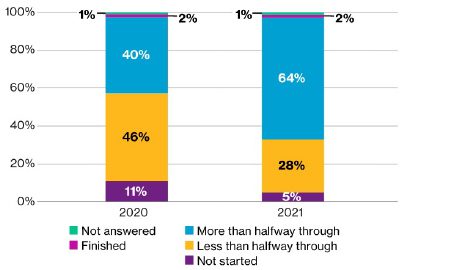

IFRS 17 is not just a new way of presenting insurance industry financials, its fundamentally a process transformation programme. According to a worldwide survey by Willis Towers Watson, the total cost faced by the global insurance industry to implement IFRS 17 is estimated to be USD 15 billion to 20 billion. Nearly two thirds (64%) of respondents reported they are more than halfway through IFRS 17 implementation, with significant progress having been made since 2020.

IFRS 17 has been in the works for over 20 years. After a number of iterations, and wide discussions with various stakeholders, the final standard was published in the summer of 2020, effective for annual reporting periods beginning 1 January 2023. In reality though the transition date is 1 January 2022, since one year of comparatives are required. This one year of comparatives is the minimum, and some insurers are doing two years of comparatives.

Keeping up to speed and preparing for IFRS 17 has already been a long and winding road for insurers. Willis Towers Watson’s comprehensive global survey on IFRS 17 programmes – encompassing 312 responses from 50 countries – has shown where insurers are making progress and experiencing most difficulties in preparing for the new international accounting standard.

Similarly to our inaugural survey conducted in July 2020, our ambition for this year’s survey was to add to the knowledge we’ve accumulated from those projects and provide the most comprehensive snapshot in the market of the insurance industry’s readiness for IFRS 17 as the months countdown to implementation in January 2023.

Carried out in April/May 2021, and with over 300 responses from insurers in over 50 countries, this article summarises some of the key findings and our views on how insurers can address the issues they highlight.

Perhaps the most surprising overall trend of the survey is that despite the greater progress made by the industry as a whole since our last survey in June/July 2020 many of those companies that previously reported being further ahead with their plans now say they are encountering wider difficulties with their implementation. This supports the idea that ‘the more you know, the less you know’, or in other words, it’s only when insurers really get into the details of the standard and how they translate into future business as usual (BAU) that all the potential issues come to light.

Looking then at some of the specifics examined in the survey:

Programme cost

Estimated costs vary significantly by insurer size, with the average programme cost for the 24 largest multinationals being USD 175 million to USD 200 million each, and USD 20 million each for the remaining 288 insurers.

Extrapolating these figures, our estimate is that IFRS 17 delivery will cost the global insurance industry between USD 15 billion and USD 20 billion.

With so many ‘moving parts’ because of multiple interconnected work streams, such as data, methodology, operating model, systems and disclosures, there is no escaping that IFRS 17 implementation is complex and costly. Nonetheless, we believe there are several ways to keep costs from ballooning out of control:

- Investment in appropriate IT systems and tools, including targeted automation, is a time and cost saver.

- Intermittently take a step back from the programme to verify efficiency and that it is offering gains to the business.

- ‘Learn quickly, fail fast’ – be adaptable; try and test new approaches quickly.

Programme resourcing

Insurers have reported a lack of sufficient qualified people to deliver IFRS 17 as a constant challenge throughout the various stages of development of the standard. That’s still the case now, with respondents to our survey citing it as their biggest concern over the next 12 months.

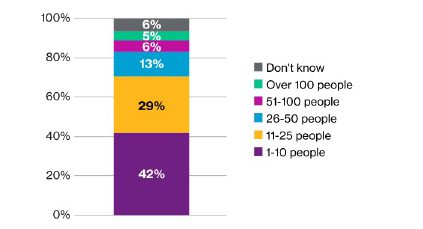

Numerically, insurers, both large and smaller, expect IFRS 17 to require many internal and external ‘hands on deck’ throughout the rest of 2021 and 2022 (see below). All told, we estimate that between 10,000 and 15,000 full-time equivalent people will be required on IFRS 17 projects over that period.

Average number of people insurers expect to be needed in IFRS 17 implementation during 2021 and 2022

This article was written by Rosa Salas, Life Director, Iberia, Simon Kazmierowski, Non-Life Director, Germany, and Kamran Foroughi, Senior Director, Insurance Consulting and Technology, Willis Towers Watson.

The article is reproduced with the kind permission of ICMIF Supporting Member Willis Re.

To a large degree, the principal challenge is having the right people doing the right things at the right time. Approaches that can increase the chances of that happening include:

- A key goal for employing technology (i.e. automation) in IFRS 17 implementation should be to enable insurers to release people to focus on value adding activities.

- IFRS 17 redefines the relationship and responsibilities of actuaries and accountants in insurance company reporting. It’s a one-time opportunity to break down siloes that could hinder productivity longer term.

- Accept that not all milestones will be achieved in time for implementation. Prioritise the most important and revisit workarounds later.

Programme progress

Nearly two thirds (64%) of respondents reported they are more than halfway through IFRS 17 implementation, with significant progress having been made since 2020.

Current status of IFRS 17 implementation

In 2020, 11% had not started, 46% was less than halfway through, 40% was more than halfway through, 2% were finished and 1% didn't answer this question. In 2021, 5% had not started, 28% was less than halfway through, 64% was more than halfway through, 2% were finished and 1% didn't answer this question.

Taking the industry as a whole, a reasonable stake in the ground seems to be that insurers are halfway through preparations for IFRS 17.

Beyond the previously mentioned lack of qualified resources (15% of participants said this was the biggest challenge to be IFRS 17 compliant), the other principal hurdles that insurers say they need to overcome in the next 12 months are issues with IT, systems and tools (12%) and working through their IFRS 17 methodology (10%).

Once insurers have understood the IFRS 17 technical specifications and different reporting approaches, some broad process and methodology traits should, in our experience, support continued progress towards implementation and ultimately wider business efficiency:

- Avoid linear execution: actuaries need to produce the actuarial assumptions and cashflows, accountants are looking at the financials and management information. Rather than work left to right, aim to work from both sides and meet in the middle.

- Be flexible – take note of the previously mentioned ‘learn quickly, fail fast’ principle. We have noted a tendency for methodology discussions to go round in circles, but it’s far more productive to draw a line under them and start building the process while still developing the methodology.

- The way insurers go about meeting the data and granularity requirements of IFRS 17 is an opportunity for the business as a whole.

IFRS 17 metrics

An area investigated in the survey was the degree to which insurers think IFRS 17 will be a useful metric for investors. Interestingly, only 52% believe it’s likely to be more or much more helpful than equivalent GAAP reporting. Furthermore, 54% of respondents say they expect to see an increase in supplementary reporting as a result of IFRS 17.

The key thing, as we see it, is to keep in mind the purpose of IFRS 17 – to make insurance financial statements more understandable and consistent for a wider range of investors.

Questions for insurers to ask themselves therefore will include:

- Will IFRS 17 disclosures meet a company’s defined objectives and to what extent will supplementary reporting be required to fill any perceived gaps? For example, some companies have raised concerns about how operating profit is depicted under the standard.

- Will we have the agility to be able to conduct quick investigations of numbers as engagement with investors, reporting authorities and rating agencies on IFRS 17 develops?

- What is non-negotiable in relation to key performance indicators? What is nice to have? Are we taking the opportunity to hit the ‘reset’ button on how we present ourselves to the outside world?

Eye on the prize

The survey provides an enlightening snapshot of where the global insurance industry is with its preparations for IFRS 17. Plenty remains to be done for certain, notably in the Asia Pacific region, but the progress made over the last year in particular should also be applauded.

The implementation date of January 2023 will, however, be upon us before we know it. Importantly, this is as much a start point as a finish line. By that we mean, specifically, how will preparing IFRS 17 disclosures become part of BAU and, just as importantly, how can the need to do so be turned into a business benefit?

To date, these are questions that, in our experience, very few companies are contemplating as they focus on getting the numbers right. But they are not questions to be left until after implementation we would suggest.

For insurers, IFRS 17 is not just a new way of presenting insurance industry financials. It’s fundamentally a process transformation programme; one which, with astute planning, can offer broader business process improvements – through more intelligent use of people, better data flows, more flexible and interconnected systems, efficiency and improved governance through use of automation and a greater depth of management information.

Those insurers that can keep their eye on these kinds of prizes should benefit the most both in terms of how their IFRS 17 financials support better investor relationships and what they get out of it as a business in the process.