Compared with Europe, the US insurance industry is still in the nascent stages of ESG integration. Given the developing perceptions of ESG, AM Best surveyed (re)insurers operating in the USA and found that 51% of stock insurance companies reported that they were actively engaged in ESG, compared to 42% of mutual insurance companies. The majority of US insurers (across all segments) agree that demand from stakeholders to explicitly consider ESG factors has grown over the last three years and that more clarity is needed from regulators, particularly with respect to identifying, measuring, and reporting ESG factors. Companies are evaluating how to integrate ESG factors into their business models, but to be viable they must also identify and assess how these factors can impact their business from a risk perspective, while also identifying new opportunities.

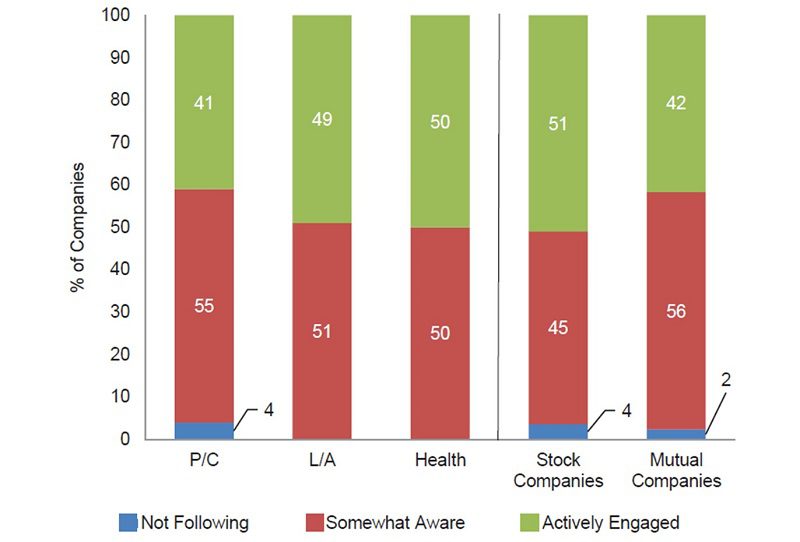

As industry discussion, policy development, and regulatory interest continue to swell around environmental, social, and governance (ESG) factors, there has been a great deal of press coverage and discussion on what that means for insurers. Following a survey conducted last year that focused on Europe and Asia-Pacific, AM Best surveyed the rated population of property/casualty (P/C), life/annuity (L/H), and health (re)insurers operating in the US to gauge how they approach ESG. We received responses from 238 P/C companies, 69 L/A companies, and 18 health companies. By segment, 50% of US health insurers responded that they are actively engaged in ESG, followed closely by 49% of L/A insurers and 41% of P/C insurers (see chart below).

In the insurance industry, stock companies are leading the pack in engagement in ESG, as 51% of stock companies reported that they were actively engaged in ESG, compared to 42% of mutual companies. AM Best expects that, given the growing interest of investors, regulators, and rating agencies, along with government disclosure requirements, this number will increase over the next year.

US insurers’ engagement with ESG

The article is reproduced from a Best’s Special Report with the kind permission of ICMIF Supporting Member AM Best. To access a copy of the full report, please click here.

Published February 2022

Compared with Europe, the insurance industry in the US is still in the nascent stages of developing a narrative around ESG, and the focus varies by segment. Health insurers concentrate more on the social impacts of health equity, which have been subject to greater scrutiny during the pandemic. P/C insurers focus more on environmental risks, and life insurers concentrate on investment risk, given the importance of yields, liquidity, and asset-liability matching.

Notably, all segments in all regions are focused on the “G”—governance—in ESG. The survey showed that insurers were generally emphasizing diversity and inclusion and view good corporate governance as key to managing and mitigating reputational risk.

Varying degrees of stakeholder pressure

Our survey found that 60% of companies agree or strongly agree that demand from stakeholders to explicitly consider ESG factors has grown over the last three years. These scores were slightly higher for stock companies than for mutual companies. Survey results show that insurers believe there are risks to ignoring stakeholder pressures related to ESG factors—77% of L/A insurers, 69% of P/C insurers, and 61% of health insurers believe that disregarding ESG factors would lead to elevated reputational risk.

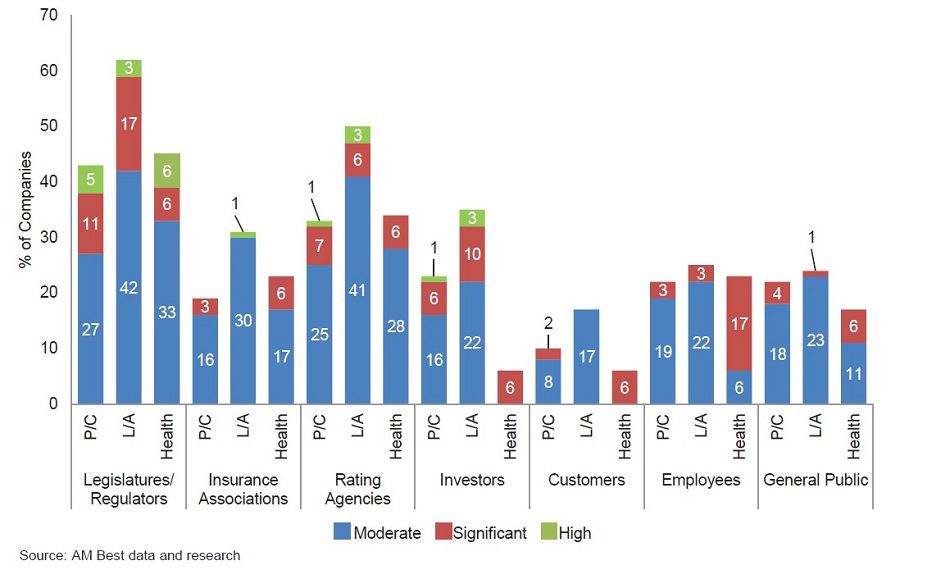

Despite perceptions of increasing stakeholder pressure, respondents across all three segments reported that the pressure tended to be more moderate than either significant or high. Legislatures and regulators are perceived to exert the most pressure, with 20% of L/A respondents perceiving a significant to high level of pressure, while P/C companies are at 16% and health companies are at 12% (see chart below).

Perceived moderate to high pressure applied by stakeholders

This is not surprising as the Securities and Exchange Commission is prompting public companies to review and bolster disclosures related to climate risk. Further, the National Association of Insurance Commissioners recently established a Climate and Resiliency Task Force, aiming to serve as the coordinating body to discuss and engage on climate-related risk and resiliency issues. Our survey found rating agencies to be the second-highest source of pressure in the moderate to high categories.

Insurers are studying and learning, but not yet implementing

Insurers are unclear on how ESG can and should be measured, and on the role they will ultimately play. Nearly 70% of life insurers agree or strongly agree that insurers will play a pivotal role in the future, compared with just over half of P/C insurers and a third of all health insurers. A large percentage of respondents were neutral, with 30% of life companies, 33% of P/C companies, and 66% of health companies taking a wait-and-see approach, indicating that they neither agree nor disagree about the role the industry has to play.

Over half of both P/C and L/A insurers agree or strongly agree that a proper understanding and integration of ESG factors is increasingly critical to the long-term viability of their business, compared to 39% for health insurers. There was considerable agreement about the need for greater clarity by insurance associations and regulators on measuring and reporting ESG factors on a globally consistent basis. Roughly 60% of the industry overall seeks greater clarity from regulators, particularly with respect to identifying, measuring, and reporting ESG factors. Nearly 75% of L/A companies agree or strongly agree that more clarity is needed, compared to 59% for P/C companies and 44% for health companies.

As the pressure grows, insurers are aware that they must understand how ESG will impact their businesses over the long term. Companies are evaluating how to integrate ESG factors into their business models, but to be viable they must also identify and assess how these factors can impact their business from a risk perspective. Still, opportunities may arise—30% of L/A companies strongly agree that ESG can provide such opportunities, compared to 24% of P/C and 11% of health companies.

Unpacking ESG: Where are actions being taken?

The L/A and P/C segments are generally consistent about the relevance of particular ESG issues. More than 80% of L/A companies stated that issues related to corporate governance and product liability (including cyber security) were moderately to highly relevant. Climate risk, innovation, clean technology, and renewables were deemed somewhat relevant, as were labour policies and labour relations. A large proportion of US P/C companies recognizes the importance of corporate governance, climate risk, and product liability. P/C companies identified pollution and waste as notable concerns. Health companies consider corporate governance and product liability the most highly relevant ESG issues.

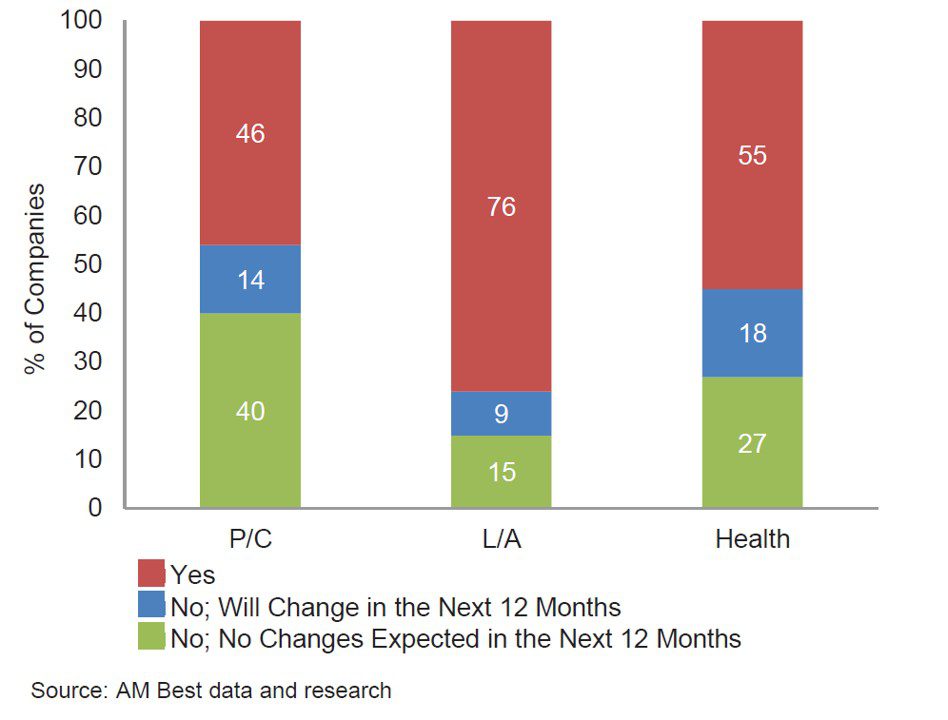

ESG and the investment process: Life/Annuity companies lead the way

For many companies, both inside and outside the insurance industry, ESG is considered an investment policy. Roughly 75% of L/A companies reported they have integrated ESG into their investment processes in some form (see chart below), followed by health companies at 55% and P/C companies at 46%. Nine percent of L/A companies, 14% of P/C companies, and 18% of health companies plan further integration in the next 12 months. More than 40% of P/C and health companies do not incorporate any specific strategies to achieve ESG investment objectives, compared with just 15% of L/A insurers.

Integration of ESG in the investment process

Much of the activity is passive. Some of the companies that use outside asset managers stated that they rely on their investment managers’ ability to screen for ESG. Among the ESG considerations factored into investment decision-making were reduced reputational risk, moral reasons, regulatory requirements, a desire to achieve higher investment returns, the need to preserve investment value, pressure from investors, and peer pressure. Those that give consideration to ESG use Negative Screening (avoiding investments in certain industries such as tobacco), and ESG Integration (explicit and systematic inclusion of ESG factors in investment) as the most popular strategies (Exhibit 8). The L/A segment leads the way in actions to achieve ESG Objectives in the investment portfolio.

Once a company commits, ESG may dominate its investment strategy. Almost half of these respondents (49%) in both the P/C and L/A segments, and 80% in the health segment, say they apply these strategies to at least 75% of their investment portfolios, while about a quarter or less implement strategies for less than 25% of their portfolio (Exhibit 9). Further, 46% of L/A insurers 42% of health insurers, and 39% of P/C insurers expect to apply ESG strategies to a greater share of their investment portfolio.

ESG in underwriting is unclear

Although a sizable majority of survey respondents in each segment generally acknowledged the importance of integrating ESG considerations into their investing activities, there was less of a consensus about the role of ESG factors in underwriting. Less than a quarter of AM Best survey respondents in each segment believe it is extremely or very important for underwriters to consider ESG factors in the underwriting process.

Around 72% of health insurance respondents felt integrating ESG factors into the underwriting process was only somewhat important or not important. Health companies offer services that help clients meet their ESG goals for improvement of employees’ well-being, such as wellness programs, mental health services, and general promotion of a healthy lifestyle. The impact of wellness and healthy lifestyle incentives may be reflected in underwriting and lower rates for companies’ group health policies.

A substantial 38% of P/C insurers, versus 5% of L/A and zero health insurers, responded that the future costs of climate risk are currently priced into policies and factored into technical provisions. The limited response about integrating ESG in the underwriting process may stem from insurers’ general ability to reprice policies annually, at which point they can factor in loss experience. AM Best expects that, given the lack of a consistent methodology for measuring climate risk and its overall impact on mortality, morbidity, property, and environmental risks, the integration of ESG into underwriting such policies will take more time.