Artificial intelligence (AI) has emerged as a promising avenue for insurers to amplify the returns on their technological investments and expedite their modernisation endeavours. The capability to implement generative AI functionalities, while minimising investment and disruption in live claims processes, provides a pragmatic starting point. In this context, it becomes incumbent upon insurers to thoroughly explore the potential advantages of generative AI and formulate sustainable strategies for its gradual integration throughout their organisational framework. Generative AI not only offers insurers an opportunity for comprehensive self-reinvention but also holds the potential to deliver heightened value to customers, shareholders, and society at large.

Introduction

A global pandemic, geopolitical and macroeconomic risks, along with a recessionary market sentiment, have created an increasingly unstable environment for insurance carriers. Additionally, non-traditional participants offering newer, customer-friendly insurance consumption models have compelled insurers to drive product and experience innovations at speed and scale. To expedite recovery and future-proof the business, insurers have heavily invested in modernizing their IT estate. Most of these transformations have focused on enhancing operational capabilities to achieve efficiency and productivity gains while adopting data-driven decision-making.

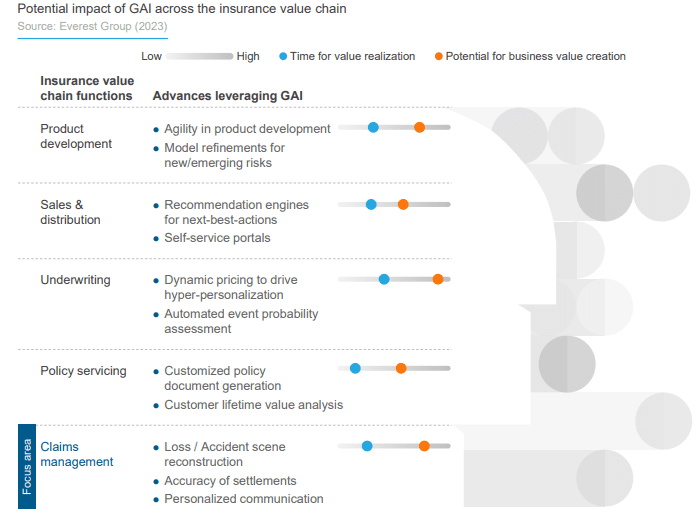

Generative AI (GAI) offers insurers a promising pathway to extract additional value from their investments and accelerate their modernization efforts.

A new report, authored by Everest Group and supported by EY, investigates the imperative and strategic roadmap for the adoption of GAI within claims operations. The report explores:

- Evolving market sentiment and priorities for P&C insurers

- The increasing interest and investment in GAI as the next frontier

- Claims operations as a logical starting point for P&C insurers’ GAI adoption journey

- A potential roadmap and key considerations for GAI adoption within claims

State of the market: P&C insurance industry

The industry headwinds have directly impacted the business performance of P&C insurers, leading to a visible deterioration in key industry performance indicators. In the past few years, combined ratios have exceeded the 100% mark. A closer look at the cost base for these P&C insurers indicates that a consistent increase in claims losses and related expenses has been a major contributor to this profitability pressure, particularly in personal lines over the last three years.

Given these circumstances, there are clear imperatives for P&C insurers to optimize their claims losses and claims-related expenses. As such, P&C insurers should explore technology-led interventions to enable an efficient claims intake process, timely investigation and mitigation, and personalized communication with customers.

Shift in market sentiment to drive GAI adoption

Market interactions with over 75 insurance enterprises between 2019-23 reveal a clear trend – conversations have shifted from a dominant focus on growth and experience to prioritizing profitable growth. Subsequently, claims transformation is expected to emerge as a dominant theme for insurers.

They are seeking to deliver superior customer experience during moment-of-truth interactions while also focusing on better management of controllable losses and expenses. The analysis also highlights a consistent focus on scaling data-driven decision-making capabilities, with the intention to scale up AI/ML adoption. However, mass adoption has been limited due to siloed investments and a lack of clarity in envisioning the benefits. GAI has the potential to address many of these challenges by employing newer technologies and enabling insurers to envision transformation possibilities.

While GAI has the potential to unlock value across insurance core operations, claims operations offer enormous value creation through increased efficiency, accuracy, and enhanced customer experience, making it an attractive starting point for GAI adoption. Currently, insurers are in the early stages of embracing GAI, and proofs of concept are being rolled out. Some insurers are independently driving these initiatives, while others seek assistance from external consulting and technology providers. Tier-1 insurers are taking a more holistic approach to GAI, with efforts in place to unlock efficiency gains, while exploring ways to enhance customer experience.

Reimagining claims management using GAI: a promising journey ahead

P&C insurance claims organizations need to address multiple pain points across the value chain. Insurers have long struggled with a lack of seamless experience across channels, inefficient manual processes for key functions that are primed for automation, and inaccuracies across settlement estimates. As an obvious next step of action, insurers are prioritizing investments that focus on improving the efficiency and quality of claims handling.

Evolution of the claims value chain: embracing GAI

GAI provides a dual benefit to insurers. It catalyzes value realization from existing AI/ML investments while also creating new avenues for value creation. In the near term, GAI is expected to drive improvements in existing processes, leading to quick wins for insurers. Once the baseline for GAI adoption is established, insurers will gain confidence to invest further. These investments may involve optimizing internal processes and enhancing stakeholder experiences. In the long term, insurers envision achieving significant workload reduction for customer-facing claims professionals, resulting in faster and more accurate decision-making capabilities that benefit both the customer and the insurer.

With the emergence of GAI, claims organizations can significantly enhance the claims experience for both customers and adjusters. Human decisions can be accurately informed and accelerated by AI-assisted data analysis, resulting in faster and smoother claims processing. We expect the GAI adoption journey to mature over three phases, involving advances in AI/ML adoption as well as pure-play GAI use cases:

- Improve: realizing efficiency gains by streamlining existing processes

- Optimize: addressing the needs of the digital-native customer

- Reinvent: fundamentally changing the insurance mindset from a risk management process to customer persistence

Roadmap for P&C insurers to get started on their GAI journeys

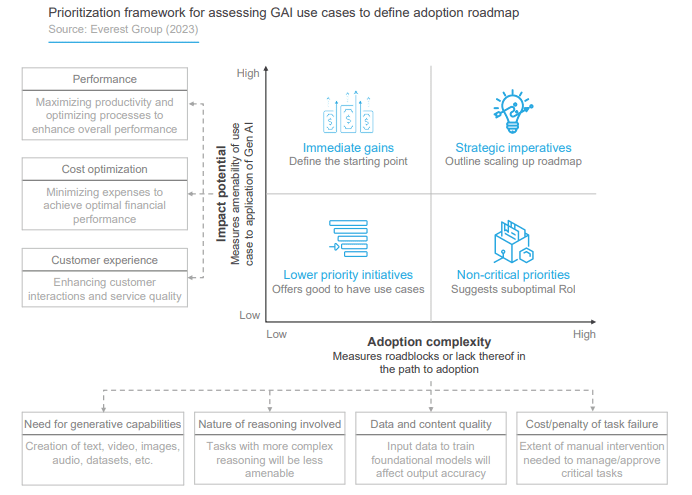

The successful implementation of GAI requires a combination of technical expertise, domain knowledge, and an agile development mindset. Organizations must assess the deployment complexity, associated timeline, and potential business impact to define a relevant starting point for adoption.

As insurers try to envision their GAI adoption journeys, we propose two critical considerations to support decision-making and help with the evaluation of the starting point:

Ease of adoption

This will require assessing:

-

- The need for GAI capabilities, such as dataset creation and multi-format content generation

- The complexity of reasoning, as it directly impacts the feasibility of adopting GAI

- The availability and quality of data for training GAI models

- The criticality of tasks, considering the cost and consequences of failure

Impact potential

This will require assessing GAI’s:

-

- Potential to maximize operational agility

- Ability to maximize efficiency and minimize expenses for optimal financial performance

- Ability to impact customer experience

Key considerations for insurers

While insurers have shown interest in embracing AI technologies for modernization, their use has been limited to select use cases such as conversational abilities and siloed data augmentation. GAI presents an opportunity to reimagine core operations, driving improved customer experience and more accurate decisions at a lower cost. However, this potential for disruption also brings unique challenges for insurers. As insurers formulate their GAI adoption roadmap, they should consider the following:

- Data preparedness

- Enterprise data privacy and security

- Talent conundrum

- Sustainability, ethics, and governance considerations

- Scaling up GAI

We believe that a cautious approach to these considerations and being open to learning from peers and providers for quick course corrections will allow P&C insurers to design a robust GAI strategy. This approach will enable them to navigate challenges effectively and fully leverage the potential of GAI to transform their core operations and drive business outcomes.

Conclusion

GAI adoption is no longer an optional consideration but a necessary requirement for insurers to remain competitive in today’s rapidly evolving technology landscape. It offers a unique opportunity for insurers to reevaluate their existing processes, unlock untapped creativity and productivity levels, and gain confidence to accelerate their transformation journeys. By embracing GAI, insurers can reinvent themselves and deliver enhanced value to customers, shareholders, and society in a holistic manner.

To fully capitalize on this opportunity, insurers must explore the potential benefits of GAI and find sustainable ways to incrementally integrate them across their workflows. As GAI continues to advance and mature, we anticipate even more significant innovations and disruptions across industries. Insurers that can effectively leverage these advances will be at the forefront of progress, meeting the dynamic demands of customers and markets. They will position themselves for long-term success in the transformative AI landscape.