US ICMIF member Securian Financial has launched a customer focused decision-support experience to educate employees about the voluntary benefits the insurer offers through employers.

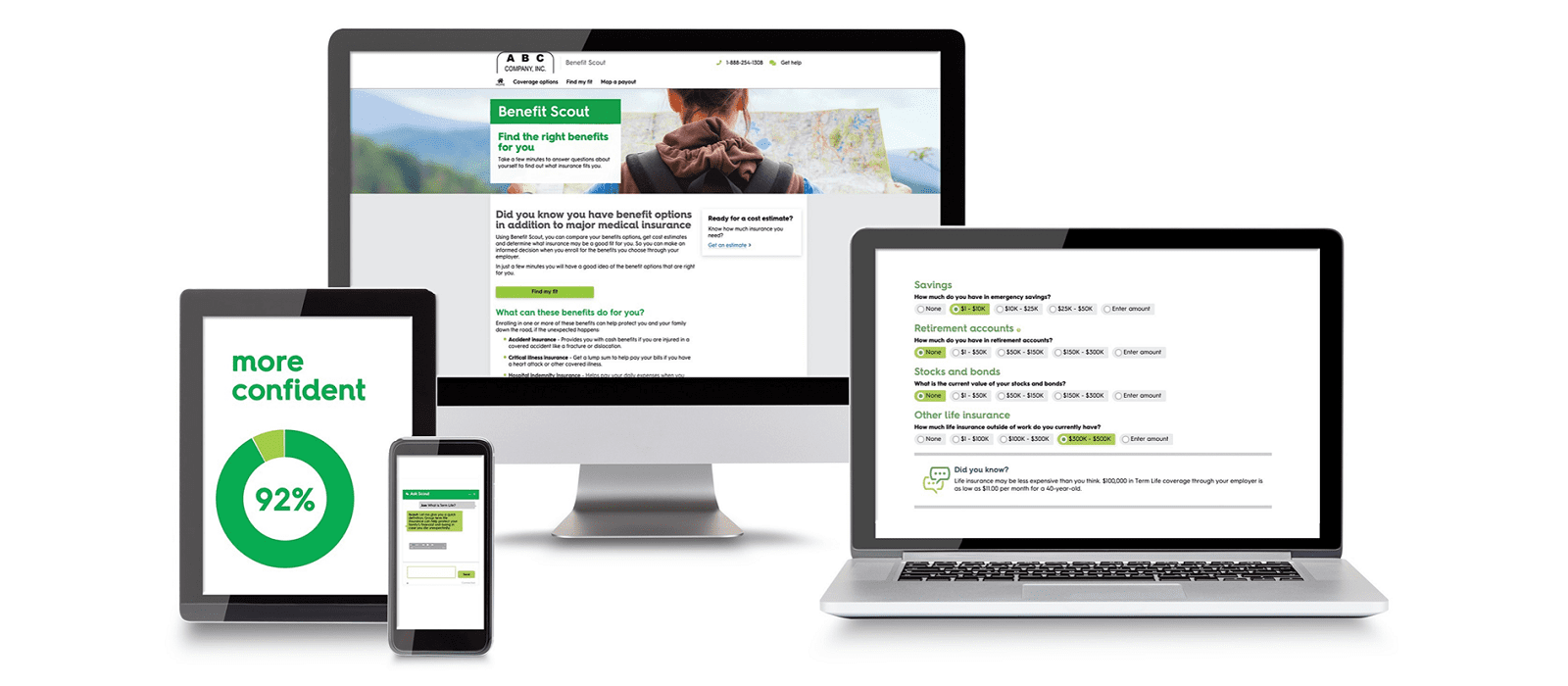

Called Benefit Scout™, the interactive, digital platform leverages artificial intelligence to guide employees step-by-step through the decision journey. The result is less guesswork for employees—and fewer questions for human resources staff—during enrollment.

How Benefit Scout works

First, employees answer a few simple questions about their family, lifestyle, savings and debts. Benefit Scout then analyses their answers with data and decision logic to calculate the options for them, based on their unique needs. Finally, employees get specific voluntary insurance benefit recommendations and cost estimates, which they can evaluate and customize before enrolling.

As part of the experience, employees have 24/7 access to Scout, the platform’s virtual chat assistant, and they can contact on-demand Securian Financial benefit counselors by phone or online chat for one-on-one support.

Benefit Scout is available at no cost to qualifying Securian Financial group insurance customers.

Voluntary benefits growing, but enrollment is challenge

According to Travis Symoniak, Securian Financial’s manager of group insurance enrollment solutions, more employers are offering voluntary benefits like supplemental life, accident, critical illness and hospital indemnity insurance to help improve their employees’ financial security. However, enrollment can often be low due to employees not understanding these benefits or not knowing that they are available to them.

“Benefit Scout helps employees better understand and make informed decisions about the Securian Financial insurance benefits available to them through their employers,” Symoniak said. “It can increase enrollment and improve participation in employer voluntary benefit programs, which helps to reduce the rate of uninsured and underinsured employees.”

Pilot demonstrates potential

In a 2018 pilot launch with a large health care provider employing more than 41,000 workers, 85 percent of employees who completed Benefit Scout’s experience enrolled in a voluntary insurance benefit. In addition, 92 percent of employees who used Benefit Scout said they were more confident about their benefit decisions after completing the experience [1].

A group insurance leader

Securian Financial is the third-largest direct writer of group life insurance in the United States [2] and also offers group accidental death and dismemberment (AD&D), accident, critical illness and hospital indemnity insurance. Specialising in large public and private employer plans, Securian Financial insures more state governments—18—than any other group life insurer and has 59 Fortune 500 customers, including 19 of the Fortune 100 [3].

[1] According to an email survey of those employees conducted by Securian Financial in 2018

[2] A.M. Best Statistical Study, U.S. Group Life, July 23, 2018. Based on 2017 group life insurance in force for Minnesota Life Insurance Group. Excludes Great-West Life Group.

[3] As of December 31, 2018