Two ICMIF members from Denmark have received national acclaim for their outstanding reputations. “danmark” health insurance and LB Insurance were ranked number one and two respectively, in terms of having the best image among financial companies in Denmark according to a recent independent survey. Seventy of the largest financial companies in Denmark were analysed, based on answers from […]

Read MoreICMIF members have achieved an aggregated growth of 39.3% (compared to global market growth of 16.8%) during the last ten years, according to the ICMIF Members: Key Statistics 2018 report. ICMIF has published an updated version of its ICMIF Members: Key Statistics report for 2018. The 2018 edition of the report provides a comprehensive overview […]

Read MoreThe insurance industry has historically often been accused of being “stale, male and pale”; dominated by older, white men with speaker line-ups for insurance conferences and events in particular often very typical of this stereotype. The International Cooperative and Mutual Insurance Federation (ICMIF) has, however, worked hard for many years to offer an alternative to […]

Read MoreSri-Lankan member of ICMIF, Amãna Takaful, received multiple honours at the prestigious Islamic Finance Forum of South Asia (IFFSA) Awards, held recently in Colombo. Amãna Takaful PLC (ATL) won the ‘Gold’ award for the ‘Takaful Entity of the Year’ category, while its off-shore subsidiary in the Maldives, Amana Takaful Maldives, won the ‘Silver’ award in […]

Read MoreThe 2018 edition is now available with new focus on the United Nations Sustainable Development Goals The International Cooperative Alliance (ICA) and the European Research Institute on Cooperative and Social Enterprises (Euricse), published the seventh annual World Cooperative Monitor last week during the ICA’s V Summit of the Cooperatives which took place in Buenos Aires (Argentina). […]

Read MoreUS ICMIF member Securian Financial is a “Top Company for Women Technologists” according to AnitaB.org, a nonprofit social enterprise committed to increasing the representation of women technologists in the global workforce. AnitaB.org recognized Securian Financial and 79 other companies recently as part of the nonprofit’s annual program identifying key national trends on women working in technology. First launched […]

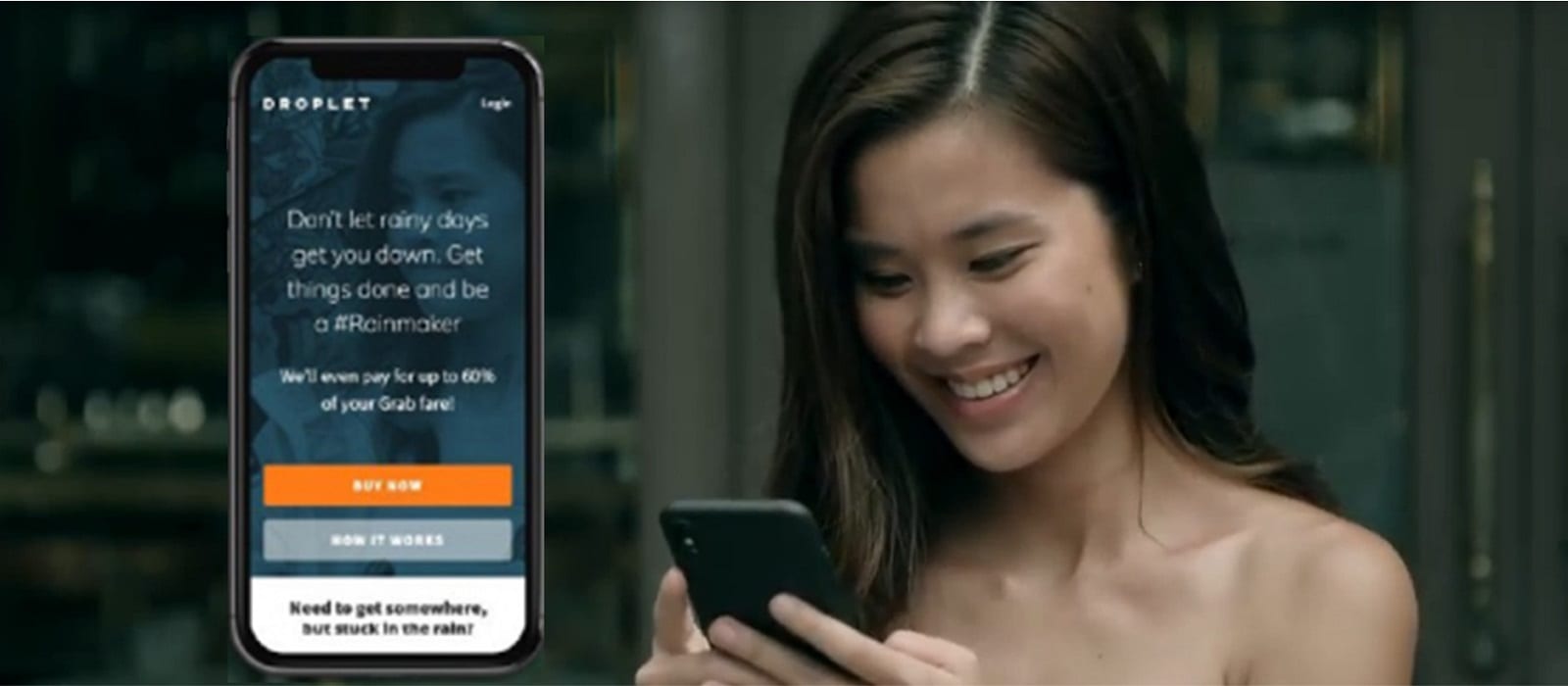

Read MoreSingapore-based ICMIF member NTUC Income (Income) has this week launched Droplet, a lifestyle-inspired insurance by Digital Income, the organisation’s in-house Digital Transformation Office (DTO). Income says that Droplet is a blue-sky response to consumers’ pain-point – surge pricing due to rain – when they book a ride on ride-hailing platforms. In Singapore, an average of 167 days of rainfall can […]

Read MoreA number of major participants in the (re)insurance industry are becoming actively involved with regards to shaping the environmental, social and governance (ESG) agenda – given their unique role as risk managers, institutional investors, and risk carriers on behalf of a wide range of industries. They also face critical risks and opportunities associated with climate-change […]

Read More