The insurance sector has been at the forefront of managing the impact of climate-related risks for many decades. Insurers are well placed to seize the structural opportunities ahead and become stewards of an orderly, whole economy transition to a net zero and climate resilient future. But doing so will require a pro-active and creative approach – a 7-step framework for a strategic climate response. Fortune will favour the risk-adjusted.

In a relatively short time, climate change has moved from an underwriting focused concern of property (re)insurers, or matters of corporate social responsibility, to a mainstream set of issues relating to prudential safety and soundness and financial stability across the financial system.

While increasing attention to ESG (environmental, social and governance) factors, reputation concerns and changing consumer sentiment have undoubtably played their part, the system-wide and structural integration of climate-related risks into financial regulation is now the primary driver and moving in only one direction.

The insurance sector has already played a key role in shaping the global regulatory landscape that has now emerged on climate, including leading a revolution in climate data and analytics, responding to Solvency II and supporting the development of a formative framework for climate-related financial risks.

There is a strategic opportunity for insurers to continue to lead. But doing so will require the industry to up its game even more and embed a strategic approach; one that not only integrates climate-related risks into day-to-day risk management but also seeks to steward a whole economy transition to a low carbon and resilient future.

Before diving into how insurers can embrace a stewardship role, let’s start with a reminder of three key inflexion points in the rising tide of climate-related financial regulation. And the leading role the insurance sector has already played in the fundamental reshaping of finance now underway.

The 1990s: An industry in crisis – and a revolution in climate data, analytics and regulation

As many may remember, a series of events in the late 1980s and early 1990s, culminating with Hurricane Andrew in 1992, presented an existential threat to the insurance industry. With losses of over USD 15bn, Andrew was responsible for the failure of at least 16 insurers between 1992 and 1993. But with crisis comes opportunity. Under pressure from their investors, the insurance industry responded with an analytical revolution in models, methods and metrics to better integrate what has become known as physical climate risks into the heart of pricing and decision making. The catastrophe risk models the industry has pioneered, marrying engineering metrics and actuarial science with human and physical geography, are providing a key analytical building block of the climate-related risk gear box now being employed across the financial system.

As discussed further in Matt Foote’s and Adhiraj Maitra’s article: Insurers can draw on their Solvency II experience to integrate climate risk and resilience, the insurance sector has also been at the centre of one of the first inflexion points in climate-related financial regulation. The introduction of requirements for modelling 1-in-200 year natural hazard scenarios via Solvency II and other regimes around the world, reinforced by insurance credit rating agency requirements, was an early front-runner to the climate stress tests that are now being introduced across the financial system.

It is therefore no surprise that a second pivotal inflexion point had its roots in a prudential climate review of the UK insurance sector, setting the foundation for a financial sector wide approach.

This article was written by Matt Scott, Senior Director – Climate and Resilience Hub, and Rowan Douglas, Head - Climate and Resilience Hub, Willis Towers Watson, and is part of its Insurer Solutions Climate Risk Series. The article is reproduced with the kind permission of ICMIF Supporting Member Willis Re.

Distinctive elements of climate-related financial risks

- Far-reaching in breadth and magnitude: the financial risks from physical and transition risk factors are relevant to multiple lines of business, sectors, and geographies. Their full impact on the financial system may therefore be larger than for other types of risks, and is potentially non-linear, correlated and irreversible.

- Uncertain and extended time horizons: the time horizons over which financial risks may be realised are uncertain, and their full impact may crystallise outside of many current business planning horizons. Using past data may not be a good predictor of future risks.

- Foreseeable nature: while the exact outcome is uncertain, there is a high degree of certainty that financial risks from some combination of physical and transition risk factors will occur.

- Dependency on short-term actions: the magnitude of future impact will, at least in part, be determined by the actions taken today. This includes actions by governments, firms, and a range of other actors.

Source: PRA Supervisory Statement SS3/19: Enhancing banks’ and insurers’ approaches to managing the financial risks from climate change. April 2019.

It is with these challenges in mind that financial regulators are once again raising the bar. For example, developing climate stress tests to determine the viability of banks and insurer’s business models out to 2050 and beyond and requiring firms to assign individual senior manager accountability for managing the financial risks from climate change.

The PRA’s ‘Dear CEO’ Letter published in July this year could well be remembered as a defining moment; one that requires all UK banks and insurers to ‘fully embed their approaches to managing climate-related financial risks by the end of 2021’.

And while the UK is clearly at the vanguard, it is certainly not alone. The mainstream integration of climate-related risk has become a global endeavour for insurers and across the entire financial sector. For example, since the beginning of September this year:

- The European Insurance and Occupational Pensions Authority (EIOPA) has published a consultation on the use of long-term climate scenarios within firm’s Own Risk and Solvency Assessment (ORSA) as part of Solvency II;

- The International Association of Insurance Supervisors (IAIS) has published its draft Application Paper to support supervisors around the world in their efforts to integrate climate-related risks into supervisory frameworks, including those relating to supervisory review and reporting, corporate governance, risk management, investments and disclosures;

- In a similar vein to the PRA’s letter, the New York Department of Financial Services has written to insurers requesting firms to integrate climate-related risks into governance frameworks, risk management processes and business strategies.

And, more broadly, the Central Bank and Supervisors Network for Greening the Financial System (NGFS) continues to go from strength to strength, expanding from eight founding institutions in late 2017 to now over 80 participants across five continents.

When considered together, these latest developments define a third inflexion point – the mainstream implementation of strategic, Board level responses to the financial risks from climate change. Importantly, this third phase will require firms to not only demonstrate they are pro-actively managing near-term climate-related risks but are also taking action to pre-emptively reduce future financial risks, including those that may not fully crystallise until the second half of the century.

This third phase represents an important shift; responding to climate-related risks can no longer be considered as a spectator sport. It requires a much more participative, strategic and creative approach, one that seeks to steward a whole economy transition to a low carbon and resilient future.

Stewarding a whole economy transition

While there’s clearly overlap between embedding the near-term physical and transition risks into every day financial risk management with those required to manage future financial risks today, there’s also some important nuances. For example, insurers can manage their near-term risks by reducing their individual exposures, such as divesting carbon intensive assets to reduce transition risks. Pre-emptively reducing future financial risks requires a wider lens and a more strategic approach. As highlighted in a speech by Sarah Breeden, Executive sponsor of the Bank’s climate work, published alongside the PRA’s Dear CEO letter: ‘given the scale of change required, we will simply not be able to divest our way to net zero’.

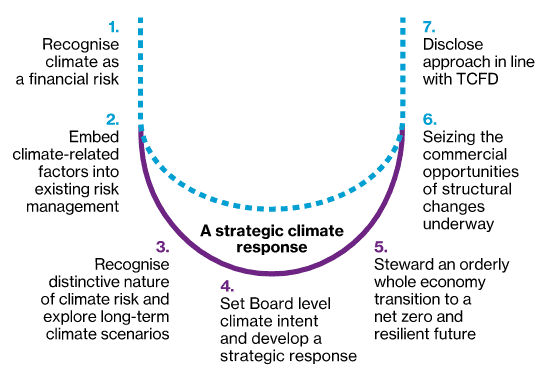

While recognising climate as a financial issue and embedding, and disclosing, near-term climate-related risks and opportunities (steps 1, 2, 6 and 7 shown by the dotted blue line below) is clearly important, a strategic approach requires a deeper shift; one which also includes steps 3-5 shown in purple.

This includes assessing the impact of long-term climate scenarios, out to 2050 and beyond, and considering the unique system-wide challenges that climate change presents (step 3). Adjusting time horizons to the long-term provides an opportunity for Directors to reflect on the Board’s responsibilities to manage future financial risks today and to set a strategic ‘climate intent’, such as agreeing to align a firm’s strategy with the goals of the Paris Agreement, or committing to a Net Zero target (step 4). This, in turn, can inform a more strategic, pro-active and creative approach; one that embraces the need for stewardship of a whole economy transition to a low carbon and resilient future (step 5).

A 7-step framework towards a strategic climate response

While the PRA’s letter, and our own recent TCFD readiness survey, clearly flag multiple areas where additional progress and capabilities are required, many financial firms are already starting to embrace a more strategic, pro-active approach. The PRA/FCA convened Climate Financial Risk Forum also evidences the strong appetite for cross-sector collaboration to advance thinking and practice. With this in mind, we are delighted to be supporting the Forum’s scenario analysis working group and helping to facilitate cross-sector dialogue more broadly. For example, through recent events bringing together financial regulators with senior industry leaders and our international work chairing the Coalition on Climate Resilient Investment.

Clearly solving a collective action problem requires a collective and collaborative approach. While the insurance sector alone will not drive the transition to a low carbon and climate resilient future, with trillions of dollars under management and billions of dollars in transaction volumes, it can certainly influence the outcome, and it is in its own enlightened self-interest to do so.

Fortune favours the risk adjusted

The good news is that a more comprehensive, strategic response has many benefits. It can provide assurance to all stakeholders, including investors, that climate-related risks, and opportunities, are fully understood and are being managed appropriately. It can also help attract and retain talent, particularly among younger colleagues who are increasingly seeking purposeful careers aligned with their values. Indeed, the integration of climate-related factors into talent and reward strategies is increasingly being viewed as an important source of differentiation and advantage.

Perhaps most importantly a strategic approach can also support insurers in orientating towards the transformative and structural opportunities presented by the low carbon, climate resilient transition. Having helped shape the landscape that is now emerging, there is no industry better placed to seize the opportunities that lie ahead.

There is still much to do to manage climate-related risks, and many questions that still need to be answered as methods, models and metrics continue to evolve. Developing a pro-active, strategic and creative approach now will be sure to pay dividends; fortune will favour the brave, well-prepared and risk adjusted.