While the Canadian insurance landscape remains polarised on the topic of ESG, the gap between the players is expected to close very quickly. This EY survey of (re)insurers with a strong presence in the Canadian market deep-dives into the different ways market players are integrating ESG into their practices, whether through their products and underwriting or through their investment portfolios. Canadian insurers are expected to continue to evolve their product offerings to increase accessibility to insurance and improve plan members’ wellbeing, as well as fully integrate ESG into their underwriting practices to better manage their risks.

Environmental, social and governance (ESG) matters have taken centre stage as a top priority for institutional investors globally, with players publicly taking a stance and setting measurable targets on their path to decarbonization. Alliances like the Net Zero Asset Manager and Asset Owner Alliances emerged supporting this mission, gaining considerable traction in recent years and setting the stage for the subsequent development of the Net Zero Insurer Alliance.

EY has completed a review of the impact of ESG on the insurance landscape and explored the different ways Canadian insurers are integrating elements of ESG into their practices. In this ESG Insurance Survey Report of 12 Canadian insurers and reinsurers, EY investigate the different steps they’re taking, driven by:

- Members in the case of mutuals and co-ops

- External scoring providers (e.g., Sustainalytics, MSCI) leading to passive index exclusion for publicly traded entities

- Anticipated regulation

- Talent attraction and retention

This article was authored by Jean-François Gagnon, EY Canada Financial Services Sustainable Finance Leader, and Janice Deganis, EY Canada Insurance Leader .

The article is reproduced with the kind permission of ICMIF Supporting Member EY.

Published November 2022

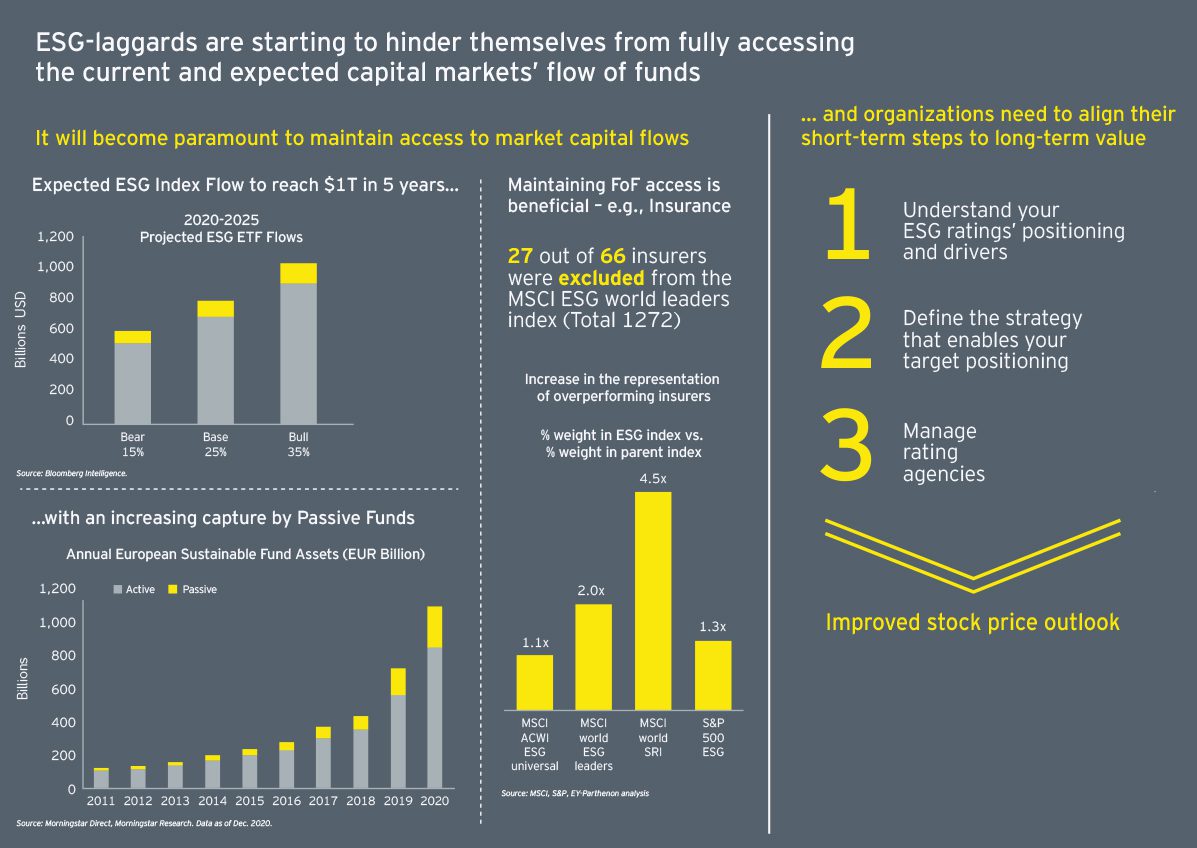

- Those insurers that have not integrated ESG properly are starting to preclude themselves from the flow of funds into ESG, captured by passive ESG funds that exclude those who don’t have the right ESG rating.

- 27 out of 66 insurers were excluded from the MSCI ESG World Leaders Index for not meeting the ESG score standards.

- Companies have had challenges in interacting with the rating agencies, understanding the requirements and ensuring they are disclosing everything they are doing.

Products and underwriting

Of the 12 respondents surveyed, 7 mentioned they are considering ESG in their underwriting and new product development practices. From an underwriting perspective, the integration of ESG has made it possible to provide different types of coverage that previously would not have exceeded the required hurdle rate. Those who are taking an ESG lens to their products are doing so with the objective of increasing accessibility to insurance, whether through developing new products to insure individuals or property that were previously uninsurable or developing incentive programs to allow members to access better rates.

Life insurers are largely focused on incentive programs for members to better manage overall wellbeing. Some are also developing innovative products that are more inclusive and better tailored to specific communities. One example is the expansion of sex-specific coverage (e.g., mammogram) for the transgender community, including gender affirmation packages.

In the P&C space, insurers are providing new types of products and better rates on the basis of ESG. For example:

- From the social perspective, some are developing parametric weather products to provide coverage for farmers whose harvest yields suffered from unusual weather activity or providing insurance to certain zones and Indigenous reserves.

- From the environmental perspective, others are providing improved auto insurance rates for hybrid or electric vehicles or higher renovation budgets if sustainable materials are being used.

- In addition, one insurer mentioned that although they are not excluding clients in particularly carbon-intensive industries, they are not willing to underwrite certain activities such as oil and gas extraction.

Three insurers also mentioned they’re currently investing “pre-product” driving research and development in areas such as the mental health space.

Reinsurers

Acting as a transformation accelerator for the insurance ecosystem, some reinsurers have positioned themselves as partners supporting insurers in the development of their ESG strategy and risk management framework. This focus has been increased since some insurers see ESG client engagement as one of management’s key performance indicators.

The decarbonization imperative

A majority of the respondents have made net-zero commitments from an operating emissions perspective. However, few have committed to net zero from a financed emissions perspective.

Operating emissions

Almost all survey respondents have defined emissions targets for their operations, many of which are now being revised since companies achieved their targets early thanks to the pandemic and the transition to work from home.

From a P&C perspective, claims operations have been highlighted as an area of high potential for reducing operating emissions, with considerations such as:

- Ensuring diversity and inclusion (D&I) is coming to life in vendor diversity

- Encouraging customers to repair rather than replace

- Using drones to assess damage in remote locations rather than sending assessors

Financed emissions

Only a select few respondents have committed to long-term financed emissions targets and established interim targets based on protocols such as the SBTis, which are altering some ways of doing business. Those who have set interim targets highlight their importance in ensuring that change begins to occur while avoiding having to manage a potential future crisis.

Almost all of the insurers mentioned that their asset managers are developing and launching socially responsible fund options (e.g., climate action funds) and are also aligned to the same ESG purpose. Two respondents told us they do not publish public ESG investment policies, such as a policy on coal, or perform direct oversight. The asset managers with whom they work have their own initiatives that prohibit investments from their portfolio investments based on specific ESG topics. One participant is developing steps to audit their external manager on ESG elements.

There was a general mindset across most insurers that the integration of ESG has not compromised financial returns and in fact has done quite the opposite. One insurer mentioned they had set an original goal of 20% of assets invested into impact investing by 2022. Since they reached this goal ahead of schedule, they’ve recalibrated it to a goal of 60% of assets invested into transition and impact investments.

Data and reporting, networks and alliances

About 65% of insurers and reinsurers who participated in our survey already report under the Task Force on Climate-Related Financial Disclosures (TCFD). The remaining 35% are considering it or are in the process of developing capabilities and processes to support upcoming TCFD reporting. About 50% also report on Sustainability Accounting Standards Board (SASB) metrics and 40% on the Global Reporting Initiative (GRI). Two respondents integrate their sustainability reporting into their annual report, while seven have an independent sustainability report, which two of the respondents told us they will integrate in the following years. For one insurer, while the parent company already publishes an ESG report, the insurance arm is currently excluded, but they plan to integrate it in the coming year.

Going beyond traditional sustainability reporting, four participants noted they have explicitly identified the United Nations Sustainable Development Goals (UN SDGs) that align most closely to their purpose and are tracking their contribution to each. Two respondents also mentioned they were in the process of developing methods to audit their reporting to ensure robustness and credibility of data and information being shared, and were actively seeking to avoid greenwashing accusations. Few mentioned that data was an impediment to proper reporting.

Some of the challenges mentioned were:

- Access to data for GHG emissions was limited when it comes to non-listed companies that make up their investment portfolio.

- Operations data as they relate to their own properties, particularly in foreign jurisdictions, was limited.

- When strong data is available for certain aspects of the business, the aggregation process is complicated.

Corporate social responsibility (CSR)

Most of the survey respondents mentioned that their organizations are involved in community outreach programs and charitable organizations, partaking in initiatives such as hunger drives and supporting building homes for lower-income individuals. The advancement of ESG has created a shift in philosophy from doing charitable work to effectively integrating it in the way they do business.

For example, one insurer spoke about a health-related cause they support. On top of donating time and funds to raise awareness, they are working on driving change for the individuals impacted through the development of a new dedicated insurance product.

Four insurers told us their CSR focus is targeted around driving community resilience, as many of them are developing impact strategies and frameworks to guide community investment programs and partnerships. One mentioned running programs for employees to deploy their skills to help start-ups globally on elements such as building up their business model.

This change in philosophy is helping insurers attract and retain talent, as they tell us this matters to both their current and potential employees. Half of the 12 participants told us their employees are highly engaged in their ESG journey. Graduates today are very purpose driven and want to work for organizations that share their personal values. Three participants added that ESG performance metrics will start to take shape more and more in their organizations and, in some cases, will be cascaded in performance appraisals.

Conclusion

1. A globally polarized landscape

The global insurance landscape remains polarized when it comes to the topic of ESG, with leaders taking strong market positions and refusing to insure long-term clients that lack a climate strategy, for example, while others have remained passive. However, with insurers that have low ESG ratings being precluded from accessing the flow of funds towards passive investments, we believe that a normalization of the industry around ESG will take place over the next three years.

Based on our experience, the ratio of those insurers we invited to this survey and those who participated, and the discussions we had, we contend the above observations and trends also hold true for Canada.

2. ESG integration happens in multiple dimensions

While many insurers have integrated ESG all the way from their product development and underwriting practices to their asset management and reporting, others are still in the process of defining their ambition. However, this gap is expected to close very quickly. Insurers will continue to evolve their product offering to best support their plan members, as well as fully integrate ESG into their underwriting practices to better manage their risks.

On the asset management side, not only is the integration of ESG necessary from a risk management perspective, it is increasingly recognized as a value creation lever. The emergence of new regulation is further driving this agenda, as the Office of the Superintendent of Financial Institutions (OSFI) will require financial institutions to publish climate disclosures — aligned with the TCFD framework — using a phased approach starting in 2024.

3. The impact of ESG on the insurance landscape

It was not clear for participants what the impact of greater ESG integration would mean for the Canadian landscape. There is no doubt that branding is being shaped by ESG, especially in a talent-scarce environment, as it is perceived as a source of talent retention and acquisition. Would this branding change bring the value proposition of the publicly traded and co-op/mutuals ever closer? Some believe it would and, to quote a co-op/mutual, “It is a welcome change, as society will benefit from public companies being more ‘ESG’…. It might, however, mean that we will need to rethink what makes us unique.”