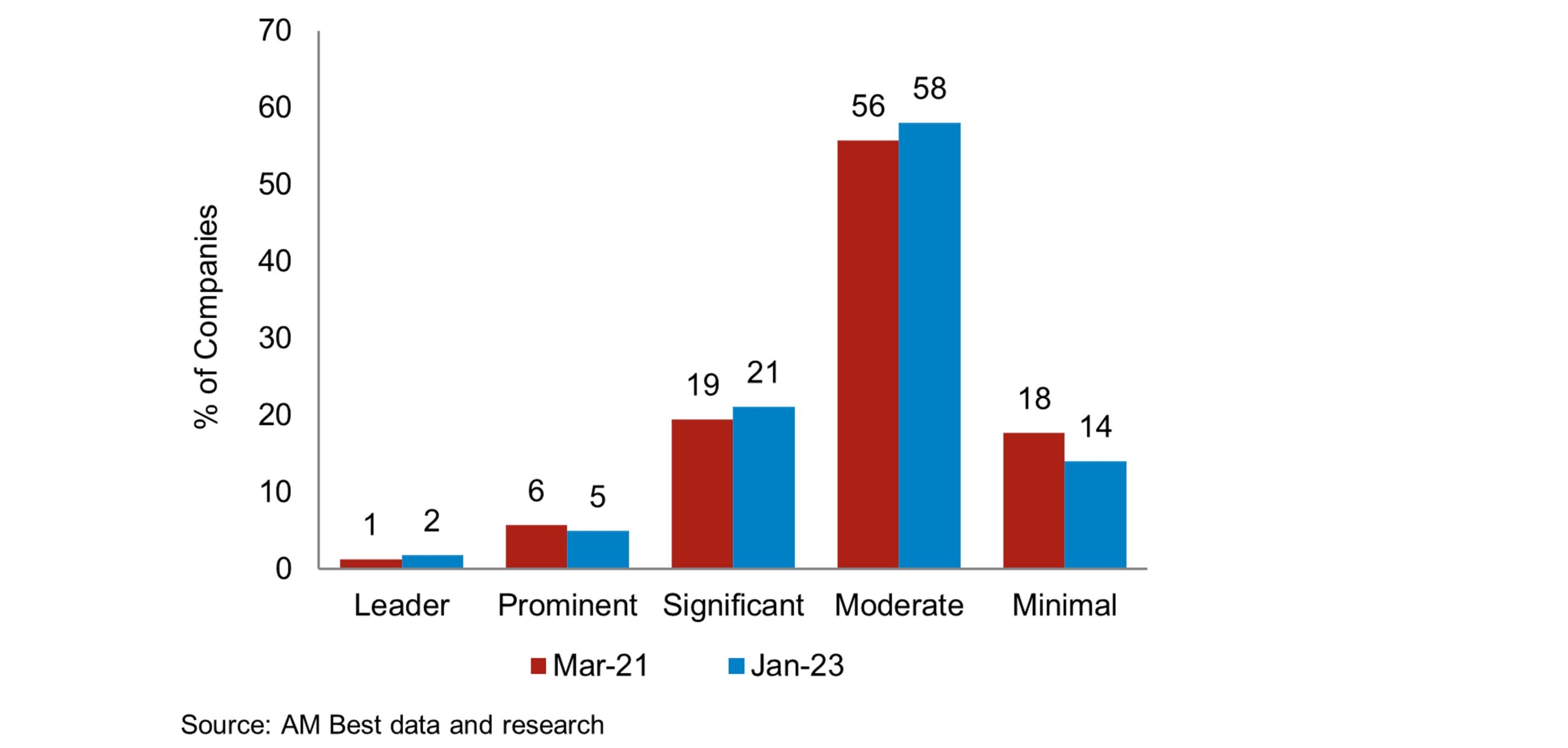

Although AM Best’s innovation capability assessments continue to skew towards lower profiles, some companies have demonstrably improved since the initial assessment cycle, resulting in a marginal shift. More companies are placing high importance on data quality to improve efficiency and profitability, and leadership teams understand that system and IT infrastructure upgrades are critical to achieving these goals. The pandemic has helped leadership to better view the links between their innovation efforts and overall strategic objectives, and develop a more comprehensive yet focused innovation strategy.

In March 2020, AM Best released its Scoring and Assessing Innovation criteria. Immediately after, the world was transformed by COVID-19. The pandemic altered the way people live and work, and spurred immense changes and innovation throughout the insurance industry. Challenges due to the pandemic continued in 2021, and persistently low yields and stagnant growth contributed to industry pressures. Inflationary pressures and rising interest rates were prominent in 2022, for the first time since the turn of the century. Technological change continues to alter consumer behavior, transforming the insurance landscape across product lines. These trends have created challenges and opportunities for insurers, accelerating the need for innovation and rewarding the most innovative insurers.

In response to the evolving risk environment, insurers accelerated their shift to digital technology and intensified their focus on product innovation and policy language modifications. Although our innovation capability assessments again skewed towards lower profiles as of year-end 2022, some companies have demonstrably improved since their initial assessments in March 2021, resulting in a marginal shift (see chart below).

Innovation input overview

Leadership: Guiding the way through change

COVID-19 and the continued transition to a new operating environment has tested companies on each innovation assessment component. Leadership, the first of four input components, already had the smallest percentage of 1s and largest percentage of 4s compared with Culture, Resources, and Process & Structure. (Scores range from 1 to 4, with 4 being the highest score possible). This was true though 2022, with a slight shift towards higher scores. The focus on and importance of innovation starts at the top, and we have observed more actions guided by clearer vision, such as more companies creating chief innovation officer positions, more frequent discussions at board meetings, and a greater emphasis on innovation throughout an organization.

Culture: Change continues

For many companies, developing an innovative culture has been an ongoing challenge, but a persistent leadership focus and employees transitioning through this environment first-hand have bolstered the innovative cultural shift. Insurance industry culture is normally conservative by design, providing a means to support risk management and mitigation, but the pandemic upended the industry’s methodically slower pace, as insurers needed to act swiftly and decisively to adapt to the rapidly changing environment. There has more active promotion of innovation throughout organizations, though some companies are better able to back that up with quantifiable evidence. Additionally, some companies are placing greater emphasis on technological and innovative skills for new hires, helping to embed innovative culture.

Resources: Systems and technology are key

With the pandemic forcing so many technological changes, many companies had to find resources to continue to compete. As a result, the innovation resources score distribution has improved, especially for those that had the lowest score of 1 in March 2021. Systems and technology improvements have helped drive the more favorable scores, although budgets and personnel resources have also grown. More companies are focusing on data quality to help improve efficiency and profitability, and leadership teams understand that system and IT infrastructure upgrades are critical to achieving these goals. Additionally, more companies are implementing training sessions to improve knowledge, as well as investing in or partnering with technology, fintech, and insurtech startups to boost existing business and launch new businesses. Other companies have engaged external consultants to upgrade risk management systems, extending key risk indicators in areas of underwriting, credit, reputation, operations, and liquidity.

Processes and structure: Innovation still an ad hoc endeavor

The vast majority of companies still lack a replicable innovation process, as more than three quarters of companies scored at the lower end of the scale, with the largest percentage of 1s compared to the other input components. However, there has been improvement. The pandemic further highlighted seamless, well-planned innovation processes and structures on the one hand, and disjointed innovation efforts on the other. Leadership at more companies was able to better view the links between their innovation strategies and strategic objectives and develop a more comprehensive yet focused innovation strategy. Many companies view data governance and management as an integral part of their strategy, as they focus on the flow and quality of data to bolster profitability.

The article is reproduced from a Best’s Special Report with the kind permission of ICMIF Supporting Member AM Best. To access a copy of the full report, please click here.

Published May 2023

Innovation output overview

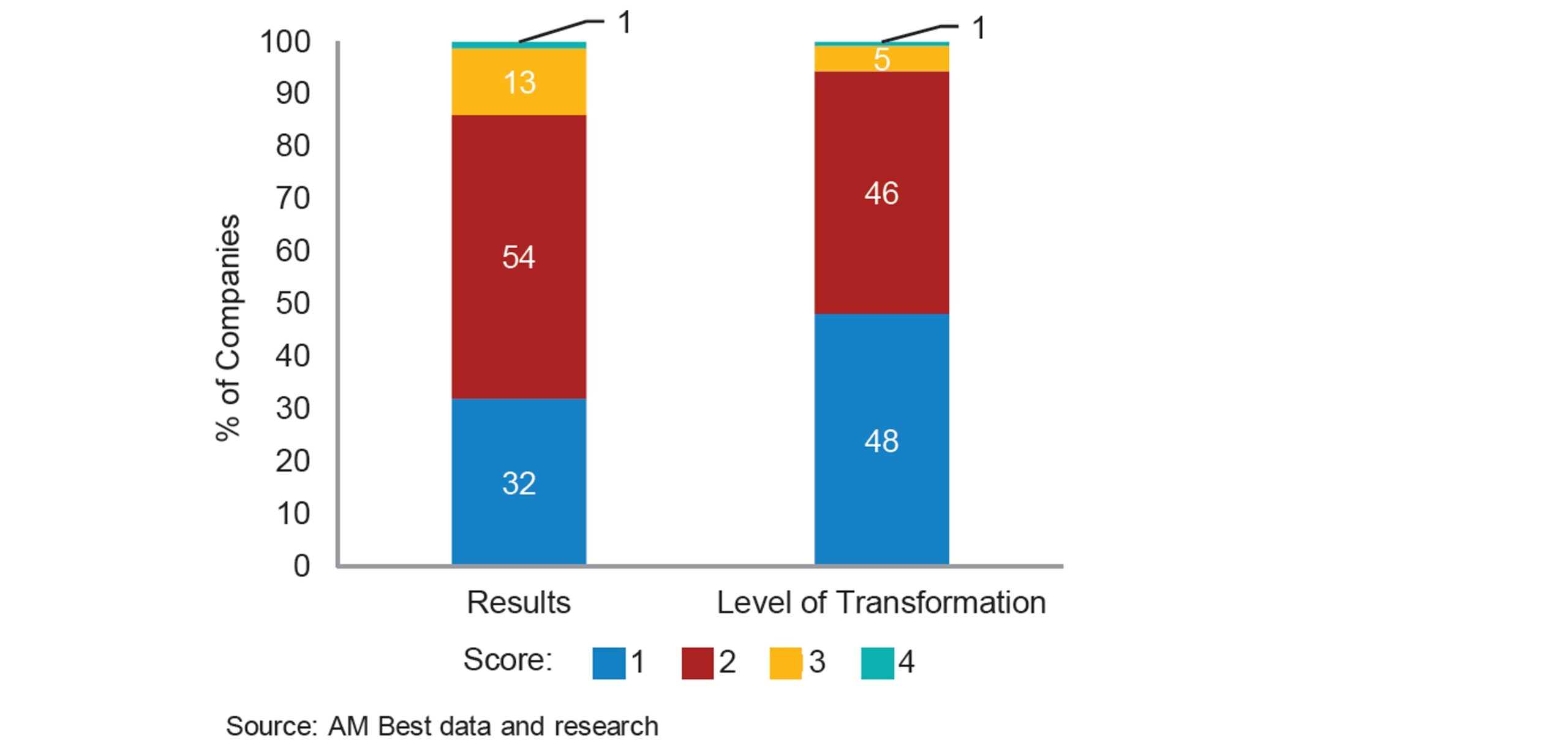

Results

Despite the improvements, most companies continue to score at the lower end of innovation output. More favorable assessments are seen in the Results subcomponent, as 14% of companies score 3 or 4, while only 6% score 3 or 4 on Level of Transformation, the other output subcomponent (see chart below).

Ultimately, innovation must lead to measurable results that make the investment of resources worthwhile. Companies that had invested significantly in innovation infrastructure before the pandemic were a leg up in resources and improved capabilities. Innovation initiatives have accelerated, but whether they will result in sustainable results over the long term remains to be seen.

Level of transformation

In Level of Transformation, less than 1% of organizations earned the highest score of 4, while just 5% earned a 3. Only companies with best-in-class output receive higher transformation scores. Transformative initiatives are those that create value, improve customer engagement and experience, lead to superior business models, or significantly enhance growth opportunities, and are comparable to leaders in other industries. As such, most companies scored at the lower end of this category.

The pandemic added numerous obstacles to overcome, but it also created tremendous opportunities. The more innovative insurers are in a position to leverage their new and existing capabilities and capitalize on offering solutions to organizations that haven’t yet significantly advanced their innovation capabilities.