Developing an innovative culture among insurers has been an ongoing challenge, but COVID-19 upended the industry’s methodically slower pace, causing insurers to act swiftly to adapt to the rapidly changing environment. However, despite the gains in creating a more-innovative culture, most companies still score at the lower end on their innovation output scores, in large part highlighting the obstacles created by the pandemic.

In March 2020, AM Best released its Scoring and Assessing Innovation methodology. Immediately after, the world was transformed by COVID-19. The pandemic altered the way people live and work, and spurred immense changes and innovation throughout the insurance industry. In response to the evolving risk environment, insurers accelerated their shift to digital technology and intensified their focus on product innovation and policy language modifications.

Although technological improvements to underwriting, sales, and other processes had already been under way for a number of insurers, the more basic operational infrastructure supporting remote working capabilities moved to the forefront of the challenges they faced. Virtually overnight, businesses shifted to a remote-based environment to stem the spread of the virus. Information technology departments faced new challenges with the vast majority of employees working offsite. There was no time to ease into these transitions; a pandemic demanded that operations shift without delay.

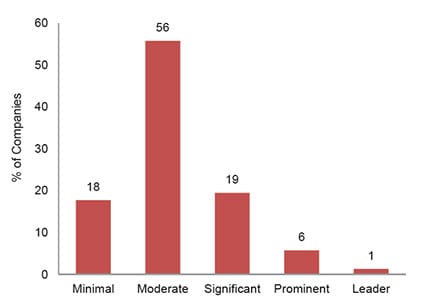

As insurers continue to navigate this new environment, AM Best’s innovation capability assessments skew toward lower profiles. As of 8 March 2021, overall results aligned closely with preliminary assessments following our innovation criteria release, as over half our rating units scored Moderate, versus 19% for Significant, 18% for Minimal, 6% for Prominent, and 1% for Leader (see below).

Source: AM Best data and research

The article is reproduced from a Best’s Special Report with the kind permission of ICMIF Supporting Member AM Best. To access a copy of the full report, please click here. Further individual reports that look at the one-year benchmarking analysis of AM Best-rated companies’ innovation assessments can be accessed here.

Innovation input overview: Leadership, culture, resources, processes and structure

Leadership: Leading the way through crisis

Over the last year, COVID-19 has tested each of the innovation assessment input components. The first of the four components, “Leadership”, remains ahead of the curve in scoring. Leadership had the smallest percentage of 1s and the largest percentage of 4s, compared with “Culture”, “Resources”, and “Processes and Structure” (Scores range from 1 to 4, with 4 being the highest score possible).

Although overall industry scores are still mostly concentrated at the lower end, management teams have largely recognized that innovation is a critical aspect of an organisation’s operations.

Executive and management teams had been considering and gradually digitizing long before the pandemic, but COVID-19 forced insurers to rethink their business and operating models, and accelerated the pace at which they have had to make the shift to digital technology.

The transition to a remote working environment presented management and employees with new communication obstacles. Management may encourage innovation, but reaching all of an organisation’s levels is still a challenge. Major disruptive moments for the insurance industry tend to result in learning opportunities. We saw this in the aftermath of the September 11 terror attacks, Hurricane Katrina in 2005, and now the pandemic.

Culture: Driving cultural change in a remote working environment

For many companies, developing an innovative culture has been an ongoing challenge. Insurance industry culture is normally conservative by design, providing a means to support risk management and mitigation. More than most industries, insurance is subject to shock losses that, owing to poorly developed products or badly handled claims, can quickly result in financial weakness—even insolvency. These risks result in a conservative culture that evaluates new initiatives sceptically, from the drawing board to the final result. But COVID-19 upended the industry’s methodically slower pace, as insurers needed to act swiftly and decisively to adapt to the rapidly changing environment.

For example, just weeks into the pandemic, Nationwide Insurance successfully pivoted to a work-from-home environment for 98% of its employees. Such transitions were necessary across the industry, but the question became how companies with a weaker innovation culture heading into this new remote environment would handle the transition.

According to a July 2020 Accenture survey of insurance human resources officers, 88% of respondents cited high workforce engagement during the pandemic, suggesting that insurers are making significant progress. This correlates with our assessment, where we have found more companies improving communication as it relates to innovation during the pandemic than prior to it, when we conducted our preliminary assessments.

Resources: Systems and technology are key

The impact of the pandemic on the volume of claims has varied by line of business, so some companies have felt more of a resource pinch than others. Some companies were forced to accelerate technology innovation—no small task during a crisis that has challenged every facet of insurance operations.

Insurers have been focused on improving legacy systems for a long time. Many insurers have already modernised systems due to need, while many others have seized this opportunity to partner with insurtechs or create internal initiatives to leverage emerging technologies, as well as to acquire more advanced capabilities.

The pandemic has accelerated these efforts, requiring improvements in other areas such as customer engagement. Furthermore, the unprecedented growth of remote workforces, along with more data and applications moving outside the traditional security perimeter, have placed greater emphasis on cyber security. According to a Six Paths Consulting study, 85% of respondents anticipate that COVID-19 will have a lasting impact on their customers’ needs and wants, but only 21% believe they have the expertise, resources, and commitment to successfully pursue new growth.

Processes and structure: Innovation still an ad hoc endeavour

The pandemic has had a profound impact on insurers by further spotlighting seamless, well-planned innovation processes and structures on the one hand or disjointed innovation efforts on the other hand.

The vast majority of companies lacked a replicable innovation process, as more than three quarters of companies scored in the bottom half, with the largest percentage of 1s compared to the other input components.

Most companies have formulated innovative initiatives ad hoc, which has diminished their ability to replicate other initiatives. The lower scores suggest the industry has generally been more reactive when it comes to major operational changes.

Data governance, management, and use have gained a greater focus, and more companies are taking steps to address those elements. Organisations have widened their focus to transition many operational functions, to adapt to the new remote environment. A multi-pronged approach became necessary, with the pandemic propelling the need to digitize quoting and submissions processes, integrate agents and brokers on the sales side, and accelerate existing trends for seamless straight-through processing on the claims side.

Innovation output overview: Results and level of transformation

Results

Most companies score at the lower end of the innovation output scores. More favourable assessments are seen in the “Results” subcomponent, as 13% of companies score 3 or 4, while only 7% score 3 or 4 on the other output subcomponent—"Level of Transformation”.

Ultimately, innovation must lead to measurable results that make the investment of resources worthwhile. Companies that had invested significantly in innovation infrastructure before the pandemic were a leg up in areas where they had already focused resources and improved capabilities. Innovation initiatives have been accelerated, but whether they will result in sustainable results over the long term remains to be seen.

Level of Transformation

Output scores for the Level of Transformation are even less favourable than that of “Results”; less than 1% of organisations earned the highest score of 4, while just 6% earned a 3. Only those companies with best-in-class output receive higher transformation scores.

Transformative initiatives are those that create value, improve customer engagement and experience, lead to superior business models, or significantly enhance growth opportunities, and are comparable to leaders in other industries. As such, most companies scored at the lower end of this category.

The pandemic has provided numerous obstacles to overcome, but it also has created the greatest potential for opportunities. The more innovative insurers are in a position to leverage their new, as well as existing, capabilities and capitalise on offering solutions to other organisations that have not yet been able to advance their innovation capabilities in a significant way.