In general, AM Best does not expect the introduction of IFRS 17 to have a direct impact on ratings. AM Best will continue to have an economic view of (re)insurers’ balance sheets to cater for different reporting standards across jurisdictions. Consistency, and comparability with financial metrics calculated under other existing reporting standards, will be a key objective when analysing (re)insurers that report under the IFRS 17 standard. Standardisation of key performance indicators (KPIs) might not emerge until two or three years after the effective date. The net/gross combined ratio usually results in bigger differences from existing ratios than the net/net ratio though it has conceptual advantages. AM Best envisages monitoring both ratios initially. AM Best will prioritise continuity in estimating net economic value due to long-term business using IFRS 17 data.

AM Best does not expect the introduction of IFRS 17 to have a direct impact on ratings in the normal course of events as AM Best targets the underlying economics of (re)insurers for analysis and that will not change. Nevertheless new insights can emerge over time and behavioural changes can occur which might affect ratings. Some of these insights may become attributable to IFRS 17.

As the 1 January 2023 IFRS 17 effective date moves into closer view, AM Best is preparing to use the new data. In this article, we discuss some of the KPIs we may use and some of the inputs to AM Best’s proprietary capital adequacy model (BCAR). AM Best anticipates that industry decisions on KPIs, along with other aspects of IFRS 17 implementation, will evolve. It may well take two or three years of experience after the effective date for practice to settle. The comments that follow therefore are offered in large part to inform debate, as well as to indicate AM Best’s current thinking as to the practice that we expect to adopt.

Combined ratios

IFRS 17 treats reinsurance held as a claims management exercise. Reinsurers do not typically bear expenses risk and, unlike now, reinsurance held will have no direct impact on an insurer’s reported other expenses, as reinsurance held commissions are not netted off against expenses under IFRS 17. Ceding commissions are instead netted off against reinsurance held premiums paid. Profit commissions are added to reinsurance recoveries.

Aside from the impact of ceded insurance commissions, AM Best’s expectation is that, for most non-life business, insurance revenue and reinsurance held expenses under IFRS 17 would normally be in the region of earned premiums and reinsurance premium expenses under current accounting.

For multi-year general measurement model (GMM) accounted non-life business, where reasonable earnings profiles for premiums are in place under existing accounting, the difference between insurance revenue and earned premiums will primarily arise from the effects of discounting.

AM Best sees three options for calculating net–of-reinsurance combined ratios:

- Option 1: Ask all IFRS 17 reporters for non-GAAP data on premiums, expenses and claims to re-create existing ratios.

- Option 2: Calculate existing ratios using IFRS 17 data, often referred to as “net/net” ratios. Here it should be recognised that net expenses are the same as gross expenses under IFRS 17, as reinsurance held commissions are no longer treated as a negative expense.

- Option 3: Incorporate IFRS 17’s treatment of reinsurance held as a claims management exercise, with no direct impact on expenses, into combined ratio calculations by using “net/gross” ratios. This means using claims after adding the net cost of reinsurance as the numerator of a combined ratio, and insurance revenue gross of reinsurance expenses as the denominator.

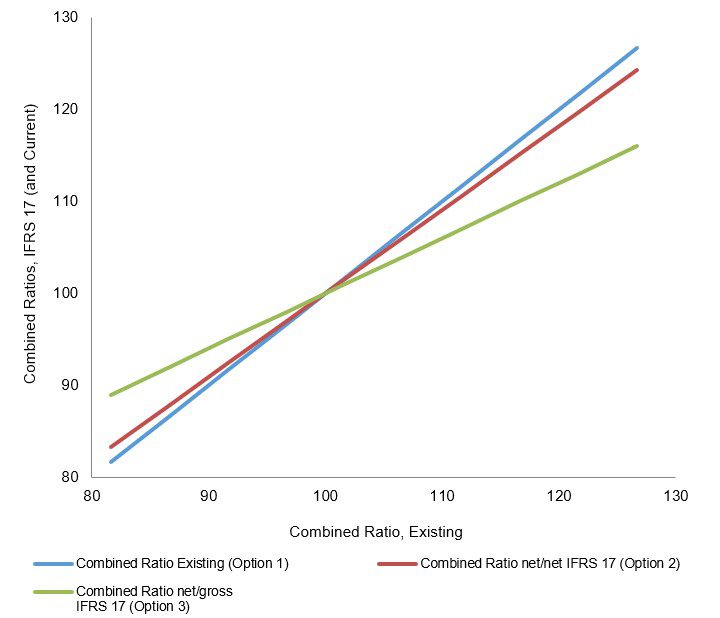

Illustrative comparison of IFRS 17 combined ratios with existing ratio

The graph is a simplified comparison of existing and new combined ratios for an insurer under the PAA with a 25% gross expense ratio and which reinsures using a 40% quota share treaty paying 15% ceding commission. The example does not allow for differences in contract boundary definitions between existing accounting and IFRS 17 or for differences due to discounting and other changes to reserve margins.

Source: AM Best data and research

The article is reproduced from a Best’s Special Report with the kind permission of ICMIF Supporting Member AM Best. To access a complimentary copy of the full report, please click here.

Published June 2022

Combined ratios – Analysis of options

The chart above shows a simplified comparison of existing (option 1) and new combined ratios for an insurer reporting under the premium allocation approach (PAA) with a 25% gross expense ratio which reinsures using a 40% quota share treaty paying 15% ceding commission.

Option 1 involves using quantities that are different from, or not part of, audited IFRS 17 financial statements. In addition to requiring premium numbers, the expenses and claims used in these ratios would usually be different due to the treatment of reinsurance commissions under IFRS 17. Furthermore contract boundary definitions vary between accounting standards. Clearly, option 1 has advantages on grounds of familiarity and comparability.

Under option 2 net-of-reinsurance revenue and expenses are both higher, by an equal amount, than those under option 1. The difference being reinsurance ceding commissions. Profit commissions increase expenses and reduce net-of-reinsurance claims compared with option 1, with no net effect on combined ratios. The effects of these changes should become more familiar when IFRS 17 accounts are published, especially if some insurers continue to provide combined ratios in the current format.

However, AM Best’s expectation on the basis of straightforward theoretical considerations is that option 2 would:

- Have little visible effect on an insurer’s ratios compared to those currently reported if ceding commissions are not significant compared with inwards premiums or gross expense

- Have little visible effect where combined ratios are in the region of 100% as increasing the numerator and denominator by the same amount has no effect on a 100% rati

- Normally reduce combined ratios that are over 100% when compared to current ratios and would increase ratios that are under 100%. The magnitude of the effect is usually of the order of 0-1 percentage poin

- The effect of ceding commission on net expense and claims ratios would be in opposite directions when the combined ratio is less than 100%. Expense ratios will increase and loss ratios will decrease. The impact on each of these ratios then is inevitably rather larger than their combined impact on a net combined ratio.

Other effects also might be anticipated using option 2. For example large profit commissions when the combined ratio is under 100% would accentuate the “expense ratio up and claims ratio down” effect while having no impact on combined ratios.

Cases with very low or high combined ratios, and/or when a high proportion of business is reinsured, and/or when ceding commission are an elevated percentage of reinsurance premiums paid, could provoke larger effects than shown in the previous chart.

Option 3 is, at least arguably, the pure way to incorporate IFRS 17’s treatment of reinsurance as a claims management exercise into the design of combined ratios. An advantage of option 3 is that, for any reinsurance held result, the ratios are unaffected by the chosen mix of reinsurance held commissions/premiums/claims recoveries that may result from reinsurance contract design, and the ratios therefore would usually be harder to manipulate than under other options.

Nevertheless, it may remain possible for reinsurance contract design to move profit between periods and between the insurance and investment results, though the latter is mitigated by discounting under IFRS 17. Option 3 amounts to adding reinsurance expenses to both the numerator and denominator of an option 2 combined ratio.

Expense ratios will usually be lower under option 3 than the net ratio under option 2. Claims ratios will be higher than the net ratios under option 2, unless the combined ratio is over 100%. The overall effect is usually to pull combined ratios towards 100%, more so as the amount of reinsurance increases and as the distance from a combined ratio of 100% increases.

Additionally, the effect of reinsurance on the combined ratio clearly becomes more transparent under option 3. Indeed ratios may be presented as a gross ratio plus the effect of reinsurance, with the latter being the reinsurance result divided by gross insurance revenue.

However, despite its advantages, option 3 is a more radical departure from current practice than option 2 and might cause more comparability difficulties.

Combined ratios - Which option will be used?

AM Best does not observe a wide consensus yet emerging on which option to use. The more limited conceptual departure from current practice in option 2, combined with the ease and reliability of using audited numbers from financial reporting and the limited changes to ratios that would normally occur, all favour the option. AM Best expects many insurers that have a peer group comprising predominantly non-IFRS 17 reporters to use option 2.

Option 1 may also be the route taken by some insurers, perhaps initially in combination with option 2. It is possible that option 1 will turn out to be a stepping-stone for some insurers and users while practice evolves and consensus forms over time.

Option 3 has some proponents and AM Best sees important advantages to the method. In particular, the ratios are invariant to the mix of reinsurance held commissions/premiums/claims that go into a reinsurance result, it provides transparency for the impact of reinsurance and it closely matches the structure of IFRS 17 reporting. It is possible that its use will expand over time.

It should be emphasised that all the options will be overlayed by the effect of discounting of claims. In general, discounting transfers profit from the investment result to the insurance services result. It will reduce claims ratios and combined ratios – more so for longer tail lines. Combined ratios will therefore become more comparable across business lines and between insurers.

AM Best expects to calculate both net/net (Option 2) and net/gross (Option 3) ratios. It is not the current intention to attempt to recreate the ratios as they would have been calculated were data from existing accounting standards available. However where companies provide their own estimates of such ratios AM Best will consider them as part of its analysis.

CSM, risk adjustment and the BCAR

The treatment of the Contractual Service Margin (CSM) under IFRS 17 reporting in solvency models will be a key part of the assessment of life insurance activities in the rating process.

AM Best makes adjustments to reported equity, when assessing available capital for the BCAR model, to allow for the net economic value due to long-term business in the life segment. Continuity with current practice will be important to the path taken by AM Best when using IFRS 17 for this purpose.

AM Best’s current practice is that capital credit added to reported equity for net economic value due to long-term business would not normally exceed 50% of a measure representing this economic value. The haircut reflects volatility of this slice of economic value, including sensitivity to assumption changes, and fungibility constraints.

It has been AM Best’s normal practice when using existing value-oriented reporting formats (for example Solvency II reporting) that reserves for risk are aggregated into the estimate of net economic value due to long-term business before a haircut is applied.

AM Best proposes to continue the same practice when using IFRS 17 data. On this basis, the IFRS 17 risk adjustment will be aggregated with the CSM as a measure of economic value due to long-term business in the life segment before applying a haircut. Continuing existing practice also means that no adjustment is made in respect of economic value due to long-term business in the non-life segment.

An advantage of aggregating the CSM and risk adjustment is that many of the estimates involved in applying IFRS 17 are ultimately concerned with drawing a line between the CSM and the risk adjustment. The sum of the two represents, at inception of a contract, simply the difference between premiums and a best estimate of claims and other cash flows. In the universe of insurance reporting this sum has to be one of the more solid quantities.

Use of an aggregation of the CSM and the risk adjustment nevertheless is consistent with AM Best’s view that the risk adjustment has a strong conceptual basis, which includes its role in ensuring profit is taken as risk runs off.

The “dual look” provided by IFRS 17 of both an earned basis income statement and a balance sheet that may be interpreted in a more value-oriented fashion is one of the standard’s strengths. Even so, it is possible to envisage a range of quantities for the risk adjustment on which preparers and their auditors might reach agreement, given that IFRS 17 is far from prescriptive on the calculation. Aggregating the CSM and risk adjustment for the net economic value due to long-term business mitigates uncertainty from discretion around the CSM/risk adjustment mix.

There will be differences between available capital (before economic value due to long-term business) under current accounting, and that under IFRS 17.

In some cases profit may be taken earlier under current accounting. In other cases profit may be taken earlier under IFRS 17. UK annuities might be an example of the former, due primarily to the discount rates used under IFRS 4, while participating life policies are expected to provide examples of the latter.

Meanwhile, products not classified as insurance under IFRS 17 will not generate a CSM whereas they may contribute to own funds under, for example, Solvency II. Wide variations across reporting under IFRS 4 in different territories, local GAAPs and regulatory reporting will contribute to the likely diversity of comparisons between equity under current reporting and that under IFRS 17.

These differences will give rise to a new mix of components of value that attract 100% credit, an assessed amount (say 50% credit) as net economic value due to long-term business, and 0% credit within available capital in the BCAR model.

AM Best views the use of audited amounts from primary financial statements prepared under IFRS 17 for a measure of net economic value due to long-term business as an improvement in transparency and reliability for the quantitative aspects of credit rating analysis.

AM Best is currently intending to continue its existing practice of haircutting a measure of economic value rather than applying a capital charge. In principle the two are arithmetical alternatives that might produce similar BCAR scores.

AM Best expects a new synthesis to emerge in the rating process of quantitative input from the BCAR model, quantitative input from elsewhere, and qualitative considerations for insurers that report under IFRS 17.

Non-life reserves in the BCAR model

Non-life outstanding claims reserves in the BCAR model will correspond to the liability for incurred claims (LIC) under IFRS 17. However, the required capital factors in the model are appropriate to undiscounted reserves so AM Best will be looking to ensure that rated companies complete the existing supplementary questionnaire, which asks for discounted and undiscounted reserves by line of business, with the discounted reserves corresponding to the LIC under IFRS 17.

Deferred acquisition costs

The treatment of deferred acquisition costs in IFRS 17 is a considerable departure from most current practices. The deferred acquisition costs that most users of insurers’ primary financial statements are familiar with—in other words costs to be amortised against the profit from in-force business (in-force DAC)—does not appear in an IFRS 17 balance sheet and may be viewed as netted off against the liability for remaining coverage (LRC).

The amount captioned as deferred acquisition costs under IFRS 17 (IFRS 17 DAC) will be costs that are to be amortised against contracts written in the future. For most insurers this would, if the caption is used, be a new asset/negative liability.

IFRS 17 DAC is transferred to in-force DAC as it becomes due for amortisation. IFRS 17 DAC also will be netted off against the LRC but the standard requires the balance sheet amount to be disclosed.

The standard does not require disclosure of the remaining balance of in-force DAC, though a record of the amount will need to be maintained for other purposes and AM Best expects that it normally will be disclosed in notes to accounts, or will otherwise be available.

AM Best is expecting to ask rated clients for the unamortised amount of in-force DAC and to set inputs to the BCAR model so that continuity is maintained. AM Best is not currently expecting IFRS 17 DAC to normally be part of available capital in the BCAR model.

Operating ratio for life segment

Under IFRS 17, premiums generate insurance service revenue over future periods to better match revenue with the claims that the premiums fund. AM Best envisages that revenue ratios will therefore become more meaningful indicators of performance. An operating ratio using the insurance and investment result for the life segment as the numerator and life segment insurance service revenue as the denominator is likely to be of interest.

Return on equity

AM Best expects return on equity (RoE) calculated using IFRS data to be a key indicator of performance. It will be possible to calculate (at least) two versions of RoE. One can be derived using profit and equity as reported. A second possibility, where there is significant business reported under the GMM, will be to use equity plus CSM as a denominator, along with a numerator on a consistent basis. For each option there will also be the usual alternative of using a normalised investment return.

Using profit as reported for life insurance business will have the advantage of greater stability as the CSM is fed into profit. A level RoE over the term of policies would equal an achieved internal rate of return (IRR) on capital retained in the insurer. This would enable RoEs to more closely serve their normal purpose of indicating the (levered) return on funds invested. Up until now RoEs in the life insurance sector have usually suffered from a weak relationship to IRRs, which has severely diminished their usefulness as an indicator of returns. Indeed (estimated) IRRs on new business are deliberately presented as an additional data point.

A separate RoE, calculated including the CSM in the denominator (and with a consistent numerator) will provide a measure that could form a bridge from RoEs for existing value oriented reporting formats (eg Solvency II) to the IFRS 17 world. AM Best expects to monitor these and other RoE measures. Consensus on RoE measures under IFRS 17 will most likely develop over time with some diversity in the calculations, as now, persisting. However AM Best will pay due attention to the new RoEs based on IFRS 17 profit, which are anticipated to become a particularly welcome addition to the KPI roster for life insurance business.

Financial leverage

Changes to equity on applying IFRS 17 will result in a degree of discontinuity in leverage ratios. AM Best attaches value to transparency in the derivation of leverage ratios and also will prioritise continuity in the derivation of the ratios.

It is normal across sectors of economic activity that leverage ratios vary, often considerably, depending on the nature of the activity and particular products, and different leverage ratios may be associated with similar debt service abilities.

The ability to service financial obligations over time is a function of an organisation’s current capitalisation and capacity to generate earnings. AM Best considers leverage and guideline tolerances together with coverage ratios whilst also allowing for income that might arise in accumulated other comprehensive income (AOCI) on a continuing basis. Additionally, the expected progression over time of these ratios is reviewed. A new mix of the various factors that are considered to assess financial leverage is likely to evolve.