AM Best expects US (re)insurers’ engagement with environmental, social and governance (ESG) factors to accelerate amid an increasing green focus from the US government. Concern about exposure to climate risk, as well as reputational risk, are likely to persuade a growing number of US (re)insurers to consider ESG factors in their investing and underwriting activities. Green infrastructure projects which support the transition from a high to low-carbon economy should present (re)insurers with new underwriting opportunities.

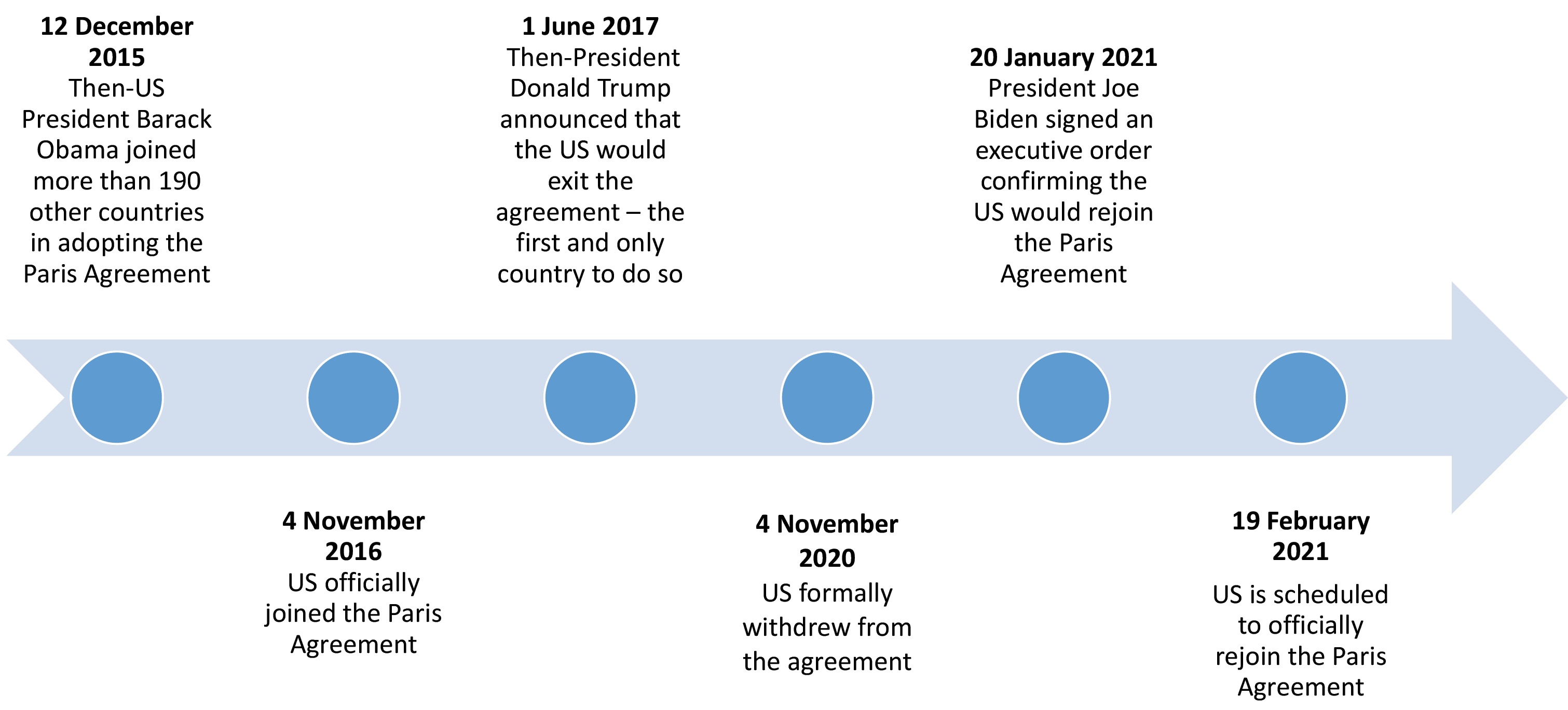

The US rejoining of the Paris Agreement – which US President Joseph R. Biden ordered during his first hours in office and which is to come into force on 19 February 2021 – is a clear sign that the new administration will be more engaged with responding to the threat of changing climate trends.

Outside the United States – in Europe and Asia Pacific, in particular – (re)insurers have been increasing the integration of ESG factors into their investment and underwriting activities. However, there has been a perception that US (re)insurers have lagged behind their global counterparts on this matter. Prospectively, AM Best expects the Biden government’s increased emphasis on climate risk to prompt US (re)insurers to accelerate their ESG efforts.

This commentary sets out some of the potential short-to-medium term impacts on the

(re)insurance industry as the US rejoins the Paris Agreement.

Climate-related disclosure requirements

Demand for increased disclosure on climate-related risks has been growing in recent years as investors, regulators, and lawmakers have acknowledged that these risks can be financially material and a potential threat to financial stability. A number of central banks and regulators, particularly in Europe, have imposed disclosure requirements to identify, monitor, and manage climate-related risks (along with broader ESG risks).

AM Best’s recent ESG survey of European and Asia-Pacific (APAC) (re)insurers noted that regulators were seen as a source of high or significant stakeholder pressure for considering ESG risks and opportunities. Regulatory requirements have pushed (re)insurers to improve their understanding of all the potential risks facing their organisation, which should contribute to strengthening the sustainability of the insurance industry over the longer-term.

Now that Democrats control the White House and Congress, they are in a stronger position to push through their environmental agenda through executive action and new legislation. In turn, US (re)insurers, particularly those that are publically listed and fall under the oversight of the Securities Exchange Commission (SEC), may gradually notice increased scrutiny on how they consider and what they disclose on climate-related risks, more in line with what is observed for their European peers. For several years, large European insurers have had to publish annual reports on the social and environmental impact of their activities. The European Commission’s technical expert group on sustainable finance has also been working on formulating a standardised taxonomy for sustainable activities, EU Green Bond Standard, and climate disclosure guidance.

Globally, there has been an uptick in the number of regulators implementing climate stress tests for banks and insurers, including in the United Kingdom, France, and Australia. As the SEC considers developing regulatory standards around how (re)insurers integrate ESG factors in their operations, they may be inclined to look to international counterparts for inspiration.

The article is reproduced from a Best’s Commentary report with the kind permission of ICMIF Supporting Member AM Best.

Published February 2021

Transition from a high to low-carbon economy

Concerns about exposure to climate risk, as well as reputational risk, are likely to persuade a growing number of US (re)insurers to consider ESG factors in their investing and underwriting activities, as the Biden administration encourages the development of sustainability regulations and projects.

AM Best’s ESG survey of insurers in Europe and Asia Pacific revealed a majority of (re)insurers consider that failure to act on stakeholder pressure around ESG issues could lead to long-term reputation challenges. Furthermore, reducing reputational risk was the most-cited reason by European and APAC survey respondents for integrating ESG factors in investment mandates.

The implementation of more stringent climate targets at a federal level is very likely to have an impact on high-emitting sectors, like the coal industry.

This might result in increased environmental regulation and the implementation of incentives, which would aim to accelerate the transition from a high to low-carbon economy.

Such measures to support the transition may encourage insurers to enhance their investment strategies by integrating ESG factors, to limit their exposure to what could become stranded assets – those assets that may lose their value unexpectedly or prematurely due to external factors.

The Keystone XL pipeline provides an example: on inauguration day, President Biden rescinded the licence, through executive action, for the planned 1,179-mile oil pipeline between Alberta, Canada and Steele City, Nebraska.

On the underwriting side, (re)insurers that provide insurance cover to so-called “toxic” industries may come under increased scrutiny and suffer from publicity that could damage their reputation by association.

If capacity is withdrawn as a consequence and coal companies, for example, are unable to find sufficient insurance cover in the international (re)insurance market, there could be business opportunities created in the captive insurance space.

Growth in green infrastructure might offer opportunities

Efforts to support the transition to a low-carbon economy and meet the US climate targets under the Paris Agreement should result in an increase in green infrastructure, including solar and wind parks and levees/floodgates to improve flooding resilience.

Some of these new technologies may require (re)insurers to redesign their product offering to take into account new risks. These projects represent significant opportunities for (re)insurers that can embrace the shift and tailor their products accordingly.

What is the Paris Agreement?

The Paris Agreement is a legally binding international treaty on climate change. In a historic display of global unity on combating climate change, the agreement was adopted by 194 countries in December 2015 and entered into force on 4 November 2016.

The agreement’s primary goal is to keep the global temperature rise this century well below 2°C above pre-industrial levels and to pursue efforts to limit the temperature increase to 1.5°C. In addition, the agreement aims to strengthen the global response to the threat of climate change.

All signatories set self-determined commitments to cut their climate-altering pollution and to strengthen those commitments over time. The agreement provides a pathway for developed nations to assist developing nations in their climate mitigation and adaptation efforts, and creates a framework for the transparent monitoring, reporting, and ratcheting up of countries’ individual and collective climate goals.

European and APAC (re)insurers’ ESG attitudes

Insurers and reinsurers globally are increasingly focusing on incorporating ESG factors into their investment and underwriting activities. A Best’s special report titled Insurers and Reinsurers: Ignoring ESG Factors Poses Reputational Risk published in November 2020 highlighted the results of an AM Best ESG survey conducted across European and Asia APAC (re)insurers.

The report revealed that (re)insurers in Europe and Asia Pacific generally recognise the importance of ESG factors to the long-term viability of their businesses, although they are at different stages of their ESG journey.

Other feedback from European and APAC (re)insurers suggested:

- Overall, there is a marked lag between recognition of ESG risks and action being taken to mitigate those risks

- Larger (re)insurers with an international focus are typically more engaged and more active in the ESG arena than their smaller peers

- In the main, investment activities are the primary focus of ESG integration, with only a few respondents highlighting underwriting initiatives

- Corporate governance, product liability including cyber security, and climate risk were cited as the most relevant ESG issues for the (re)insurance industry

- Lack of transparent and comparable definitions and data is stifling greater application of sustainable investing practices.