactions are not possible

The following areas in the (re)insurance industry could be affected:

- property/specialty covers (e.g. property damage, business interruption, supply chain interruption).

- casualty covers (e.g. hospital which has been negligent in the maintenance of its emergency generators).

- Life & Health covers in extreme cases (e.g. water supply/sanitation plants not working anymore).

- financial insurance lines (e.g. credit risk if production is interrupted for a long time) and (re)insurance assets

- (re)insurance industry operations.

Regulatory attention regarding digitalisation in the financial industry is evolving. One concern is the application of adaptive self-learning algorithms. With advancements in AI/ML, we will in some cases lose our ability to control and understand the machine decision-making processes. Another worry is how liability regimes react to products and services using AI/ML, which could change the insurability of such products and services.

As algorithms become more ingrained in consumer services companies and (re)insurance industry operations:

- the risk exposure to algorithmically generated conclusions is accumulating

- the risk of unknowingly feeding and reinforcing biased and incorrect data into algorithmic processes is a reality

- the auditability of business processes may be challenged

This "black box" risk poses a potential impact:

- across all lines of business

- to strategic and business model considerations in the (re)insurance industry

- to regulatory scrutiny, which will increase the operational risk for the (re)insurance industry

Diverging liability regimes may:

- lead to unintended coverage because we are not aware of local standards

- expose the (re)insurance industry to more and new operational risks

- create new exposures, especially in liability

- put the (re)insurance industry in the position of being non-compliant in a given market.

Mental disorders fall into a broad spectrum of conditions, according to the World Health Organization (WHO). These include neurological disorders, substance use disorders, depression, anxiety, schizophrenia and bipolar disorder. WHO also prioritises epilepsy and dementia as neurological conditions that share common aspects with mental disorders in terms of provision of services. Suicide is an extreme but not uncommon outcome for people with untreated mental disorders. Mental disorders in children and adolescents are of concern because of their increasing high prevalence and the accompanying disabilities. First signs of increasing claims in the field already are materialising in the business. In 2012, untreated mental, neurological and substance use disorders accounted for 13% of the total global burden of disease, and research indicates that this number has since gone up.

Mental disorders need treatment, which is expensive. If untreated, they can contribute to:

- obesity

- cardiovascular diseases

- substance abuse with related negative side effects

- suicide

- burnout

- lower productivity

The following areas in the (re)insurance industry could be affected:

- health covers due to increased healthcare costs

- life covers if morbidity increases workers' compensation/employment liability covers in casualty in cases where work was a key contributor.

Survey methodology

The SONAR team surveyed 309 professionals at insurers and large corporations as well as experts in academia globally in fall 2020. Participants filled out an anonymous online questionnaire. More than two thirds of the respondents were experts at primary insurers, brokers, and reinsurers (Swiss Re employees were excluded from the survey). Not all areas that are affected are captured or enumerated. Risk areas vary from company to company.